Question: PROBLEM SET 2 19pts total Buying Pesos ANSWER FOR QUIZ ENTRY $ 1. It is now Apr.9. At SPOT, what is the total US$ value

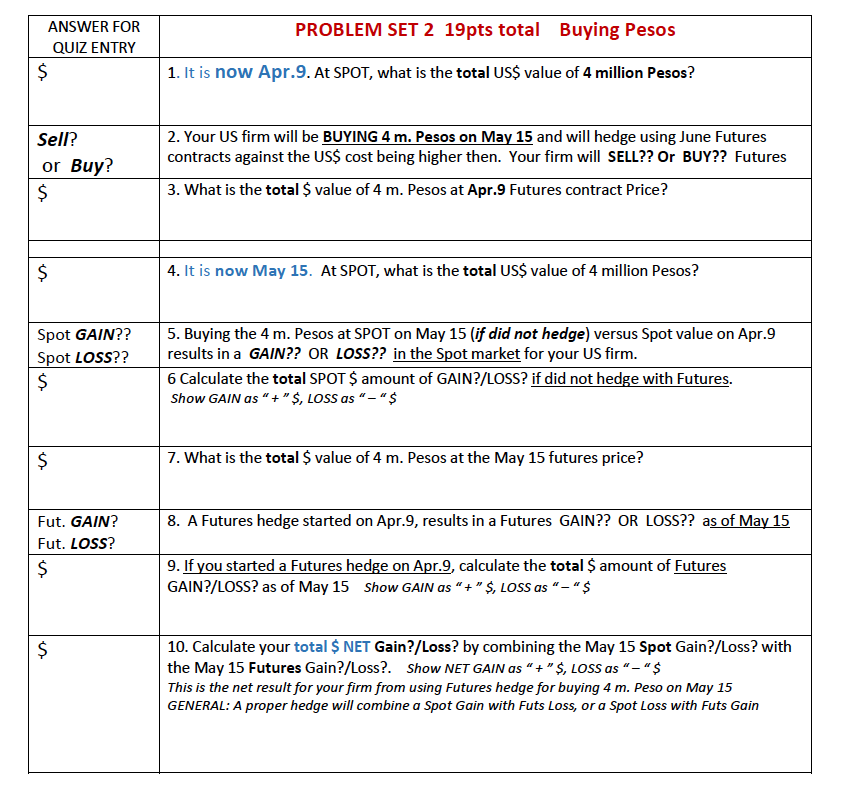

PROBLEM SET 2 19pts total Buying Pesos ANSWER FOR QUIZ ENTRY $ 1. It is now Apr.9. At SPOT, what is the total US$ value of 4 million Pesos? Sell? or Buy? $ 2. Your US firm will be BUYING 4 m. Pesos on May 15 and will hedge using June Futures contracts against the US$ cost being higher then. Your firm will SELL?? Or BUY?? Futures 3. What is the total $ value of 4 m. Pesos at Apr.9 Futures contract Price? $ 4. It is now May 15. At SPOT, what is the total US$ value of 4 million Pesos? Spot GAIN?? Spot LOSS?? $ 5. Buying the 4 m. Pesos at SPOT on May 15 (if did not hedge) versus Spot value on Apr.9 results in a GAIN?? OR LOSS?? in the Spot market for your US firm. 6 Calculate the total SPOT $ amount of GAIN?/LOSS? if did not hedge with Futures. Show GAIN as " + "$, LOSS as "-"$ $ $ 7. What is the total $ value of 4 m. Pesos at the May 15 futures price? 8. A Futures hedge started on Apr.9, results in a Futures GAIN?? OR LOSS?? as of May 15 Fut. GAIN? Fut. LOSS? $ $ 9. If you started a Futures hedge on Apr.9, calculate the total amount of Futures GAIN?/LOSS? as of May 15 Show GAIN as " + " $, LOSS as $ $ 10. Calculate your total $ NET Gain?/Loss? by combining the May 15 Spot Gain?/Loss? with the May 15 Futures Gain?/Loss?. Show NET GAIN as + " $, LOSS as _"$ This is the net result for your firm from using Futures hedge for buying 4 m. Peso on May 15 GENERAL: A proper hedge will combine a Spot Gain with Futs Loss, or a Spot Loss with Futs Gain PROBLEM SET 2 19pts total Buying Pesos ANSWER FOR QUIZ ENTRY $ 1. It is now Apr.9. At SPOT, what is the total US$ value of 4 million Pesos? Sell? or Buy? $ 2. Your US firm will be BUYING 4 m. Pesos on May 15 and will hedge using June Futures contracts against the US$ cost being higher then. Your firm will SELL?? Or BUY?? Futures 3. What is the total $ value of 4 m. Pesos at Apr.9 Futures contract Price? $ 4. It is now May 15. At SPOT, what is the total US$ value of 4 million Pesos? Spot GAIN?? Spot LOSS?? $ 5. Buying the 4 m. Pesos at SPOT on May 15 (if did not hedge) versus Spot value on Apr.9 results in a GAIN?? OR LOSS?? in the Spot market for your US firm. 6 Calculate the total SPOT $ amount of GAIN?/LOSS? if did not hedge with Futures. Show GAIN as " + "$, LOSS as "-"$ $ $ 7. What is the total $ value of 4 m. Pesos at the May 15 futures price? 8. A Futures hedge started on Apr.9, results in a Futures GAIN?? OR LOSS?? as of May 15 Fut. GAIN? Fut. LOSS? $ $ 9. If you started a Futures hedge on Apr.9, calculate the total amount of Futures GAIN?/LOSS? as of May 15 Show GAIN as " + " $, LOSS as $ $ 10. Calculate your total $ NET Gain?/Loss? by combining the May 15 Spot Gain?/Loss? with the May 15 Futures Gain?/Loss?. Show NET GAIN as + " $, LOSS as _"$ This is the net result for your firm from using Futures hedge for buying 4 m. Peso on May 15 GENERAL: A proper hedge will combine a Spot Gain with Futs Loss, or a Spot Loss with Futs Gain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts