Question: Problem Set 8 4 Problem E 4 : Accounting for Bad Debts ( 3 0 points ) Page 1 2 of 1 4 Presented below

Problem Set

Problem E: Accounting for Bad Debts points

Page of

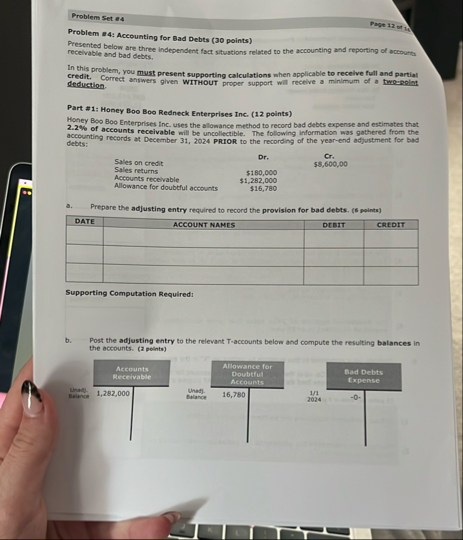

Presented below are three independent fact situations related to the accounting and reporting of accounta recelvable and bad debts.

In this problem, you must present supporting calculations when applicable to recelve full and partial credit. Correct answers glven WITHOUT proper support will recelve a minimum of a twopepint deduction.

Part #: Honey Boo Boo Redneck Enterprises Inc. points

Honey Boo Boo Enterprises inc. uses the allowance method to record bad debes expense and estimates that of accounts recelvable will be uncollectible. The following information was gathered from the accounting records at December PRIOR to the recording of the yearend adjustment for bad debts:

Sales on credit

Sales returns

Actounts recelvable

Allowance for doubtful accounts

Dr

$

$

$

$

a Prepare the adjusting entry required to recond the provision for bad debts. points

tableDATEACCOUNT MAMES,DEEIT,CREDIT

Supporting Computation Required:

b Post the adjusting entry to the relevant Taccounts below and compute the resulting balances in the accounts. aeintsProblem Set

Page of

Your Answer

Identify the amount of bad debts expense that Honey Boo Boo c Enterprises Inc. reported in its income statement for the yebr ended December : points

Your Answer

d Provide the proper presentation of accounts recelvable in the GAAP balanct sheet of Honey Boo Boo Enterprises Inc., at December including the appropriate description and the amount reported: psints

Dalance Sheet at December :

Amount

Current Assets;

Accounts Receivable, net of Allowance of

Supporting Computation Required:Problem Set

Page

Part a: Klam Rumway Projects Company points

Klum Rutway Projects Company unes the allowance method to record bad debts expense and estimatrs that of net sales will be uncollectible. The following information was gathered from the accounting records at December PRIOR to the recording of the yearend adjustment for bad debts:

Sales on credit

Sales returns

Accounts recelvable

Allowance for doubtha accounts

$

$

$

a Prepare the adjusting entry required to record the provision for bad debts. $ peinss

tableDATEACCOUNT NAMES,DEBIT,CREDIT

Supporting Computation Required:

b Pont the adjusting entry to the relevant Taccounts below and compute the resulting balances in

A the accounts. a peinta

Your Answer

Identify the amount of bad debts expense that Klum Runway Projects Company reported in its income statement for the year ended December : peietsSet

Page of

Povide the proper presentation of accounts receivable in the GAPP balanoe sheet of xlum Runway Projects Company at December including the appropriate description and the amount reported: points

Batance Sheet at December :

Amount

Current Assets:

Accounts Receivable, net of Allowance

Supporting Computation Required:

Part a: Kelvin Thermal Products polints

De December the accountant for Kelvin Thermal Products determined that accounts receivable contained customer accounts with total balances of $ that were uncollectible.

Frepare the general journal entry to properly writeoff the account as a bad debt under the allowance method. peints

tableDATEACCOUNT NAMES,DEBIT,CREDIT

b Post the writeeff entry to the relevant Taccounts below and compute the resulting balances in

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock