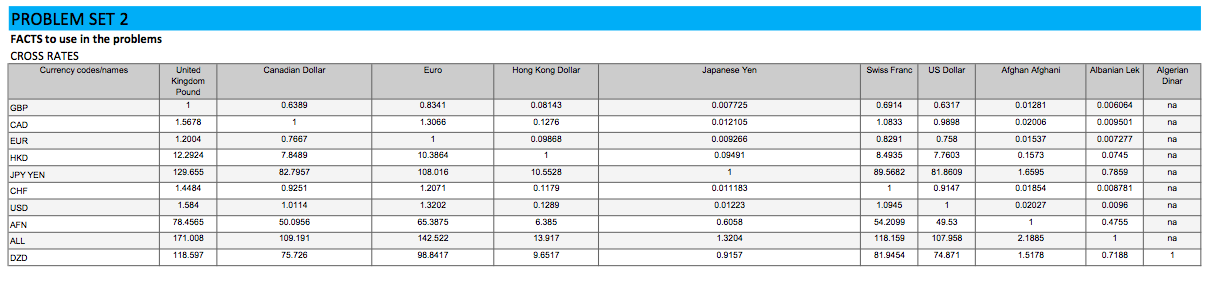

Question: PROBLEM SET 2 FACTS to use in the problems CROSS RATES Currency codesames Canadian Dollar Euro Hong Kong Dollar Japanese Yen Swiss Franc US Dollar

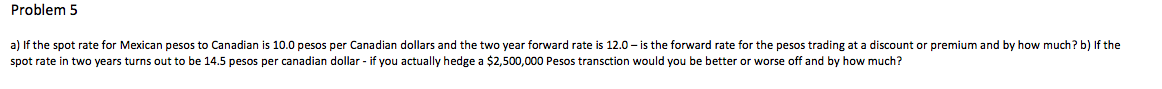

PROBLEM SET 2 FACTS to use in the problems CROSS RATES Currency codesames Canadian Dollar Euro Hong Kong Dollar Japanese Yen Swiss Franc US Dollar Afghan Afghani Albanian Lek United Kingdom Pound Algerian Dinar 0.6389 na 0.8341 1.3066 0.08143 0.1276 1.5678 GBP CAD EUR HKD JPY YEN CHF USD 0.007725 0.012105 0.009266 0.09491 1.2004 0.7667 7.8489 0.6914 1.0833 0.8291 8.4935 89.5682 12.2924 10.3864 108.016 1.2071 0.01281 0.02006 0.01537 0.1573 1.6595 0.01854 0.02027 129.655 0.6317 0.9898 0.758 7.7603 81.8609 0.9147 1 49.53 107.958 0.006064 0.009501 0.007277 0.0745 0.7859 0.008781 0.0096 0.4755 1.4484 92.7957 0.9251 1.0114 50.0956 109.191 0.1179 0.1289 6.385 13.917 1.584 78.4565 171.008 118.597 0.011183 0.01223 0.6058 1.3204 AFN 65.3875 1.0945 54.2099 118.159 81.9454 142.522 2 1885 DZD 75.726 98.8417 9.6517 0.9157 74.871 1.5178 0.7188 Problem 5 a) If the spot rate for Mexican pesos to Canadian is 10.0 pesos per Canadian dollars and the two year forward rate is 12.0 - is the forward rate for the pesos trading at a discount or premium and by how much? b) If the spot rate in two years turns out to be 14.5 pesos per canadian dollar - if you actually hedge a $2,500,000 Pesos transction would you be better or worse off and by how much

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts