Question: Problem Solving: Based on the given information, answer the following questions. You constructed a portfolio consisting of the following stocks: Stock A Stock B Stock

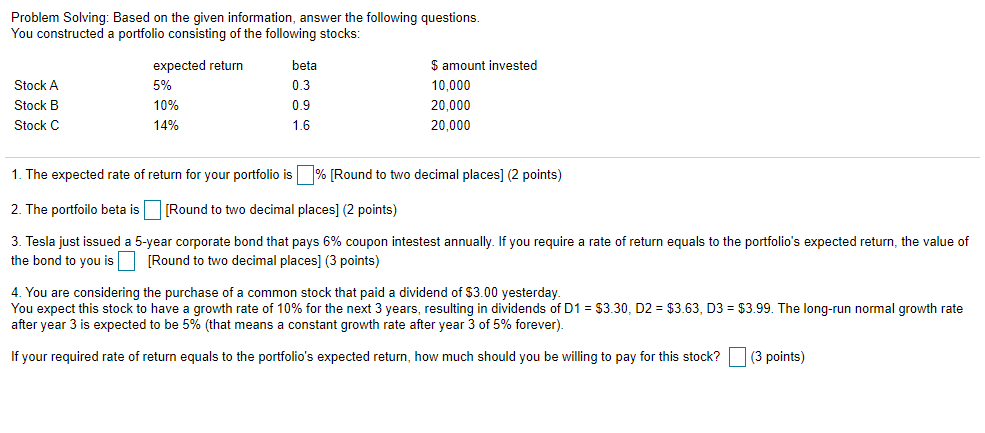

Problem Solving: Based on the given information, answer the following questions. You constructed a portfolio consisting of the following stocks: Stock A Stock B Stock C expected return 5% 10% 14% beta 0.3 0.9 1.6 $ amount invested 10.000 20,000 20,000 1. The expected rate of return for your portfolio is % [Round to two decimal places) (2 points) 2. The portfoilo beta is [Round to two decimal places) (2 points) 3. Tesla just issued a 5-year corporate bond that pays 6% coupon intestest annually. If you require a rate of return equals to the portfolio's expected return, the value of the bond to you is [Round to two decimal places] (3 points) 4. You are considering the purchase of a common stock that paid a dividend of $3.00 yesterday. You expect this stock to have a growth rate of 10% for the next 3 years, resulting in dividends of D1 = $3.30, D2 = $3.63, D3 = $3.99. The long-run normal growth rate after year 3 is expected to be 5% (that means constant growth rate after year 3 of 5% forever). If your required rate of return equals to the portfolio's expected return, how much should you be willing to pay for this stock? (3 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts