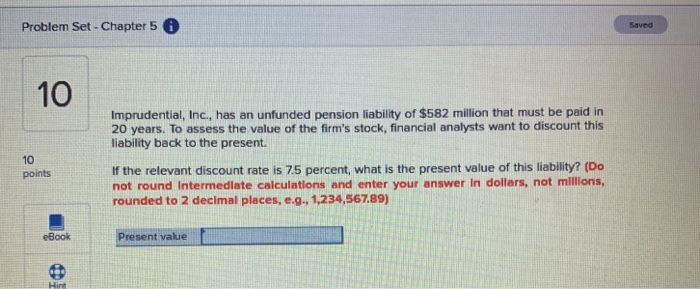

Question: Problem Set - Chapter 5 Saved Imprudential, Inc., has an unfunded pension liability of $582 million that must be paid in 20 years. To assess

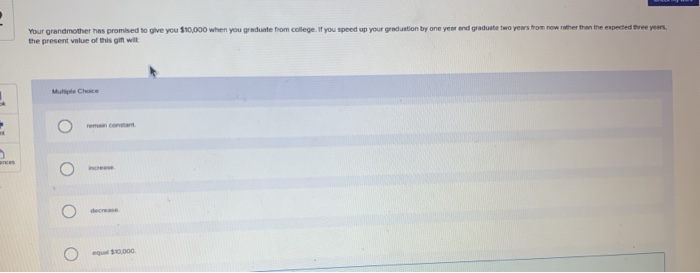

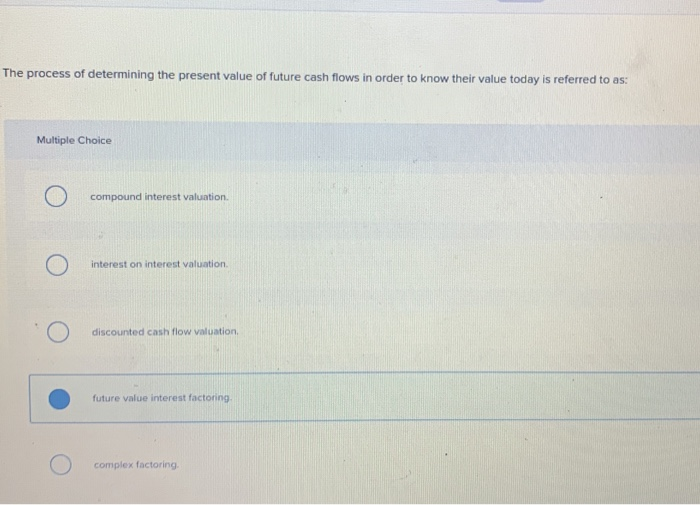

Problem Set - Chapter 5 Saved Imprudential, Inc., has an unfunded pension liability of $582 million that must be paid in 20 years. To assess the value of the firm's stock, financial analysts want to discount this liability back to the present. 10 points If the relevant discount rate is 7.5 percent, what is the present value of this liability? (Do not round Intermediate calculations and enter your answer in dollars, not millions rounded to 2 decimal places, e.g., 1,234,567.89) eBook Present value Your grandmother has promised to give you $10,000 when you graduate from college. If you speed up your graduation by one year and graduate two years from now wher than the expected three years the present value of this wit M oe Choice o remain.com o o o The process of determining the present value of future cash flows in order to know their value today is referred to as: Multiple Choice O compound interest valuation o interest on interest valuation o discounted cash flow valuation, future value interest factoring o complex factoring

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts