Question: Problem statement: A small manufacturing company is considering a proposal to produce a proprietary component under contract to a customer. The contract calls for delivery

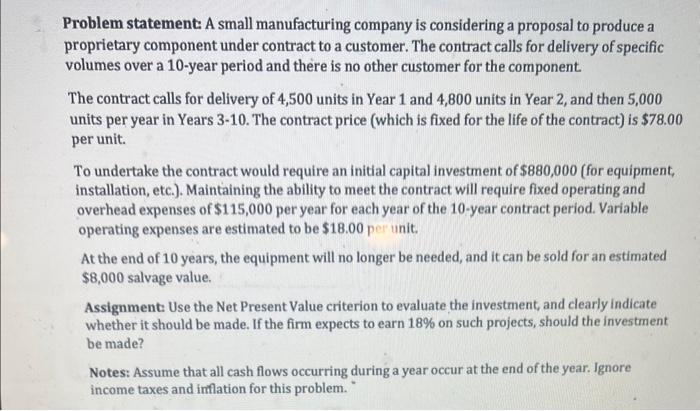

Problem statement: A small manufacturing company is considering a proposal to produce a proprietary component under contract to a customer. The contract calls for delivery of specific volumes over a 10-year period and there is no other customer for the component. The contract calls for delivery of 4,500 units in Year 1 and 4,800 units in Year 2, and then 5,000 units per year in Years 3-10. The contract price (which is fixed for the life of the contract) is $78.00 per unit. To undertake the contract would require an initial capital investment of $880,000 (for equipment, installation, etc.). Maintaining the ability to meet the contract will require fixed operating and overhead expenses of $115,000 per year for each year of the 10-year contract period. Variable operating expenses are estimated to be $18.00 per unit. At the end of 10 years, the equipment will no longer be needed, and it can be sold for an estimated $8,000 salvage value. Assignment: Use the Net Present Value criterion to evaluate the investment, and clearly indicate whether it should be made. If the firm expects to earn 18% on such projects, should the investment be made? Notes: Assume that all cash flows occurring during a year occur at the end of the year. Ignore income taxes and imflation for this

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts