Question: Problem Sets P1. The questions below are about the valuation of a security that pays $1,100 next year and $1,460 four years from now. P1.1

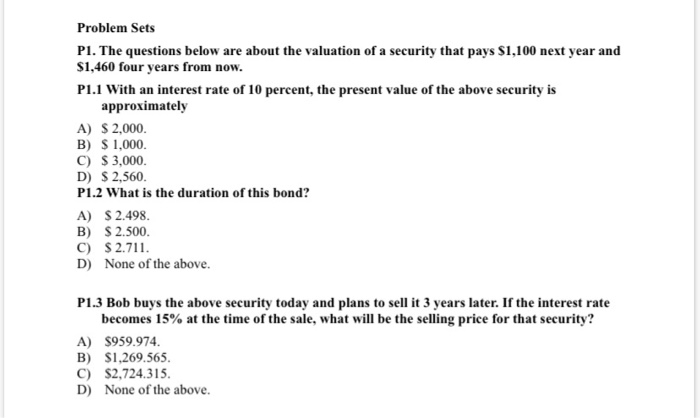

Problem Sets P1. The questions below are about the valuation of a security that pays $1,100 next year and $1,460 four years from now. P1.1 With an interest rate of 10 percent, the present value of the above security is approximately A) $ 2,000. B) $ 1,000. C) $3,000. D) $ 2,560. P1.2 What is the duration of this bond? A) $ 2.498. B) $2.500. C) $ 2.711. D) None of the above. P1.3 Bob buys the above security today and plans to sell it 3 years later. If the interest rate becomes 15% at the time of the sale, what will be the selling price for that security? A) $959.974. B) $1,269.565. C) $2,724.315. D) None of the above. P1.2 What is the duration of this bond? A) $ 2.498. B) $2.500. C) $2.711. D) None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts