Question: PROBLEM SET 4 CHAPTER 17: 1. Why might individuals purchase futures contracts rather than the underlying asset? 2. What is the difference in cash flow

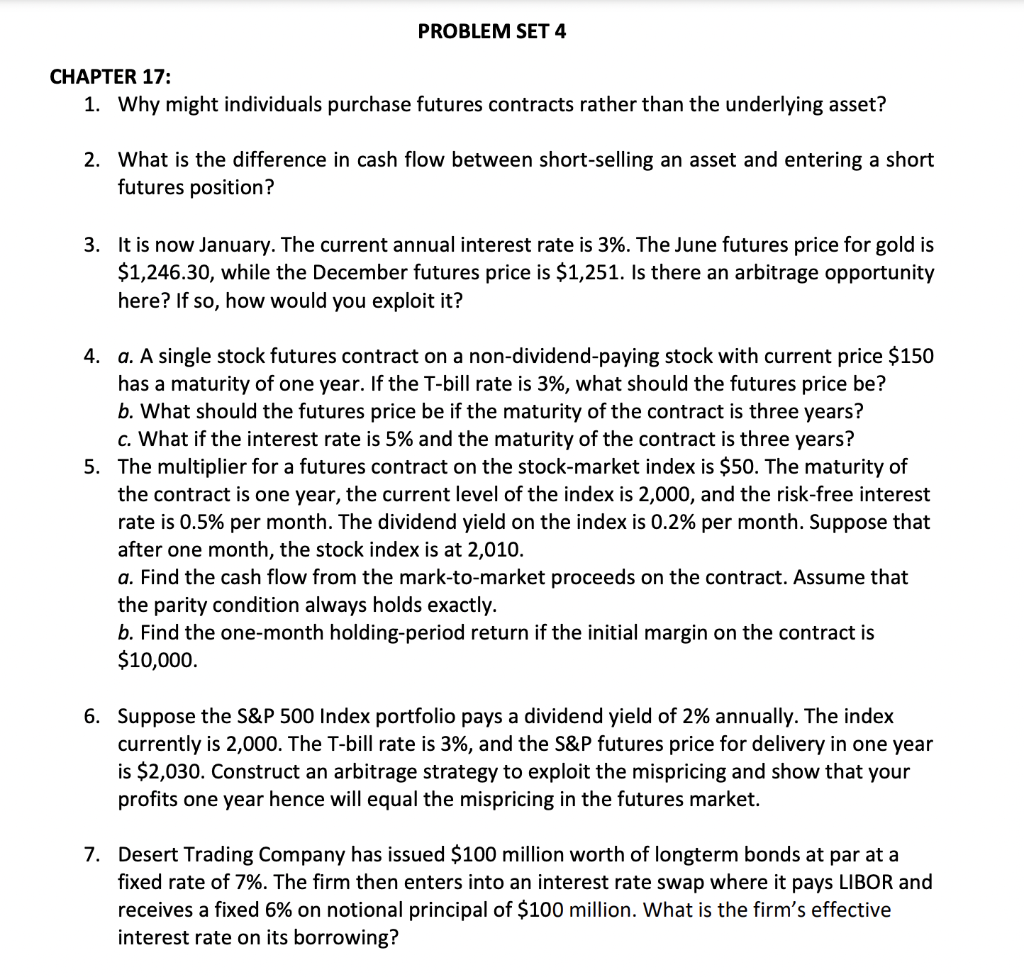

PROBLEM SET 4 CHAPTER 17: 1. Why might individuals purchase futures contracts rather than the underlying asset? 2. What is the difference in cash flow between short-selling an asset and entering a short futures position? 3. It is now January. The current annual interest rate is 3%. The June futures price for gold is $1,246.30, while the December futures price is $1,251. Is there an arbitrage opportunity here? If so, how would you exploit it? 4. a. A single stock futures contract on a non-dividend-paying stock with current price $150 has a maturity of one year. If the T-bill rate is 3%, what should the futures price be? b. What should the futures price be if the maturity of the contract is three years? c. What if the interest rate is 5% and the maturity of the contract is three years? 5. The multiplier for a futures contract on the stock-market index is $50. The maturity of the contract is one year, the current level of the index is 2,000, and the risk-free interest rate is 0.5% per month. The dividend yield on the index is 0.2% per month. Suppose that after one month, the stock index is at 2,010. a. Find the cash flow from the mark-to-market proceeds on the contract. Assume that the parity condition always holds exactly. b. Find the one-month holding-period return if the initial margin on the contract is $10,000. 6. Suppose the S&P 500 Index portfolio pays a dividend yield of 2% annually. The index currently is 2,000. The T-bill rate is 3%, and the S&P futures price for delivery in one year is $2,030. Construct an arbitrage strategy to exploit the mispricing and show that your profits one year hence will equal the mispricing in the futures market. 7. Desert Trading Company has issued $100 million worth of longterm bonds at par at a fixed rate of 7%. The firm then enters into an interest rate swap where it pays LIBOR and receives a fixed 6% on notional principal of $100 million. What is the firm's effective interest rate on its borrowing

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts