Question: Problem: Sinclair Pharmaceuticals, a small drug company, just completed development of a vaccine that will protect against Helicobacter pylori, a bacteria that causes a number

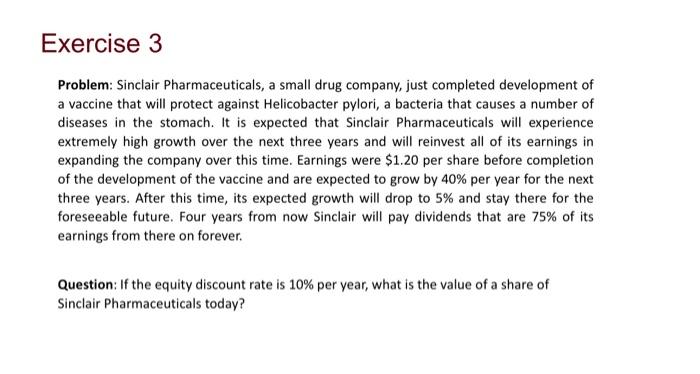

Problem: Sinclair Pharmaceuticals, a small drug company, just completed development of a vaccine that will protect against Helicobacter pylori, a bacteria that causes a number of diseases in the stomach. It is expected that Sinclair Pharmaceuticals will experience extremely high growth over the next three years and will reinvest all of its earnings in expanding the company over this time. Earnings were $1.20 per share before completion of the development of the vaccine and are expected to grow by 40% per year for the next three years. After this time, its expected growth will drop to 5% and stay there for the foreseeable future. Four years from now Sinclair will pay dividends that are 75% of its earnings from there on forever. Question: If the equity discount rate is 10% per year, what is the value of a share of Sinclair Pharmaceuticals today

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts