Question: Problem solving: Separate Trading Registered Interest and Principal Securities (STRIPS) are sold at discount and offering no coupon regardless of the term. STRIPS are instruments

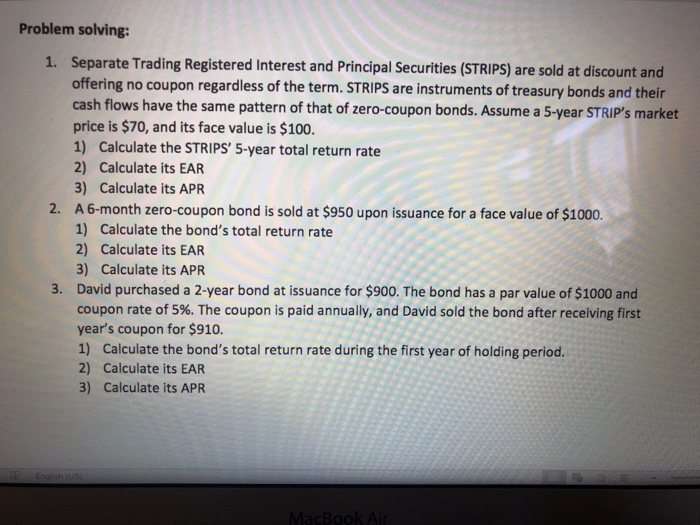

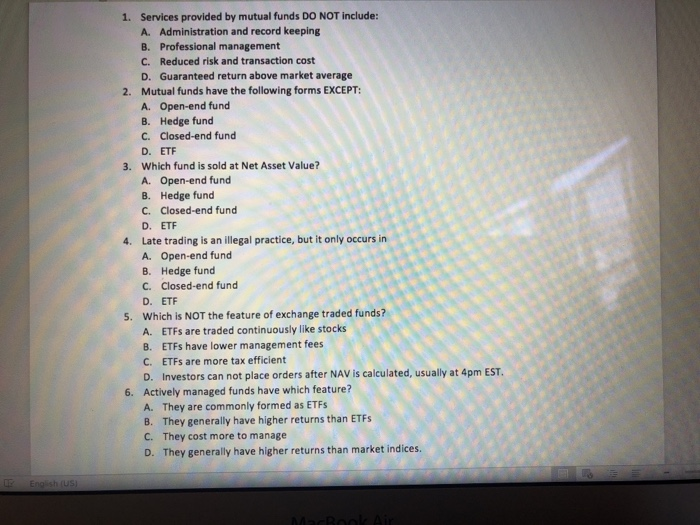

Problem solving: Separate Trading Registered Interest and Principal Securities (STRIPS) are sold at discount and offering no coupon regardless of the term. STRIPS are instruments of treasury bonds and their cash flows have the same pattern of that of zero-coupon bonds. Assume a 5-year STRIP's market price is $70, and its face value is $100 1) Calculate the STRIPS' 5-year total return rate 2) Calculate its EAR 3) Calculate its APR A 6-month zero-coupon bond is sold at $950 upon issuance for a face value of $1000. 1) Calculate the bond's total return rate 2) Calculate its EAR 3) Calculate its APR David purchased a 2-year bond at issuance for $900. The bond has a par value of $1000 and coupon rate of 5%. The coupon is paid annually, and David sold the bond after receiving first year's coupon for $910. 1) Calculate the bond's total return rate during the first year of holding period. 2) Calculate its EAR 3) Calculate its APR 1. 2. 3. Services provided by mutual funds DO NOT include: A. 1. Administration and record keeping B. Professional management C. Reduced risk and transaction cost Guaranteed return above market average D. Mutual funds have the following forms EXCEPT: A. Open-end fund B. Hedge fund C. Closed-end fund D. ETF Which fund is sold at Net Asset Value? A. Open-end fund B. Hedge fund C. Closed-end fund D. ETF Late trading is an illegal practice, but it only occurs in A. Open-end fund B. Hedge fund C. Closed-end fund D. ETF Which is NOT the feature of exchange traded funds? A. ETFs are traded continuously like stocks B. ETFs have lower management fees C. ETFs are more tax efficient D. Investors can not place orders after NAV is calculated, usually at 4pm EST. Actively managed funds have which feature? A. They are commonly formed as ETFs B. They generally have higher returns than ETFs C. They cost more to manage D. They generally have higher returns than market indices 2. 3. 4. 5. 6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts