Question: Problem Set #2 There are five questions for a total of 100 points. You must support your answers with formulas or explanations. Unsupported answers will

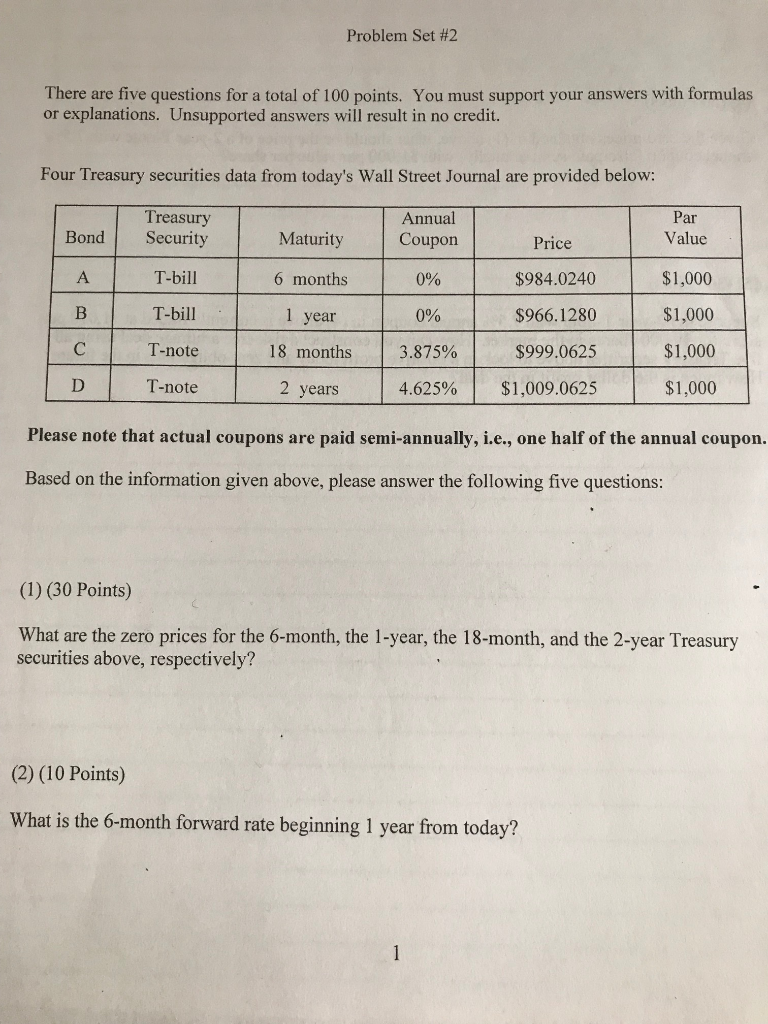

Problem Set #2 There are five questions for a total of 100 points. You must support your answers with formulas or explanations. Unsupported answers will result in no credit. Four Treasury securities data from today's Wall Street Journal are provided below: Treasury Par Annual Bond Security Maturity Coupon Value $1,000 $1,000 $1,000 $1,000 Price $984.0240 $966.1280 $999.0625 T-bill T-bill T-note T-note 6 months 0% 0% l year 18 months | 3.875% 2 years 4.625%| $1,009.0625 Please note that actual coupons are paid semi-annually, i.e., one half of the annual coupon. Based on the information given above, please answer the following five questions: (1) (30 Points) What are the zero prices for the 6-month, the 1-year, the 18-month, and the 2-year Treasury securities above, respectively? (2) (10 Points) What is the 6-month forward rate beginning 1 year from today

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts