Question: Problem Set 1 You will see a simplified version of Walmart's financial statements. Income Statements in 2013 and 2014 Balance Sheets in 2013 and 2014

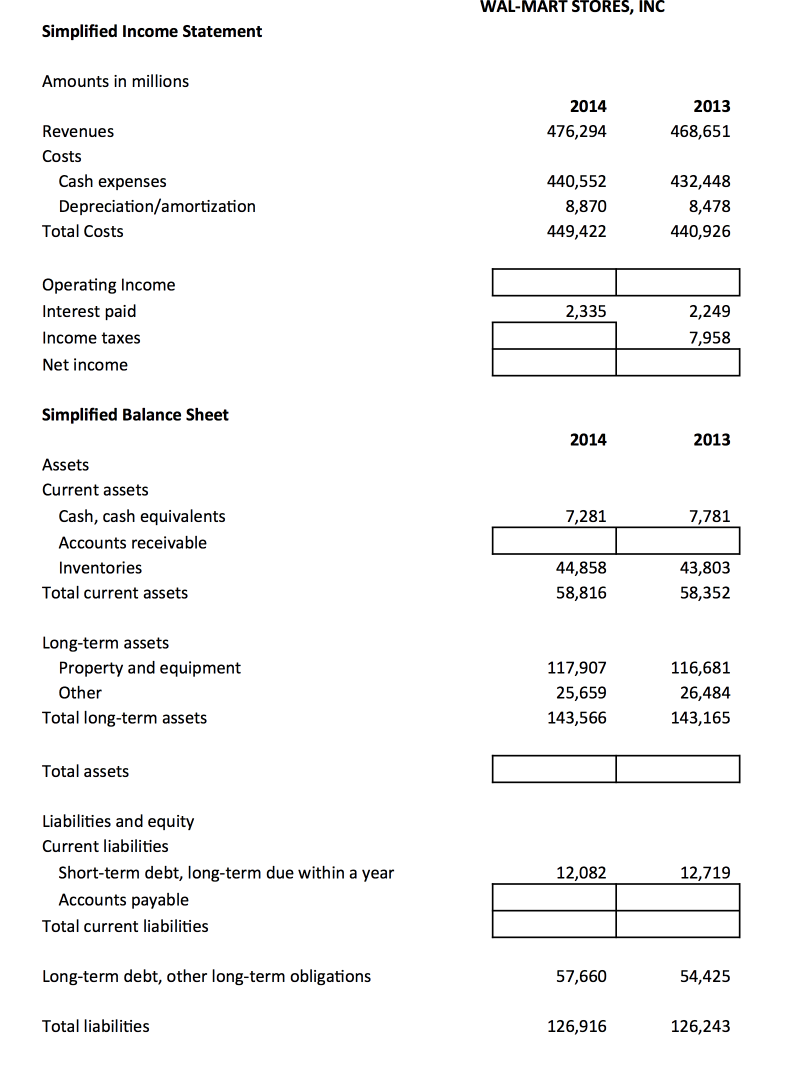

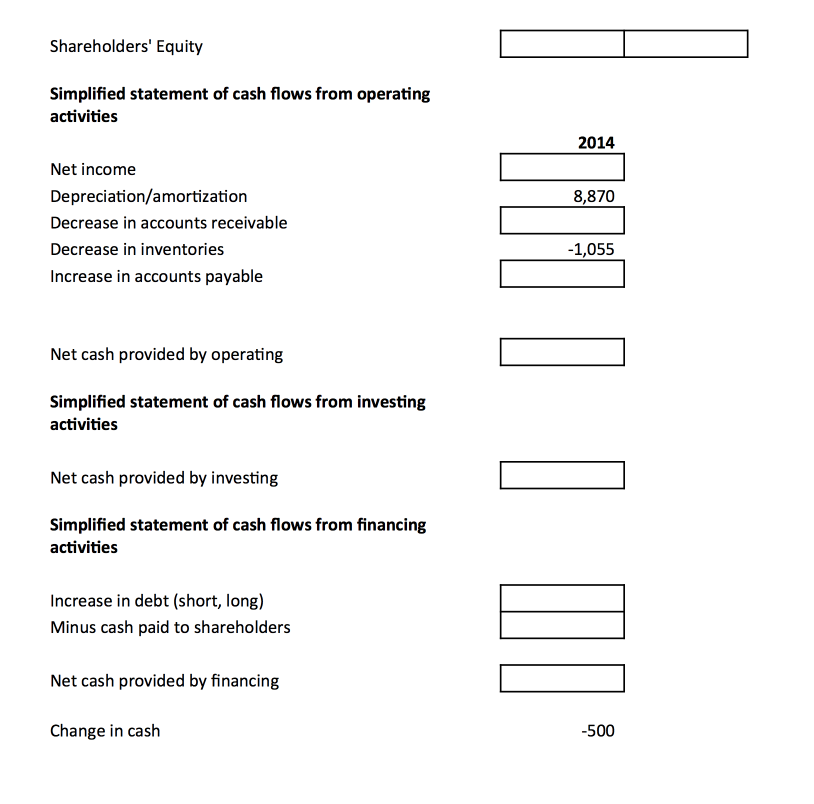

Problem Set 1 You will see a simplified version of Walmart's financial statements. Income Statements in 2013 and 2014 Balance Sheets in 2013 and 2014 Cash Flow Statement in 2014 There are some missing numbers. Fill them in. Assume the corporate income tax rate in 2014 was 0.330317. Find out the cash flows from operating, investing, and financing activities. Should Walmart pay out money to shareholders or raise from shareholders? How much? WAL-MART STORES, INC Simplified Income Statement Amounts in millions 2014 476,294 2013 468,651 Revenues Costs Cash expenses Depreciation/amortization Total Costs 440,552 8,870 449,422 432,448 8,478 440,926 2,335 Operating Income Interest paid Income taxes Net income 2,249 7,958 Simplified Balance Sheet 2014 2013 7,281 7,781 Assets Current assets Cash, cash equivalents Accounts receivable Inventories Total current assets 44,858 58,816 43,803 58,352 Long-term assets Property and equipment Other Total long-term assets 117,907 25,659 143,566 116,681 26,484 143,165 Total assets Liabilities and equity Current liabilities Short-term debt, long-term due within a year Accounts payable Total current liabilities 12,082 12,719 Long-term debt, other long-term obligations 57,660 54,425 Total liabilities 126,916 126,243 Shareholders' Equity Simplified statement of cash flows from operating activities 2014 8,870 Net income Depreciation/amortization Decrease in accounts receivable Decrease in inventories Increase in accounts payable -1,055 Net cash provided by operating Simplified statement of cash flows from investing activities Net cash provided by investing Simplified statement of cash flows from financing activities Increase in debt (short, long) Minus cash paid to shareholders Net cash provided by financing Change in cash -500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts