Question: Problem Set 2: Suppose that bond ABC is the underlying asset for a futures contract with settlement six months from now. You know the following

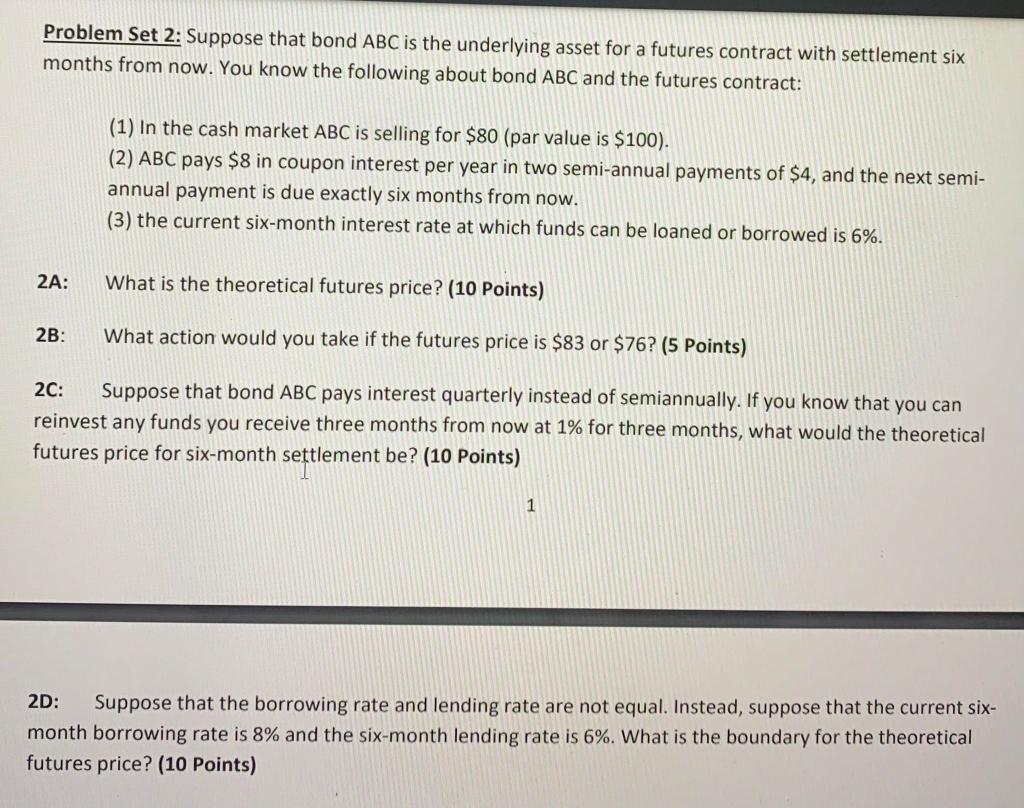

Problem Set 2: Suppose that bond ABC is the underlying asset for a futures contract with settlement six months from now. You know the following about bond ABC and the futures contract: (1) In the cash market ABC is selling for $80 (par value is $100). (2) ABC pays $8 in coupon interest per year in two semi-annual payments of $4, and the next semi- annual payment is due exactly six months from now. (3) the current six-month interest rate at which funds can be loaned or borrowed is 6%. 2A: What is the theoretical futures price? (10 Points) 2B: What action would you take if the futures price is $83 or $76? (5 Points) 20: Suppose that bond ABC pays interest quarterly instead of semiannually. If you know that you can reinvest any funds you receive three months from now at 1% for three months, what would the theoretical futures price for six-month settlement be? (10 Points) 1 2D: Suppose that the borrowing rate and lending rate are not equal. Instead, suppose that the current six- month borrowing rate is 8% and the six-month lending rate is 6%. What is the boundary for the theoretical futures price? (10 Points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts