Question: Problem Set #18 - due Friday, December 8, 2022@8AM (circle your final answers) 1. You own a portfolio that is 20% invested in Stock X,30%

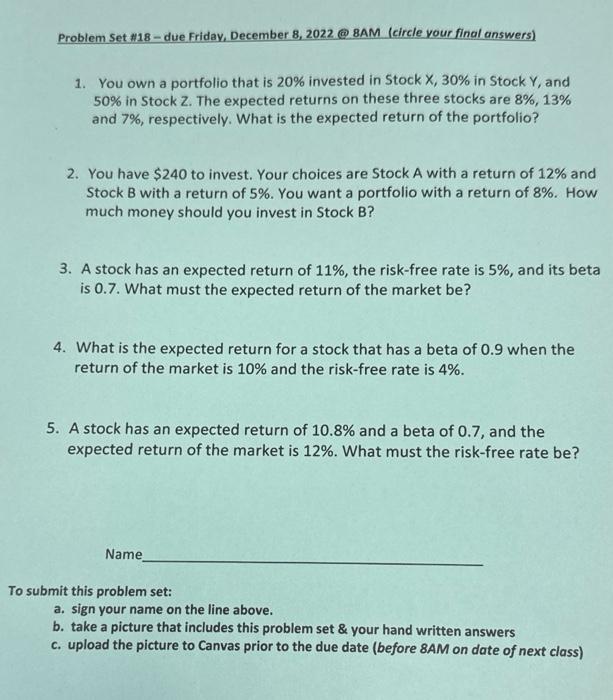

Problem Set \#18 - due Friday, December 8, 2022@8AM (circle your final answers) 1. You own a portfolio that is 20% invested in Stock X,30% in Stock Y, and 50% in Stock Z. The expected returns on these three stocks are 8%,13% and 7%, respectively. What is the expected return of the portfolio? 2. You have $240 to invest. Your choices are Stock A with a return of 12% and Stock B with a return of 5%. You want a portfolio with a return of 8%. How much money should you invest in Stock B? 3. A stock has an expected return of 11%, the risk-free rate is 5%, and its beta is 0.7 . What must the expected return of the market be? 4. What is the expected return for a stock that has a beta of 0.9 when the return of the market is 10% and the risk-free rate is 4%. 5. A stock has an expected return of 10.8% and a beta of 0.7 , and the expected return of the market is 12%. What must the risk-free rate be? Name To submit this problem set: a. sign your name on the line above. b. take a picture that includes this problem set & your hand written answers c. upload the picture to Canvas prior to the due date (before 8AM on date of next class)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts