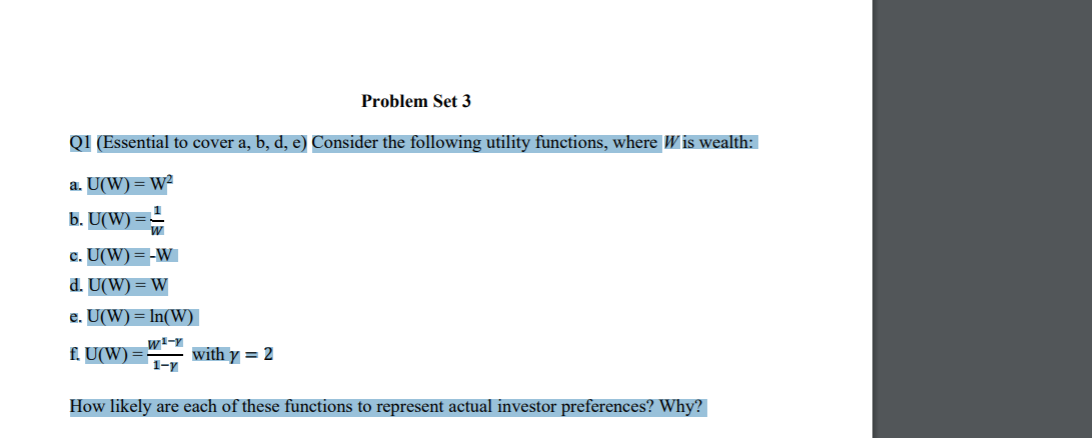

Question: Problem Set 3 Q1 (Essential to cover a, b, d, e) Consider the following utility functions, where Wis wealth: a. U(W)=W2 b. U(W) c. U(W)

Problem Set 3 Q1 (Essential to cover a, b, d, e) Consider the following utility functions, where Wis wealth: a. U(W)=W2 b. U(W) c. U(W) =-W d. U(W) = W e. U(W) = ln(W) wl- f. U(W) with y = 2 1-2 How likely are each of these functions to represent actual investor preferences? Why? Problem Set 3 Q1 (Essential to cover a, b, d, e) Consider the following utility functions, where Wis wealth: a. U(W)=W2 b. U(W) c. U(W) =-W d. U(W) = W e. U(W) = ln(W) wl- f. U(W) with y = 2 1-2 How likely are each of these functions to represent actual investor preferences? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts