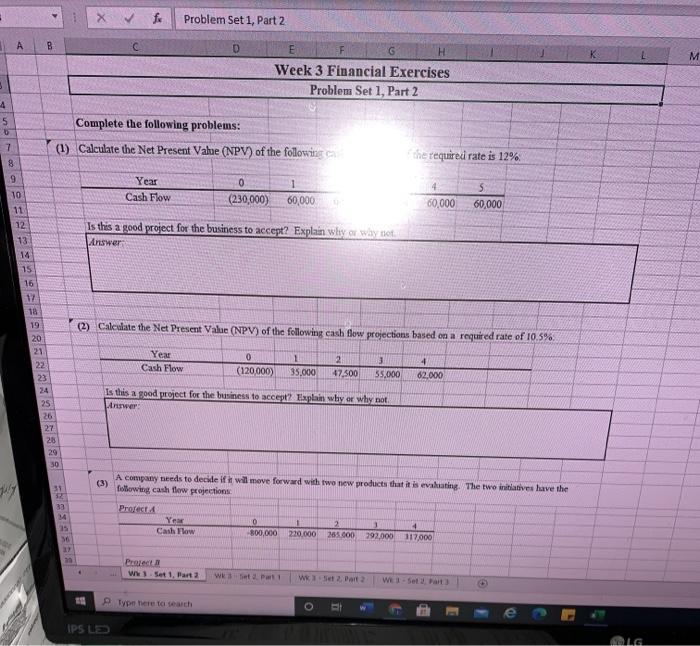

Question: Problem Set 1, Part 2 B D M E Week 3 Financial Exercises Problem Set 1, Part 2 5 Complete the following problems: (1) Calculate

Problem Set 1, Part 2 B D M E Week 3 Financial Exercises Problem Set 1, Part 2 5 Complete the following problems: (1) Calculate the Net Present Value (NPV) of the following a 7 8 the required rate is 12% 9 10 Year Cash Flow 0 (230,000) 1 60,000 60,000 5 60,000 12 13 Is this a good project for the business to accept? Explain why why not Answer 14 15 (2) Calculate the Net Present Value (NPV) of the following cash flow projections based on a required rate of 10.5% 16 17 18 19 20 21 22 23 24 Year Cash Flow 0 (120,000) 1 35,000 3 55.000 47.500 4 62.000 Is this a good project for the business to accept? Explains why or why not Answer 25 26 27 28 29 30 A company needs to decide if it will move forward with two new products that it is evaluating. The two initiatives have the following cash flow projections 39 33 Project Yes 0 3 Cash Flow 800.000 270.000 265.000 92.000 117,000 30 12 Project W. Set 1 Part 2 W 2 Part 2 Typ here to search o IPS L LG

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts