Question: . . . PROBLEM SET 1 Question#1: Stock A and B have the following dividend and price data for the last five years: Stock A

.

.

.

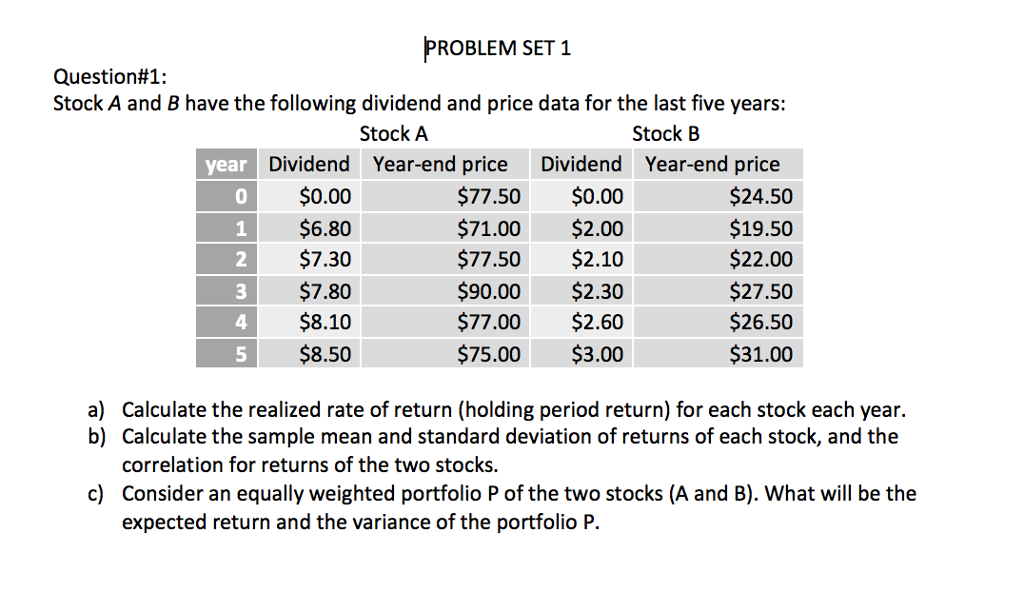

PROBLEM SET 1 Question#1: Stock A and B have the following dividend and price data for the last five years: Stock A Stock B Dividend Year-end price Dividend Year-end price year 0 2 3 4 5 $0.00 $6.80 $7.30 $7.80 $8.10 $77.50$0.00 $71.00 $2.00 $77.50$2.10 $90.00$2.30 $77.00$2.60 $75.00 $3.00 $24.50 $19.50 $22.00 $27.50 $26.50 $31.00 a) Calculate the realized rate of return (holding period return) for each stock each year. b) Calculate the sample mean and standard deviation of returns of each stock, and the correlation for returns of the two stocks. Consider an equally weighted portfolio P of the two stocks (A and B). What will be the expected return and the variance of the portfolio P. c)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts