Question: problem solving: The Vancouver Company, using a process system, manufacture work boots, its main product, and wallets, its by-product. They both emerge at the split-off

problem solving:

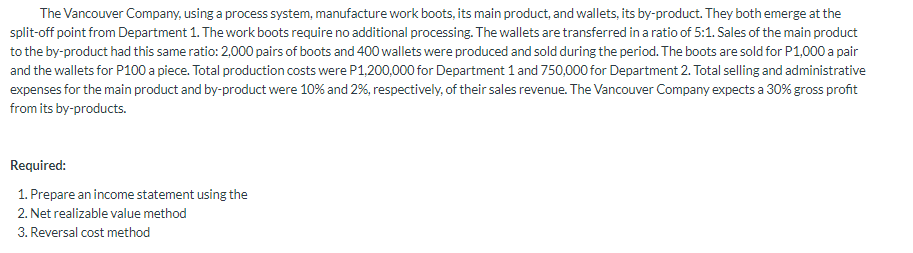

The Vancouver Company, using a process system, manufacture work boots, its main product, and wallets, its by-product. They both emerge at the split-off point from Department 1. The work boots require no additional processing. The wallets are transferred in a ratio of 5:1. Sales of the main product to the by-product had this same ratio: 2,000 pairs of boots and 400 wallets were produced and sold during the period. The boots are sold for P1,000 a pair and the wallets for P100 a piece. Total production costs were P1,200,000 for Department 1 and 750,000 for Department 2. Total selling and administrative expenses for the main product and by-product were 10% and 2%, respectively, of their sales revenue. The Vancouver Company expects a 30% gross profit from its by-products. Required: 1. Prepare an income statement using the 2. Net realizable value method 3. Reversal cost method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts