Question: Problem Solving: 1. A business starts this year with P1,000,000 assets with no debt. The expected ROE equals 10%. Suppose the firm decides to have

Problem Solving:

1. A business starts this year with P1,000,000 assets with no debt. The expected ROE equals 10%. Suppose the firm decides to have a payout of 40% for this year. How much is the expected total dividends for next year?

2. CAD Holdings is experiencing rapid growth. Earnings and dividends are expected to grow at a rate of 14% for the next 2 years, at 11% the following year, and at a constant rate of 6% on year 4 and thereafter. Its last dividend was P1.25 and required rate of return is 12%. What is the estimated value of CAD share?

3. What is the cost of equity of a fairly valued P100 par value preferred stock that pays 7.5% annual dividend? The stock's book value per share and market price is P98.30 and P95.15, respectively.

4. ACD Co. paid P1.25 dividend per share which is expected to grow at a rate of 5.6%. If the current market value and book value per share are P62.10 and P59.00, respectively. What is the required rate of return?

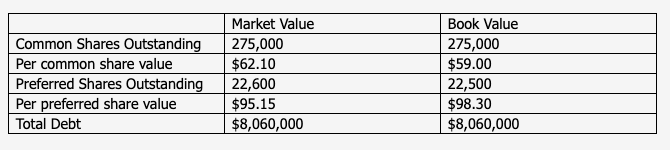

5. Calculate the company's weighted cost of capital using the answer in #3, #4, a YTM of 6%, and the table below. Assume a 32% tax rate.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts