Question: Problem Set 3 1. A preferred stock pays a dividend of $3.35 per share. The interest rate on this stock is 12 percent. What is

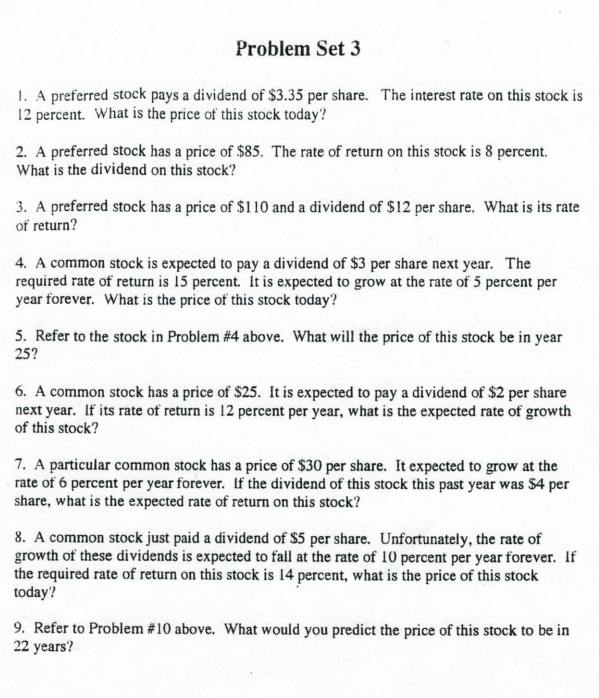

Problem Set 3 1. A preferred stock pays a dividend of $3.35 per share. The interest rate on this stock is 12 percent. What is the price of this stock today? 2. A preferred stock has a price of $85. The rate of return on this stock is 8 percent. What is the dividend on this stock? 3. A preferred stock has a price of $110 and a dividend of $12 per share. What is its rate of return? 4. A common stock is expected to pay a dividend of $3 per share next year. The required rate of return is 15 percent. It is expected to grow at the rate of 5 percent per year forever. What is the price of this stock today? 5. Refer to the stock in Problem #4 above. What will the price of this stock be in year 25? 6. A common stock has a price of $25. It is expected to pay a dividend of $2 per share next year. If its rate of return is 12 percent per year, what is the expected rate of growth of this stock? 7. A particular common stock has a price of $30 per share. It expected to grow at the rate of 6 percent per year forever. If the dividend of this stock this past year was $4 per share, what is the expected rate of return on this stock? 8. A common stock just paid a dividend of $5 per share. Unfortunately, the rate of growth of these dividends is expected to fall at the rate of 10 percent per year forever. If the required rate of return on this stock is 14 percent, what is the price of this stock today? 9. Refer to Problem #10 above. What would you predict the price of this stock to be in 22 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts