Question: Problem Solving: If you park on campus all day 3 days per week what would be the rate of return for buying a semester permit

Problem Solving:

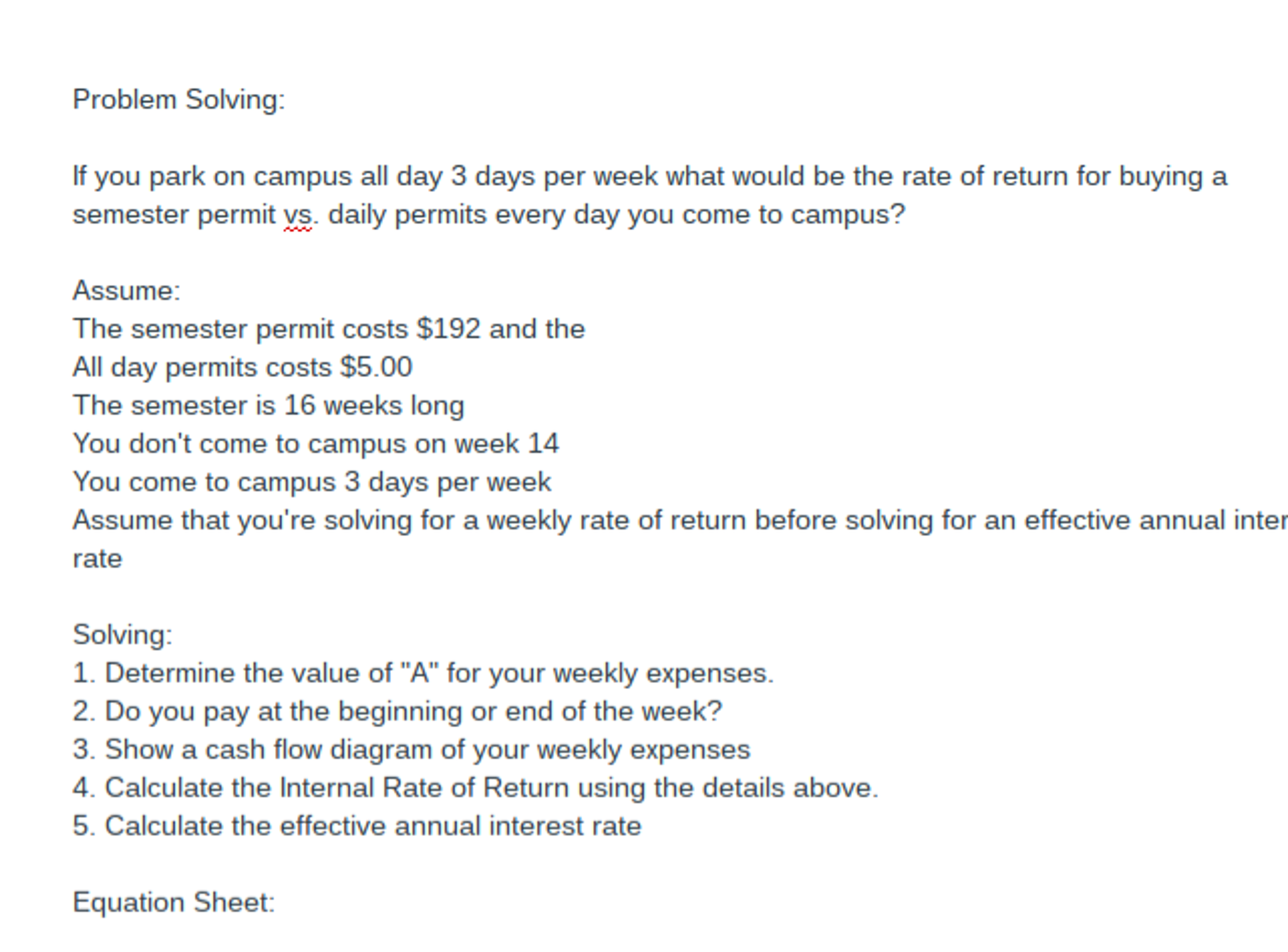

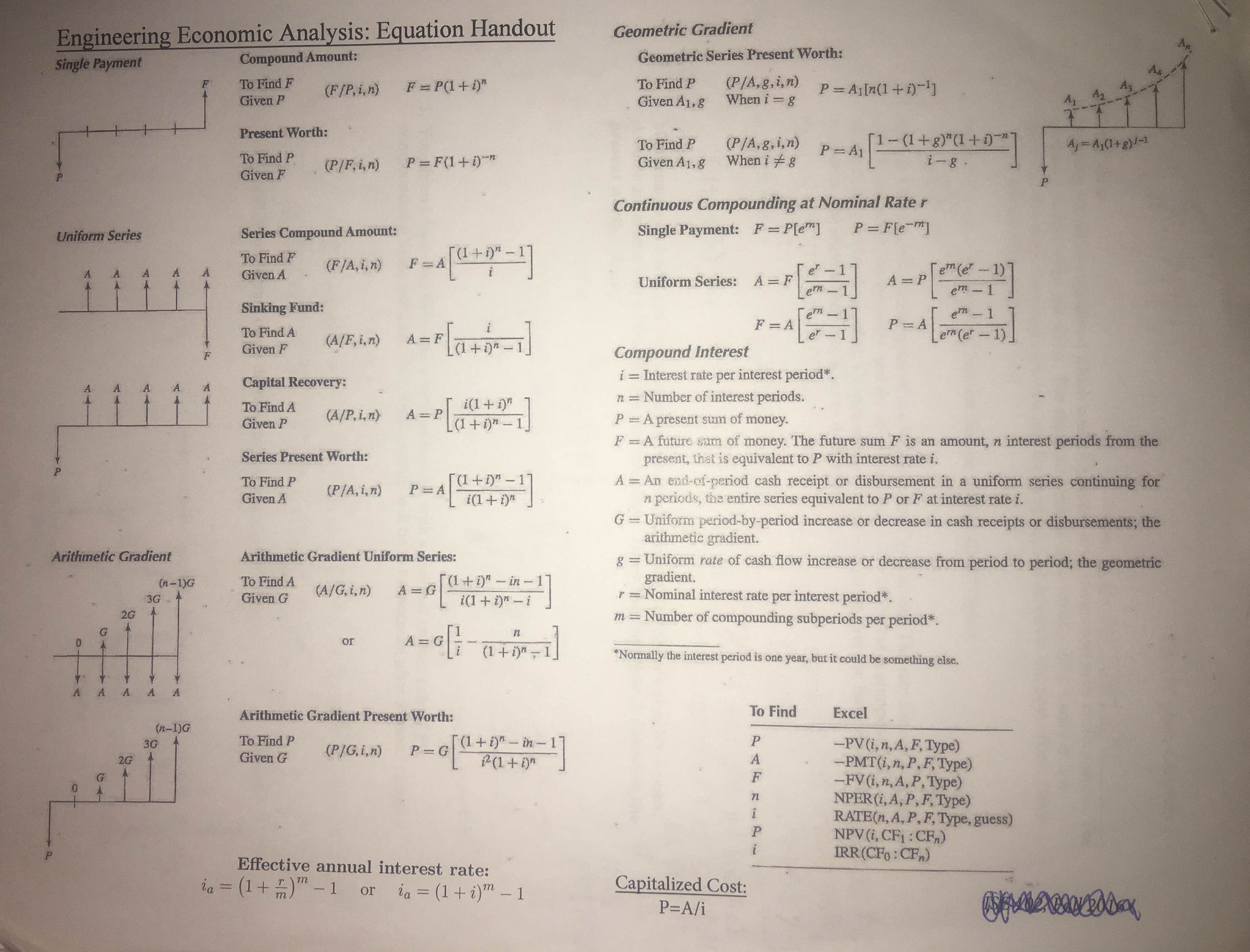

If you park on campus all day 3 days per week what would be the rate of return for buying a semester permit vs. daily permits every day you come to campus? Assume: The semester permit costs $192 and the All day permits costs $5.00 The semester is 16 weeks long You don't come to campus on week 14 You come to campus 3 days per week Assume that you're solving for a weekly rate of return before solving for an effective annual inter rate Solving: Determine the value of "A" for your weekly expenses. Do you pay at the beginning or end of the week? Show a cash flow diagram of your weekly expenses Calculate the Internal Rate of Return using the details above. Calculate the effective annual interest rate Compound Amount: To Find F Given P (F/P, i, n) F = P(1 + i)^n Present Worth: To Find P Given F (P/F, i, n) P = F(1 + i)^-n Series Compound Amount: To Find F Given A (F/A, i, n) F = A [(1 + i)^n - 1/i] Sinking Fund: To Find A Given F (A/F, i, n) A = F[i/(1 + i)^n - 1] Capital Recovery: To Find A Given P (A/P, i, n) A = P [i(1 + i)^n/(1 + i)^n - 1] Series Present Worth: To Find P Given A (P/A, i, n) P = A [(1 + i)^n - 1/i(1 + i)^n] Arithmetic Gradient Uniform Series: To Find A Given G (A/G, i, n) A = G [(1 + i)^n - in - 1/i(1 + i)^n - i] or A = G[1/i - n/(1 + i)^n - 1] Arithmetic Gradient Present Worth: To Find P Given G (P/G, i, n) P = G[(1 + i)^n - in - 1/i^2 (1 + i)^n] Effective annual interest rate: i_a = (1 + r/m)^m - 1 or i_a = (1 + i)^m - 1 Geometric Gradient Geometric Series Present Worth: To Find P (P/A, g, i, n) Given A_1, g When i = g P = A_1[n(1 + i)^-1] To Find P (P/A, g, i, n) Given A_1, g When i notequalto g P = A_1 [1 - (1 + g)^n (1 + i)^-n/i - g] Continuous Compounding at Nominal Rate r Single Payment: F = P[e^m] P = F[e^-m] Uniform Series: A = F[e^r - 1/e^m - 1] A = P[e^m(e^r - 1)/e^m - 1] F = A[e^m - 1/e^r - 1] P = A[e^m - 1/e^m(e^r - 1)] Compound Interest i = Interest rate per interest period*. n = Number of interest periods. P = A present sum of money. F = A future sum of money. The future sum F is an amount, n interest periods from the present, that is equivalent to P with interest rate i. A = An end-of-period cash receipt or disbursement in a uniform series continuing for n periods the entire series equivalent to P or F at interest rate i. G = Uniform period-by-period increase or decrease in cash receipts or disbursements; the arithmetic gradient. g = Uniform rate of cash flow increase or decrease from period to period; the geometric gradient. r = Nominal interest rate per interest period*. m = Number of compounding subperiods per period*. *Normally the interest period is one year, but it could be something else. To Find Excel P -PV (i, n, A, F, Type) A -PMT (i, n, P, F, Type) F -FV(i, n, A, P, Type) n NPER(i, A, P, F, Type) i RATE(n, A, P, F, Type, guess) P NPV (i, CF_1: CF_n) i IRR(CF_0: CF_n) Capitalized Cost: P = A/i

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts