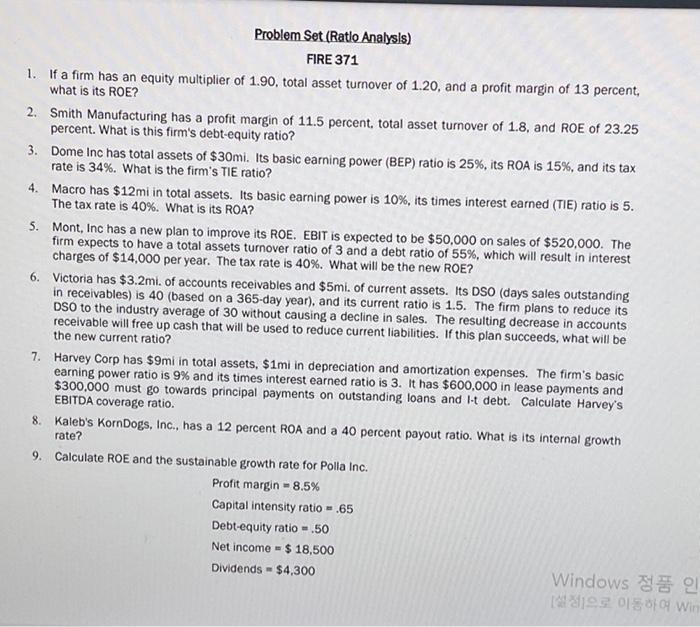

Question: Problem Set (Ratlo Analysls) FIRE 371 1. If a firm has an equity multiplier of 1.90, total asset turnover of 1.20, and a profit margin

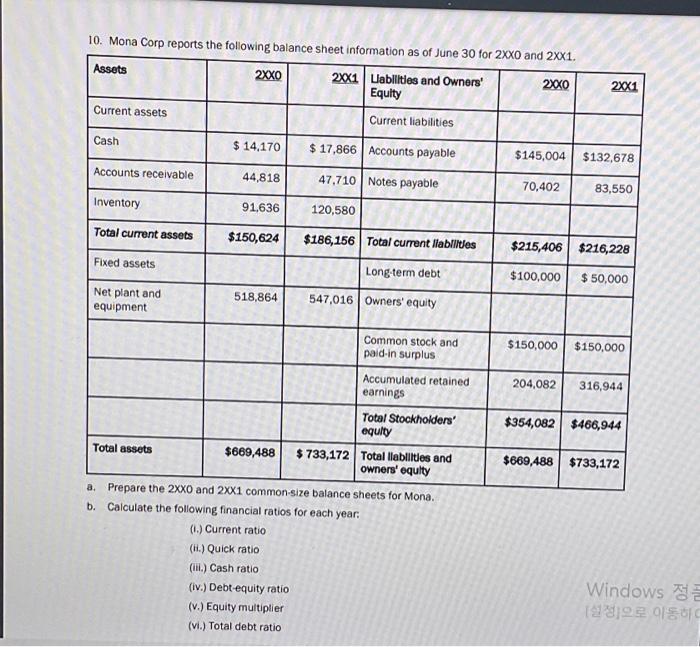

Problem Set (Ratlo Analysls) FIRE 371 1. If a firm has an equity multiplier of 1.90, total asset turnover of 1.20, and a profit margin of 13 percent, what is its ROE? 2. Smith Manufacturing has a profit margin of 11.5 percent, total asset turnover of 1.8, and ROE of 23.25 percent. What is this firm's debt-equity ratio? 3. Dome Inc has total assets of $30mi. Its basic earning power (BEP) ratio is 25%, its ROA is 15%, and its tax rate is 34%. What is the firm's TIE ratio? 4. Macro has $12mi in total assets. Its basic earning power is 10%, its times interest earned (TIE) ratio is 5. The tax rate is 40%. What is its ROA? 5. Mont, Inc has a new plan to improve its ROE. EBIT is expected to be $50,000 on sales of $520,000. The firm expects to have a total assets turnover ratio of 3 and a debt ratio of 55%, which will result in interest charges of $14,000 per year. The tax rate is 40%. What will be the new ROE? 6. Victoria has $3.2mi. of accounts receivables and $5mi. of current assets. Its DSO (days sales outstanding in receivables) is 40 (based on a 365-day year), and its current ratio is 1.5. The firm plans to reduce its DSO to the industry average of 30 without causing a decline in sales. The resulting decrease in accounts receivable will free up cash that will be used to reduce current liabilities. If this plan succeeds, what will be the new current ratio? 7. Harvey Corp has $9mi in total assets, $1mi in depreciation and amortization expenses. The firm's basic earning power ratio is 9% and its times interest earned ratio is 3 . It has $600,000 in lease payments and $300.000 must go towards principal payments on outstanding loans and I.t debt. Calculate Harvey's EBITDA coverage ratio. 8. Kaleb's KornDogs, Inc., has a 12 percent ROA and a 40 percent payout ratio. What is its internal growth rate? 9. Calculate ROE and the sustainable growth rate for Polla Inc. Profit margin =8.5% Capital intensity ratio =.65 Debt-equity ratio =.50 Net income =$18,500 Dividends =$4,300 10. Mona Corp reports the following balance sheet information as of June 30 for 2x and yyt a. Prepare the 20 and 21 common-size balance sheets for Mona. b. Calculate the following financial ratios for each year: (i.) Current ratio (ii.) Quick ratio (iii.) Cash ratio (iv.) Debt-equity ratio (v.) Equity multiplier (vi.) Total debt ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts