Question: PROBLEM SOLVING Exercise 2 - 1 As of December 31, 2020, Grimmie Company's general ledger reported a total cash balance of F695,000. Breakdown of the

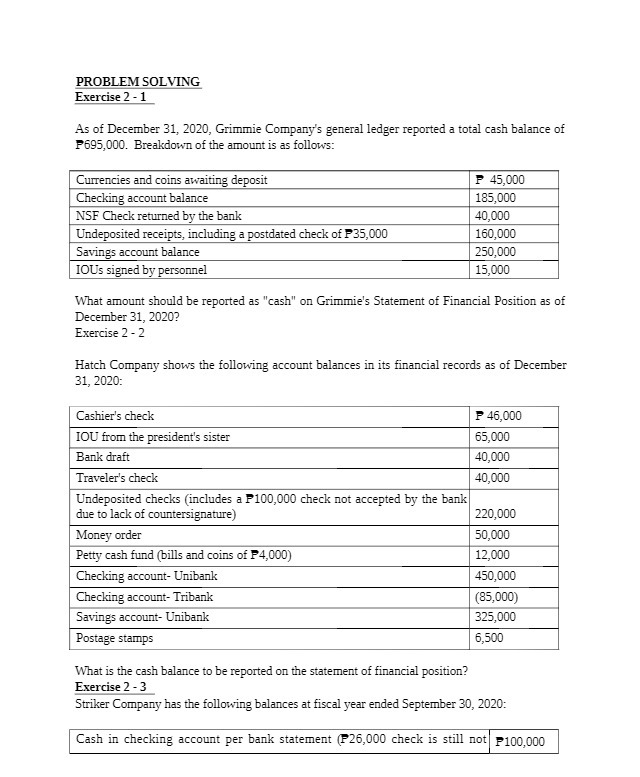

PROBLEM SOLVING Exercise 2 - 1 As of December 31, 2020, Grimmie Company's general ledger reported a total cash balance of F695,000. Breakdown of the amount is as follows: Currencies and coins awaiting deposit F 45,000 Checking account balance 185,000 NSF Check returned by the bank 40,000 Undeposited receipts, including a postdated check of F35,000 160,000 Savings account balance 250,000 IOUs signed by personnel 15,000 What amount should be reported as "cash" on Grimmie's Statement of Financial Position as of December 31, 2020? Exercise 2 - 2 Hatch Company shows the following account balances in its financial records as of December 31, 2020: Cashier's check F 46,000 IOU from the president's sister 65,000 Bank draft 40,000 Traveler's check 40,000 Undeposited checks (includes a P100,000 check not accepted by the bank due to lack of countersignature 220,000 Money order 50,000 Petty cash fund (bills and coins of P4,000) 12,000 Checking account- Unibank 450,000 Checking account- Tribank (85,000) Savings account- Unibank 325,000 Postage stamps 6,500 What is the cash balance to be reported on the statement of financial position? Exercise 2 - 3 Striker Company has the following balances at fiscal year ended September 30, 2020: Cash in checking account per bank statement (F26,000 check is still not F100,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts