Question: PROBLEM SET A Note: In this chapter and in all succeeding work throughout the course, unless instructed otherwise, use the following rates, ceiling, and maximum

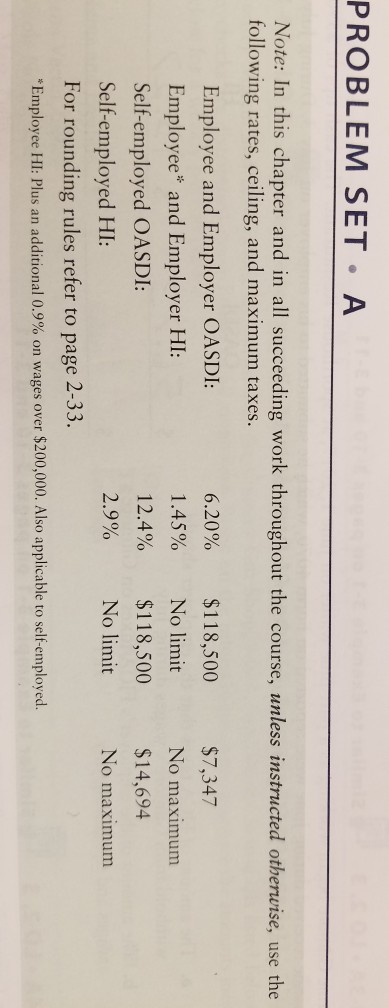

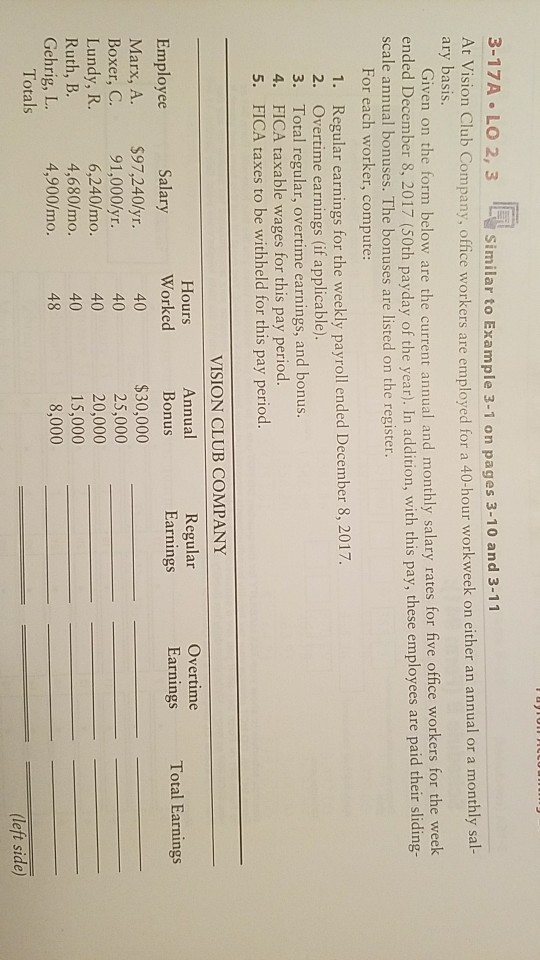

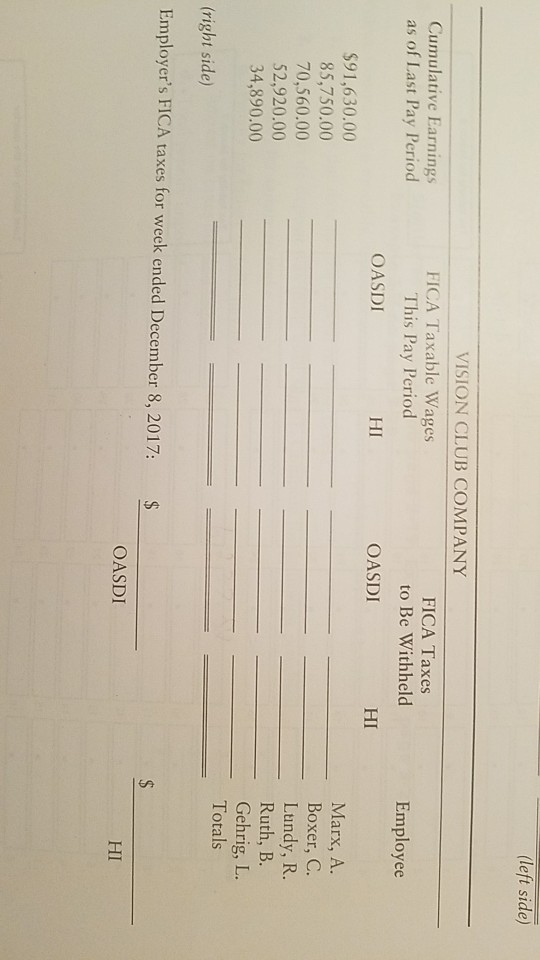

PROBLEM SET A Note: In this chapter and in all succeeding work throughout the course, unless instructed otherwise, use the following rates, ceiling, and maximum taxes. Employee and Employer OASDI Employee* and Employer HI: Self-employed OASDI: Self-employed HI: For rounding rules refer to page 2-33. "Employee Hi Plus an additional 0.9% on wages over $200,000. Also applicable to self-employed. 6.20% 1.45% 12.4% 2.9% $118,500 Nolimit $118,500 No limit $7,347 No maximum $14,694 No maximum

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts