Question: Problem Set: The NPV Rule In Figure 1, the sloping straight line represents the opportunities for investment in the capital market, and the solid curved

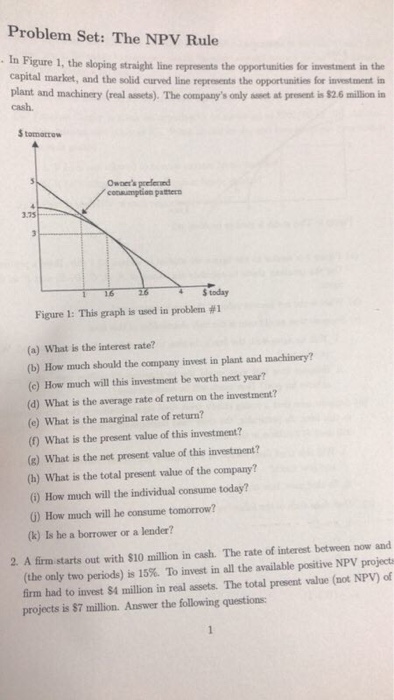

Problem Set: The NPV Rule In Figure 1, the sloping straight line represents the opportunities for investment in the capital market, and the solid curved line represents the opportunities for investment in plant and machinery (real assets). The company's only aet at prosent is $2.6 million in cash. tomatrow consuemption patter 3.75 S today Figure 1: This graph is used in problem #1 (a) What is the interest rate? (b) How much should the company invest in plant and machinery? (c) How much will this investment be worth next year? (d) What is the average rate of return on the investment? (e) What is the marginal rate of return? (0) What is the present value of this investment? (8) What is the net present value of this investment? (h) What is the total present value of the company? (6) How much will the individual consume today 0) How much will he consume tomorrow? (k) Is he a borrower or a lender? 2. A firm starts out with $10 million in cash. The rate of interest between now and (the only two periods) is 15%. To invest in all the available positive NPV project firm had to invest $4 million in real assets. The total present value (not NPV) of projects is $7 million. Answer the following questions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts