Question: Problem Set Problem #1: Capital Budgeting (50 points) Part 1: You are analyzing two investments in plant assets. Page 2 of 13 Option A

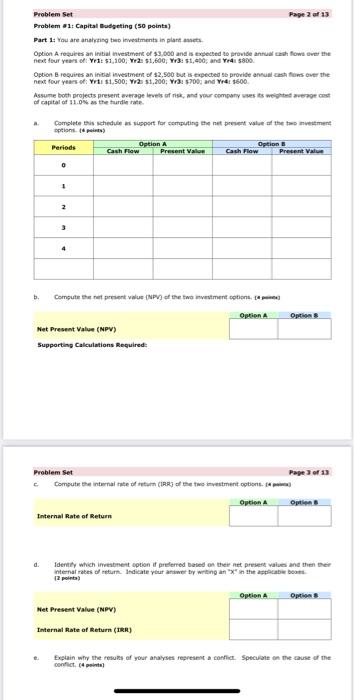

Problem Set Problem #1: Capital Budgeting (50 points) Part 1: You are analyzing two investments in plant assets. Page 2 of 13 Option A requires an initial investment of $3,000 and is expected to provide annual cash flows over the next four years of: Yes: $1,100, Ye2: $1,600, Yr3: $1,400; and Yr4: $800. Option B requires an initial investment of $2,500 but is expected to provide annual cash flows over the next four years of: Yr1: $1,500; 2 $1,200; Yr3: $700; and Yed: $600. Assume both projects present average levels of risk, and your company uses its weighted average cost of capital of 11.0% as the hurdle rate. Complete this schedule as support for computing the net present value of the two investment options. (4 points) b. Periods 2 3 4 Option A Option B Cash Flow Present Value Cash Flow Present Value Compute the net present value (NPV) of the two investment options. Net Present Value (NPV) Supporting Calculations Required: Option A Option Problem Set Page 3 of 13 Compute the internal rate of return (IRR) of the two investment options. [4 Option A Option B d. Internal Rate of Return Identify which investment option if preferred based on their net present values and then their internal rates of return. Indicate your answer by writing an "X" in the applicable boxes Net Present Value (NPV) Internal Rate of Return (IRR) Option A Option 8 Explain why the results of your analyses represent a conflict. Speculate on the cause of the conflict. (4)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts