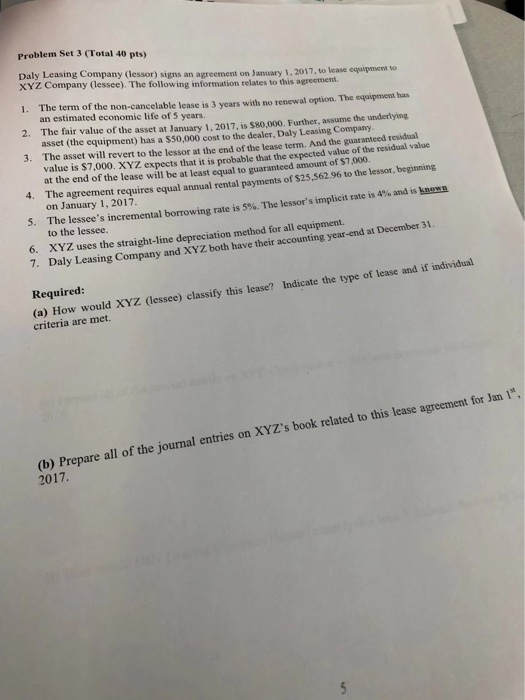

Question: Problem Set 3 (Total 40 pts) Daly Leasing Company (lessor) signs an agreement on January 1, 2017, to lease eqpaipmve to XYZ Company (lessee). The

Problem Set 3 (Total 40 pts) Daly Leasing Company (lessor) signs an agreement on January 1, 2017, to lease eqpaipmve to XYZ Company (lessee). The following information relates to this agreement 1. The term of the non-cancelable lease is 3 years with no renewal option. The equipment has an estimated economic life of5 years. 2. The fair value of the asset at January 1, 2017, is $80,000. Further, assume the underlying asset (the equipment) has a $50,000 cost to the dealer, Daly Leasing Company. 3. The asset will revert to the lessor at the end of the lease term. And the guaranteed residual value is $7,000. XYZ expects that it is probable that the expected value of the residual value at the end of the lease will be at least equal to guaranteed amount of $7,000. 4. The agreement requires equal annual rental payments of $25,562.96 to the lessor, beginning on January 1, 2017. 5. The lessee's incremental borrowing rate is 5%. The lessor's implicit rate is 4% and is known to the lessee. XYZ uses the straight-line depreciation method for all equipment. Daly Leasing Company and XYZ both have their accounting year-end at December 31 6. 7. (a) How would XYZ (lessee) classify this lease? Indicate the type of lease and if individual criteria are met. Required: (b) Prepare all of the journal entries on XYZ's book related to this lease agreement for Jan 1 2017. 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts