Question: Problem Seven (Problem 7) Required: Advise Riley whether his calculation of 2023 net income for tax purposes is correct. If it is not, recalculate a

Problem Seven (Problem 7)

Required:

Advise Riley whether his calculation of 2023 net income for tax purposes is correct. If it is not, recalculate a revised net income for tax purposes, and briefly explain the changes you made. Assume Other deductions total $1,000.

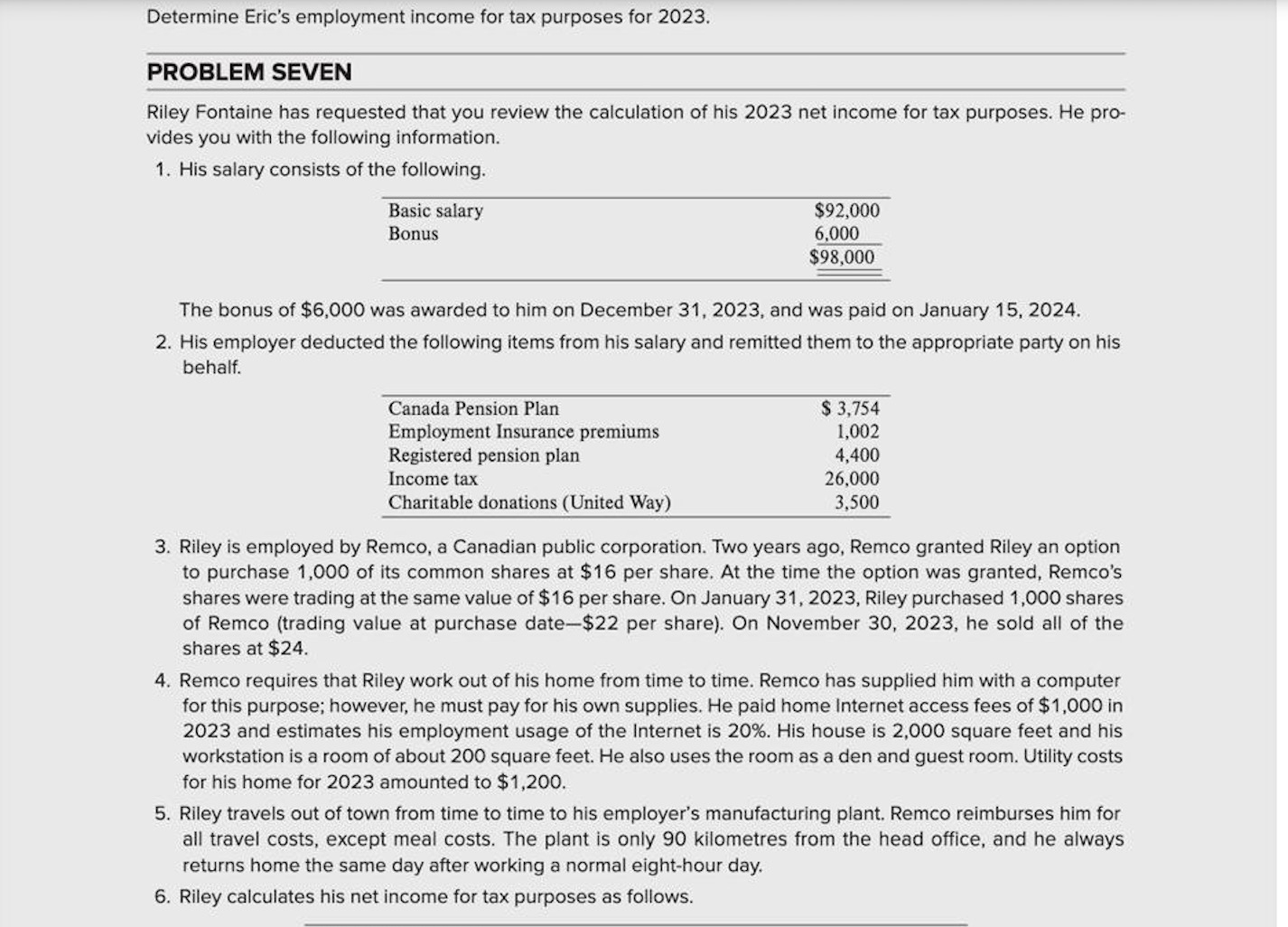

Riley Fontaine has requested that you review the calculation of his 2023 net income for tax purposes. He provides you with the following information.

1. His salary consists of the following.

Basic salary. $92,000

Bonus. 6,000

The bonus of $6,000 was awarded to him on December 31, 2023, and was paid on January 15, 2024.

2. His employer deducted the following items from his salary and remitted them to the appropriate party on his behalf.

Canada Pension Plan.$ 3,754

Employment Insurance premiums. 1,002

Registered pension plan.4,400

Income tax. 26,000

Charitable donations (United Way). 3,500

3. Riley is employed by Remco, a Canadian public corporation. Two years ago, Remco granted Riley an option to purchase 1,000 of its common shares at $16 per share. At the time the option was granted, Remco's shares were trading at the same value of $16 per share. On January 31, 2023, Riley purchased 1,000 shares of Remco (trading value at purchase date-$22 per share). On November 30, 2023, he sold all of the shares at $24.

4. Remo requires that Riley work out of his home from time to time. Remco has supplied him with a computer for this purpose; however, he must pay for his own supplies. He paid home Internet access fees of $1,000 in 2023 and estimates his employment usage of the Internet is 20%. His house is 2,000 square feet and his workstation is a room of about 200 square feet. He also uses the room as a den and guest room. Utility costs for his home for 2023 amounted to $1,200.

5. Riley travels out of town from time to time to his employer's manufacturing plant. Remco reimburses him for all travel costs, except meal costs. The plant is only 90 kilometres from the head office, and he always returns home the same day after working a normal eight-hour day.

6. Riley calculates his net income for tax purposes as follows.

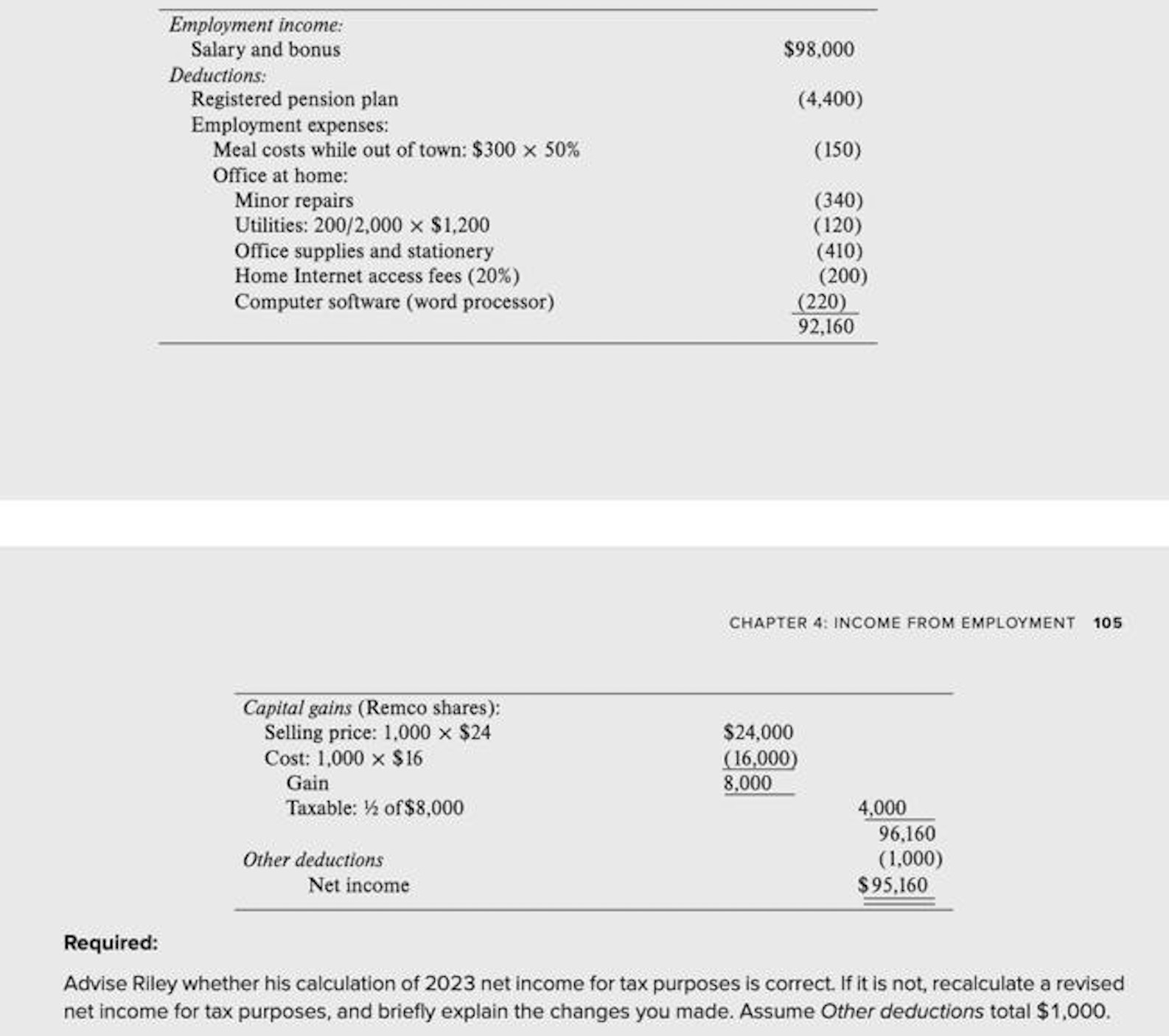

| Employment income: | |

| Salary and bonus | $98,000 |

| Deductions: | |

| Registered pension plan | (4,400) |

| Employment expenses: | |

| Meal costs while out of town: $300 x 50% | (150) |

| Office at home: | |

| Minor repairs | (340) |

| Utilities: 200/2,000 x $1,200 | (120) |

| Office supplies and stationery | (410) |

| Office supplies and stationary | (200) |

| Computer software ( word processor) | (220) |

| 92,160 |

Capital gains (Remco shares):

Selling price: 1,000 x $24 $24,000

Cost: 1,000 x $16 (16,000)

Gain 8,000

Taxable: of$8,000 4,000

96,160

Other deductions: (1000)

Net income $95,160

Required:

Advise Riley whether his calculation of 2023 net income for tax purposes is correct. If it is not, recalculate a revised net income for tax purposes, and briefly explain the changes you made. Assume Other deductions total $1,000.

Step by Step Solution

There are 3 Steps involved in it

To determine if Rileys calculation of his 2023 net income for tax purposes is correct and to recalculate if needed lets break down each component Step ... View full answer

Get step-by-step solutions from verified subject matter experts