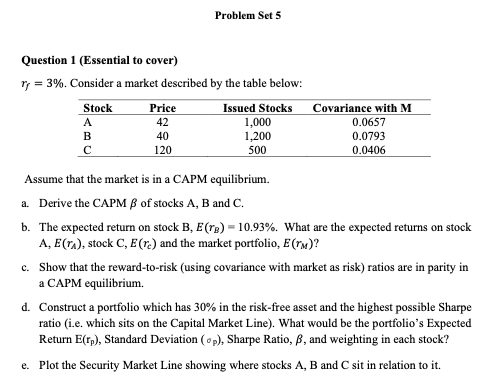

Question: Problem Set 5 Question 1 (Essential to cover) r = 3%. Consider a market described by the table below: Stock Price Issued Stocks A 42

Problem Set 5 Question 1 (Essential to cover) r = 3%. Consider a market described by the table below: Stock Price Issued Stocks A 42 1,000 B 40 1,200 120 Covariance with M 0.0657 0.0793 0.0406 500 Assume that the market is in a CAPM equilibrium. a. Derive the CAPM B of stocks A, B and C. b. The expected return on stock B, E(TB) = 10.93%. What are the expected returns on stock A, E(ra), stock C, E(re) and the market portfolio, E(TM)? c. Show that the reward-to-risk (using covariance with market as risk) ratios are in parity in a CAPM equilibrium d. Construct a portfolio which has 30% in the risk-free asset and the highest possible Sharpe ratio (i.e. which sits on the Capital Market Line). What would be the portfolio's Expected Return E(rp), Standard Deviation (p), Sharpe Ratio, B, and weighting in each stock? e. Plot the Security Market Line showing where stocks A, B and C sit in relation to it. Problem Set 5 Question 1 (Essential to cover) r = 3%. Consider a market described by the table below: Stock Price Issued Stocks A 42 1,000 B 40 1,200 120 Covariance with M 0.0657 0.0793 0.0406 500 Assume that the market is in a CAPM equilibrium. a. Derive the CAPM B of stocks A, B and C. b. The expected return on stock B, E(TB) = 10.93%. What are the expected returns on stock A, E(ra), stock C, E(re) and the market portfolio, E(TM)? c. Show that the reward-to-risk (using covariance with market as risk) ratios are in parity in a CAPM equilibrium d. Construct a portfolio which has 30% in the risk-free asset and the highest possible Sharpe ratio (i.e. which sits on the Capital Market Line). What would be the portfolio's Expected Return E(rp), Standard Deviation (p), Sharpe Ratio, B, and weighting in each stock? e. Plot the Security Market Line showing where stocks A, B and C sit in relation to it

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts