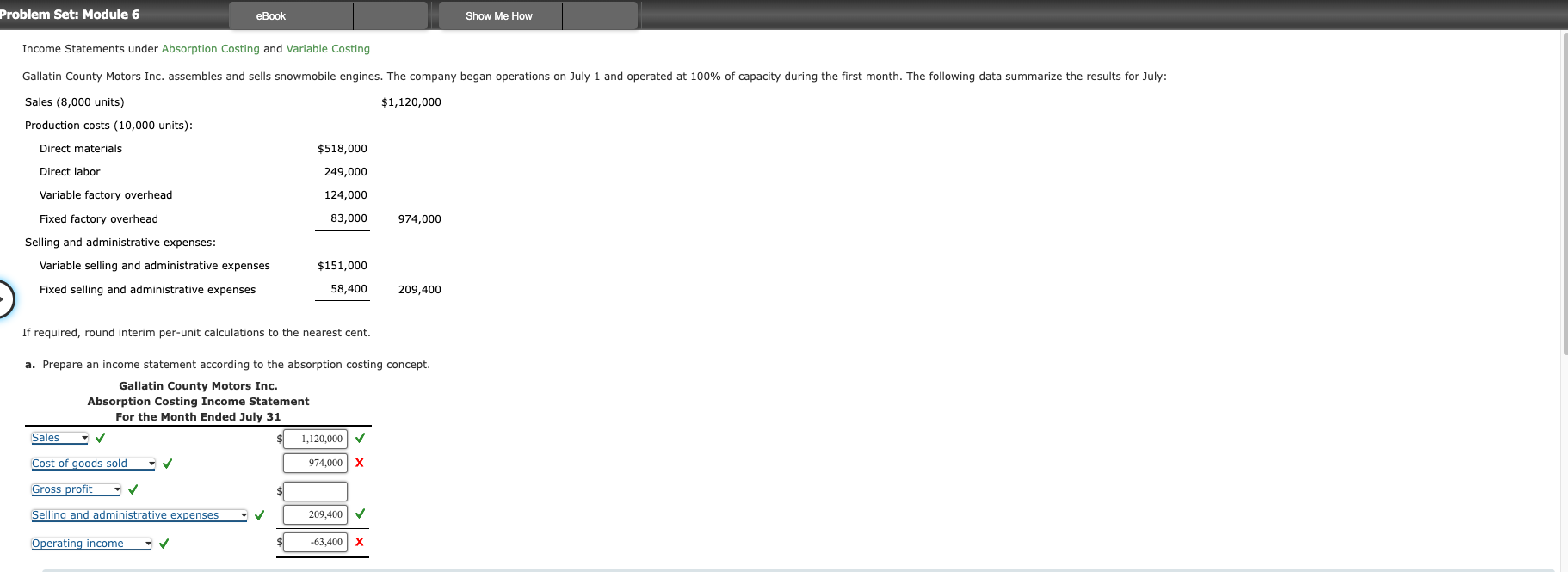

Question: Problem Set: Module 6 eBook Show Me How Income Statements under Absorption Costing and Variable Costing Gallatin County Motors Inc. assembles and sells snowmobile engines.

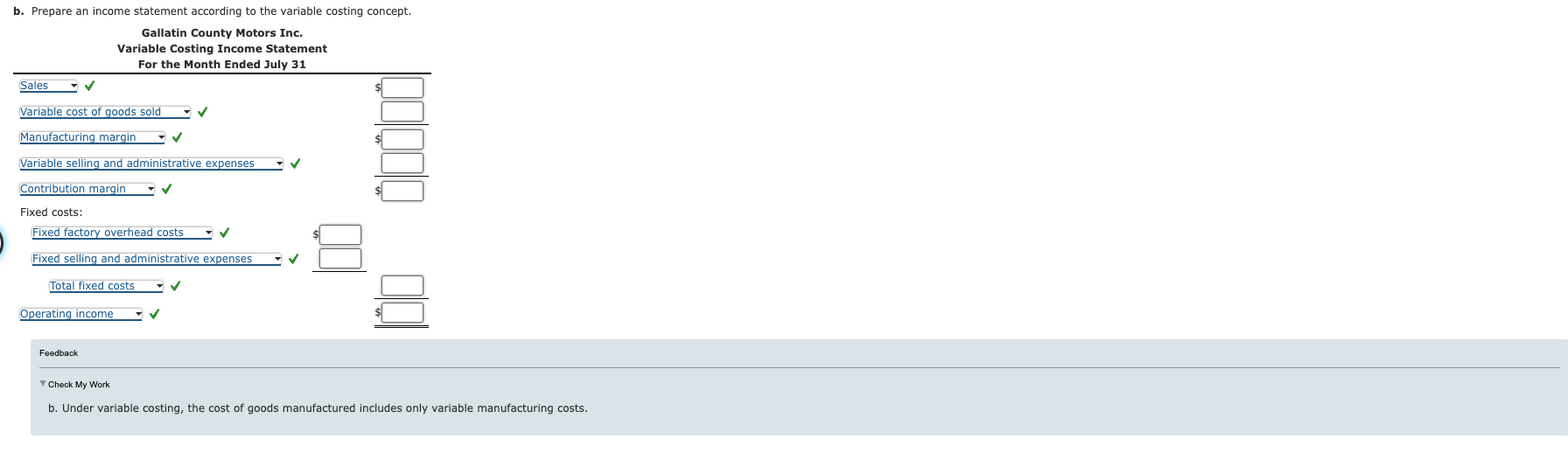

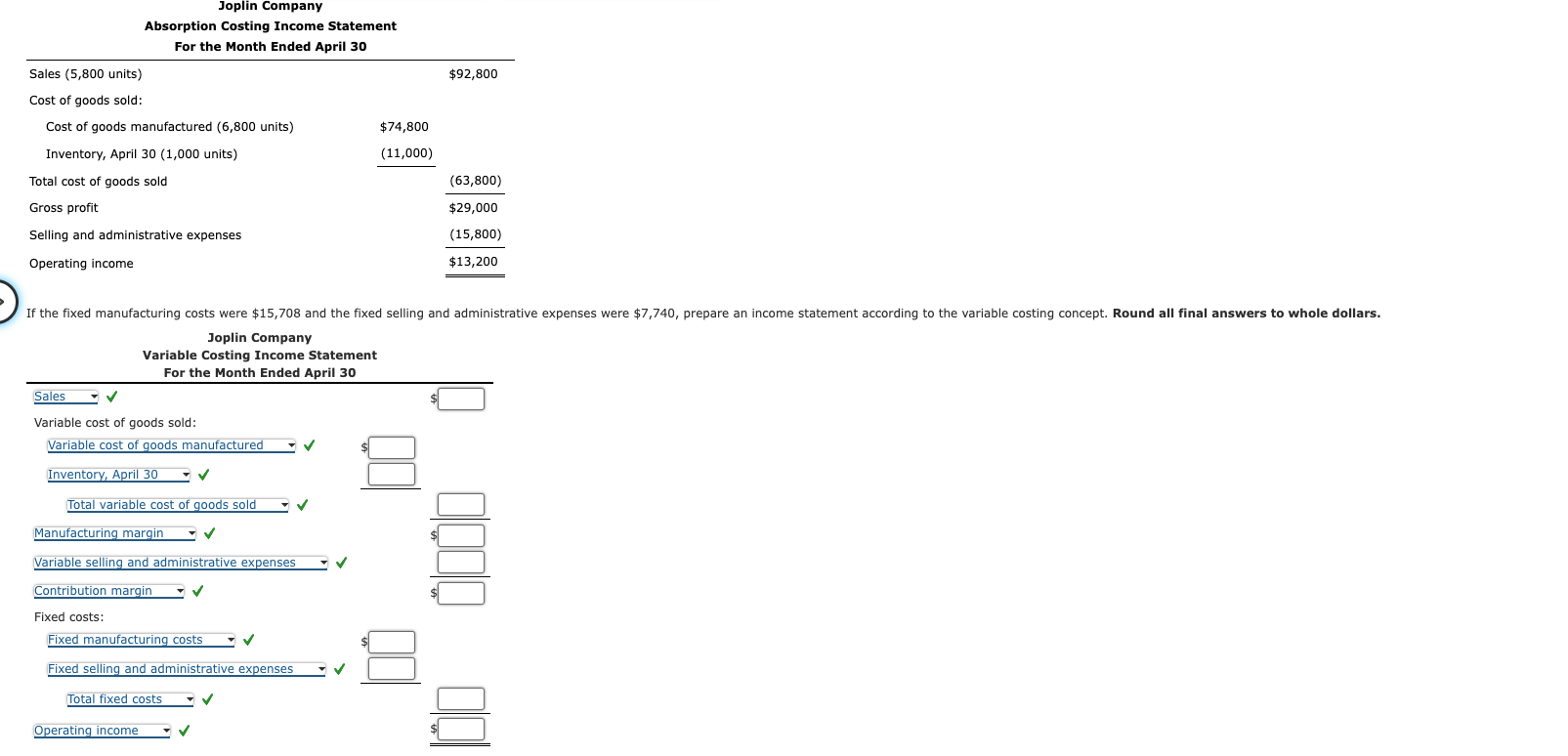

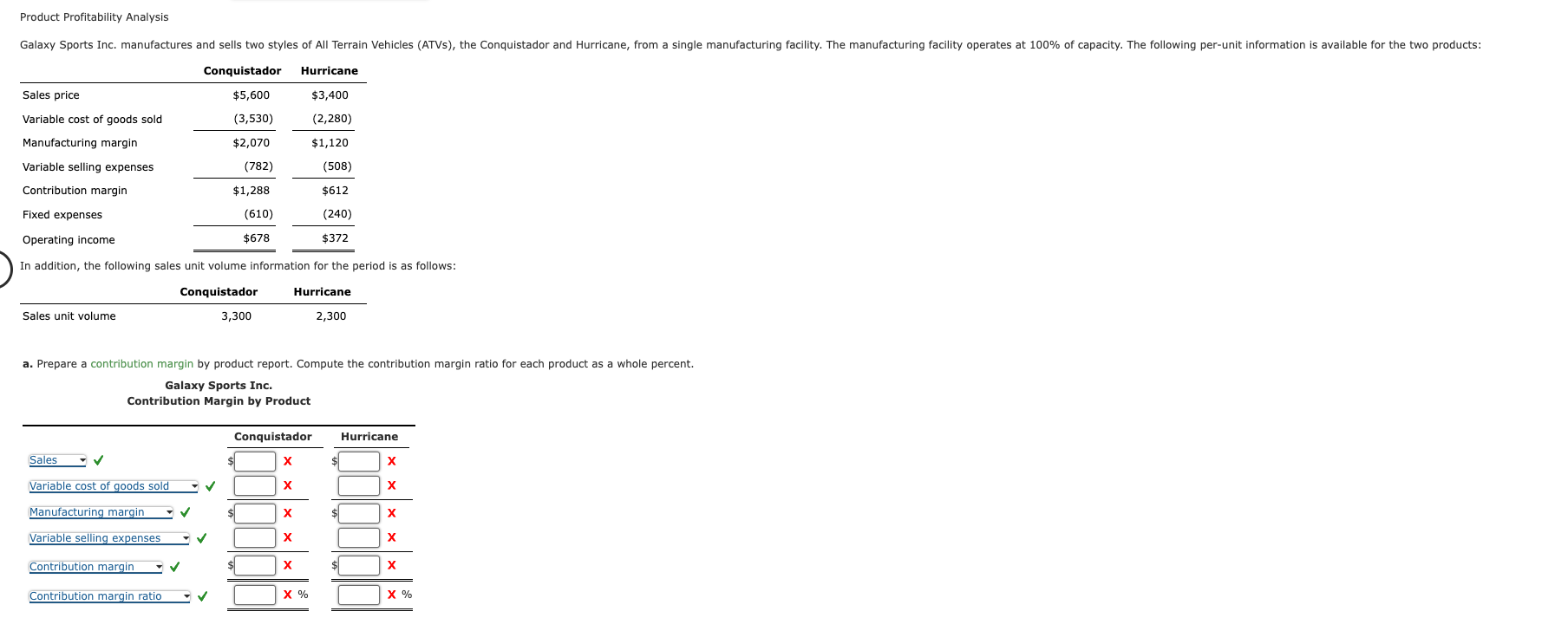

Problem Set: Module 6 eBook Show Me How Income Statements under Absorption Costing and Variable Costing Gallatin County Motors Inc. assembles and sells snowmobile engines. The company began operations on July 1 and operated at 100% of capacity during the first month. The following data summarize the results for July: Sales (8,000 units) $1,120,000 Production costs (10,000 units) : Direct materials $518,000 Direct labor 249,000 Variable factory overhead 124,000 Fixed factory overhead 83,000 974,000 Selling and administrative expenses: Variable selling and administrative expenses $151,000 Fixed selling and administrative expenses 58,400 209,400 If required, round interim per-unit calculations to the nearest cent. a. Prepare an income statement according to the absorption costing concept. Gallatin County Motors Inc. Absorption Costing Income Statement For the Month Ended July 31 Sales 1,120,000 Cost of goods sold 974,000 X Gross profit Selling and administrative expenses 209,400 Operating income 63,400 Xb. Prepare an income statement according to the variable costing concept. Gallatin County Motors Inc. Variable Costing Income Statement For the Month Ended July 31 Sales Variable cost of goods sold Manufacturing margin Variable selling and administrative expenses Contribution margin Fixed costs: Fixed factory overhead costs Fixed selling and administrative expenses Total fixed costs Operating income Feedback Check My Work b. Under variable costing, the cost of goods manufactured includes only variable manufacturing costs.Joplin Company Absorption Costing Income Statement For the Month Ended April 30 Sales (5,800 units) $92,800 Cost of goods sold: Cost of goods manufactured (6,800 units) $74,800 Inventory, April 30 (1,000 units) (11,000) Total cost of goods sold (63,800) Gross profit $29,000 Selling and administrative expenses (15,800) Operating income $13,200 If the fixed manufacturing costs were $15,708 and the fixed selling and administrative expenses were $7,740, prepare an income statement according to the variable costing concept. Round all final answers to whole dollars. Joplin Company Variable Costing Income Statement For the Month Ended April 30 Sales Variable cost of goods sold: Variable cost of goods manufactured Inventory, April 30 Total variable cost of goods sold v Manufacturing margin Variable selling and administrative expenses Contribution margin Fixed costs: Fixed manufacturing costs Fixed selling and administrative expenses Total fixed costs Operating incomeProduct Profitability Analysis Galaxy Sports Inc. manufactures and sells two styles of All Terrain Vehicles (ATVs), the Conquistador and Hurricane, from a single manufacturing facility. The manufacturing facility operates at 100% of capacity. The following per-unit information is available for the two products: Conquistador Hurricane Sales price $5,600 $3,400 Variable cost of goods sold 3,530) (2,280) Manufacturing margin $2,070 $1,120 Variable selling expenses (782) (508) Contribution margin $1,288 $612 Fixed expenses (610 (240) Operating income $678 $372 In addition, the following sales unit volume information for the period is as follows: Conquistador Hurricane Sales unit volume 3,300 2,300 a. Prepare a contribution margin by product report. Compute the contribution margin ratio for each product as a whole percent. Galaxy Sports Inc. Contribution Margin by Product Conquistador Hurricane Sales V X X Variable cost of goods sold y X Manufacturing margin X X Variable selling expenses X Contribution margin X X Contribution margin ratio X % X %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts