Question: Problem Solving (46 points): Show all your work (use of formula, etc.) in solving the problems. You still need to show your work even if

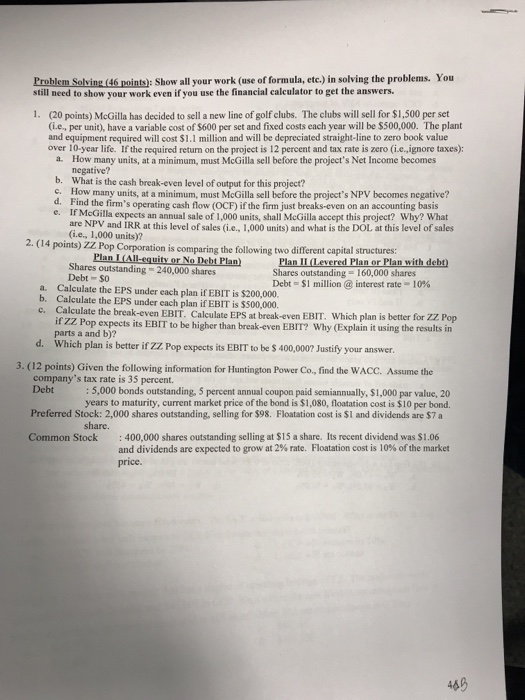

Problem Solving (46 points): Show all your work (use of formula, etc.) in solving the problems. You still need to show your work even if you use the financial calculator to get the answers. 1. (20 points) McGilla has decided to sell a new line of golf clubs. The clubs will sell for $1,500 per set and equipment required will cost $1.1 million and will be depreciated straight-line to zero book value a. How many units, at a minimum, must McGilla sell before the project's Net Income becomes (i.e., per unit), have a variable cost of $600 per set and fixed costs each year will be $500,000. The plant over 10-year life. If the required return on the project is 12 percent and tax rate is zero (i.e,ignore taxes): negative? What is the cash break-even level of output for this project? b. C. How many units, at a minimum, must McGilla sell before the project's NPV becomes negative? d. Find the firm's operating cash flow (OCF) if the firm just breaks-even on an accounting basis e. If McGilla expects an annual sale of 1,000 units, shall McGilla accept this project? Why? What are NPV and IRR at this level of sales (i.e., 1,000 units) and what is the DOL at this level of sales (i.e., 1,000 units)? 2. (14 points) ZZ Po p Corporation is comparing the following two different capital structures: No Plan I Levered Plan or Plan with debt) Shares outstanding 160,000 shares Debt. $1 million @ interest rate-10% Shares outstanding 240,000 shares Debt $0 a. Calculate the EPS under each plan if EBIT is $200,000. b. Calculate the EPS under each plan if EBIT is $500,000. c. Calculate the break-even EBIT. Calculate EPS at break-even EBIT. Which plan is better for ZZ Pop if ZZ Pop expects its EBIT to be higher than break-even EBIT? Why (Explain it using the results in parts a and b)? Which plan is better if ZZ Pop expects its EBIT to be S 400,0007 Justify your answer. d. 3. (12 points) Given the following information for Huntington Power Co, find the WACC. Assume the company's tax rate is 35 percent. Debt 5,000 bonds outstanding, 5 percent annual coupon paid semiannually, $1,000 par value, 20 years to maturity, current market price of the bond is $1,080, floatation cost is $10 per bond. Preferred Stock: 2,000 shares outstanding, selling for $98. Floatation cost is $1 and dividends are $7a share. Common Stock 400,000 shares outstanding selling at $15 a share. Its recent dividend was $1.06 and dividends are expected to grow at 2% rate. Floatation cost is 10% of the market price. 465 Problem Solving (46 points): Show all your work (use of formula, etc.) in solving the problems. You still need to show your work even if you use the financial calculator to get the answers. 1. (20 points) McGilla has decided to sell a new line of golf clubs. The clubs will sell for $1,500 per set and equipment required will cost $1.1 million and will be depreciated straight-line to zero book value a. How many units, at a minimum, must McGilla sell before the project's Net Income becomes (i.e., per unit), have a variable cost of $600 per set and fixed costs each year will be $500,000. The plant over 10-year life. If the required return on the project is 12 percent and tax rate is zero (i.e,ignore taxes): negative? What is the cash break-even level of output for this project? b. C. How many units, at a minimum, must McGilla sell before the project's NPV becomes negative? d. Find the firm's operating cash flow (OCF) if the firm just breaks-even on an accounting basis e. If McGilla expects an annual sale of 1,000 units, shall McGilla accept this project? Why? What are NPV and IRR at this level of sales (i.e., 1,000 units) and what is the DOL at this level of sales (i.e., 1,000 units)? 2. (14 points) ZZ Po p Corporation is comparing the following two different capital structures: No Plan I Levered Plan or Plan with debt) Shares outstanding 160,000 shares Debt. $1 million @ interest rate-10% Shares outstanding 240,000 shares Debt $0 a. Calculate the EPS under each plan if EBIT is $200,000. b. Calculate the EPS under each plan if EBIT is $500,000. c. Calculate the break-even EBIT. Calculate EPS at break-even EBIT. Which plan is better for ZZ Pop if ZZ Pop expects its EBIT to be higher than break-even EBIT? Why (Explain it using the results in parts a and b)? Which plan is better if ZZ Pop expects its EBIT to be S 400,0007 Justify your answer. d. 3. (12 points) Given the following information for Huntington Power Co, find the WACC. Assume the company's tax rate is 35 percent. Debt 5,000 bonds outstanding, 5 percent annual coupon paid semiannually, $1,000 par value, 20 years to maturity, current market price of the bond is $1,080, floatation cost is $10 per bond. Preferred Stock: 2,000 shares outstanding, selling for $98. Floatation cost is $1 and dividends are $7a share. Common Stock 400,000 shares outstanding selling at $15 a share. Its recent dividend was $1.06 and dividends are expected to grow at 2% rate. Floatation cost is 10% of the market price. 465

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts