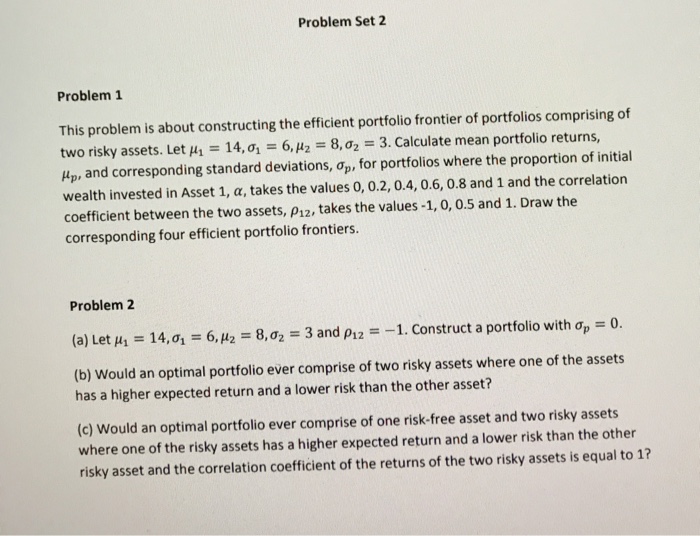

Question: Problem Set 2 Problem1 This problem is about constructing the efficient portfolio frontier of portfolios comprising of two risky assets. Let ?1-14, ?1-6,H2-8,02-3. Calculate mean

Problem Set 2 Problem1 This problem is about constructing the efficient portfolio frontier of portfolios comprising of two risky assets. Let ?1-14, ?1-6,H2-8,02-3. Calculate mean portfolio returns, ?p and corresponding standard deviations, ?p, for portfolios where the proportion of initial wealth invested in Asset 1, a, takes the values 0, 0.2, 0.4, 0.6, 0.8 and 1 and the correlation coefficient between the two assets, p12, takes the values-1, 0, 0.5 and 1. Draw the corresponding four efficient portfolio frontiers. Problem 2 (a) Let ?? 14,01 :: 6,H2-8, ?.-3 and ?12--1. Construct a portfolio with ?p 0. (b) Would an optimal portfolio ever comprise of two risky assets where one of the assets has a higher expected return and a lower risk than the other asset? (c) Would an optimal portfolio ever comprise of one risk-free asset and two risky assets where one of the risky assets has a higher expected return and a lower risk than the other risky asset and the correlation coefficient of the returns of the two risky assets is equal to 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts