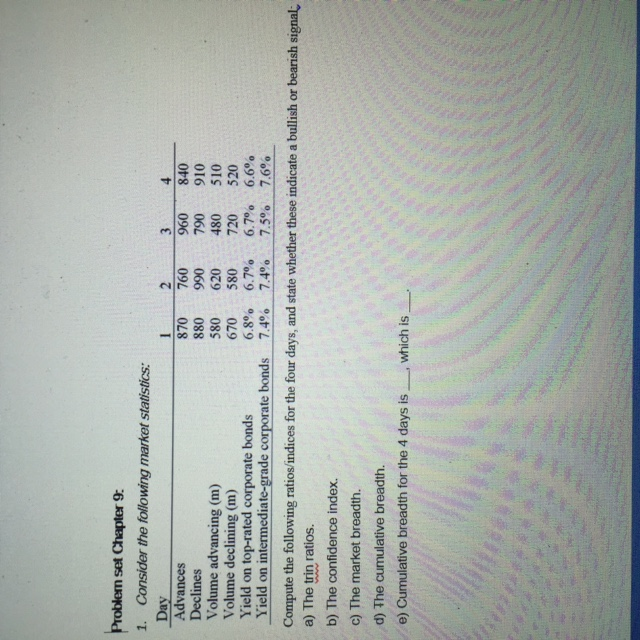

Question: Problem set Chapter 9: 1. Consider the following market statistics: Day Advances 870 760960 840 Declines 880990 910 Volume advancing (m) 580 620 480 510

Problem set Chapter 9: 1. Consider the following market statistics: Day Advances 870 760960 840 Declines 880990 910 Volume advancing (m) 580 620 480 510 Volume declining (m) 670 580 720 520 Yield on top-rated corporate bonds 6.8 % 6.7% 6.7% 6.6% Yield on intermediate-grade corporate bonds 7.4% 4 7.4% 77.5% 7.6% Compute the following ratios/indices for the four days, and state whether these indicate a bullish or bearish signal a) The tuin ratios. b) The confidence index. c) The market breadth. d) The cumulative breadth. e) Cumulative breadth for the 4 days is , which is

Step by Step Solution

There are 3 Steps involved in it

To address this problem we will compute the necessary ratios and indices based on the given market statistics for each of the four days Lets break dow... View full answer

Get step-by-step solutions from verified subject matter experts