Question: Problem Solving/Short Answer Corporation Treta needs to raise certain amount of money in capital so it can buy the equipment needed to conduct its business.

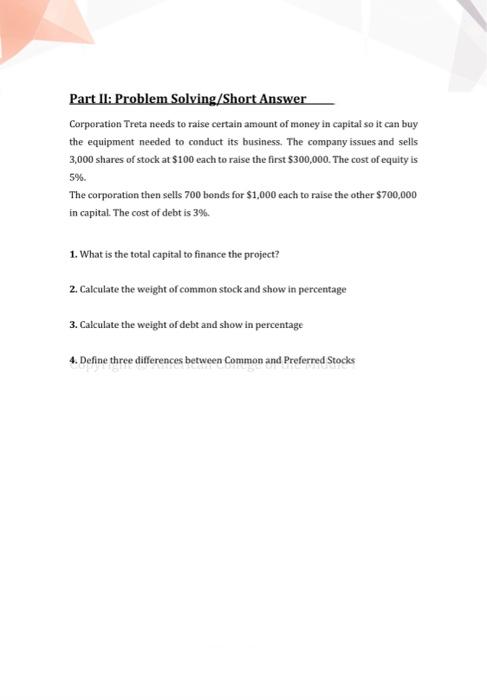

Problem Solving/Short Answer

Corporation Treta needs to raise certain amount of money in capital so it can buy

the equipment needed to conduct its business. The company issues and sells

3,000 shares of stock at $100 each to raise the first $300,000. The cost of equity is

5%.

The corporation then sells 700 bonds for $1,000 each to raise the other $700,000

in capital. The cost of debt is 3%.

1. What is the total capital to finance the project?

2. Calculate the weight of common stock and show in percentage

3. Calculate the weight of debt and show in percentage

4. Define three differences between Common and Preferred Stocks

Part II: Problem Solving/Short Answer Corporation Treta needs to raise certain amount of money in capital so it can buy the equipment needed to conduct its business. The company issues and sells 3,000 shares of stock at $100 each to raise the first $300,000. The cost of equity is 5%. The corporation then sells 700 bonds for $1,000 each to raise the other $700,000 in capital. The cost of debt is 3%. 1. What is the total capital to finance the project? 2. Calculate the weight of common stock and show in percentage 3. Calculate the weight of debt and show in percentage 4. Define three differences between Common and Preferred Stocks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts