Question: Problem Statement: Amberjack Company is trying to decide on an allocation base to use to assign manufacturing overhead to jobs. The company has always used

Problem Statement:

Amberjack Company is trying to decide on an allocation base to use to assign manufacturing overhead to jobs. The company has always

used direct labor hours to assign manufacturing overhead to products, but it is trying to decide whether it should use a different allocation

base such as direct labor dollars or machine hours.

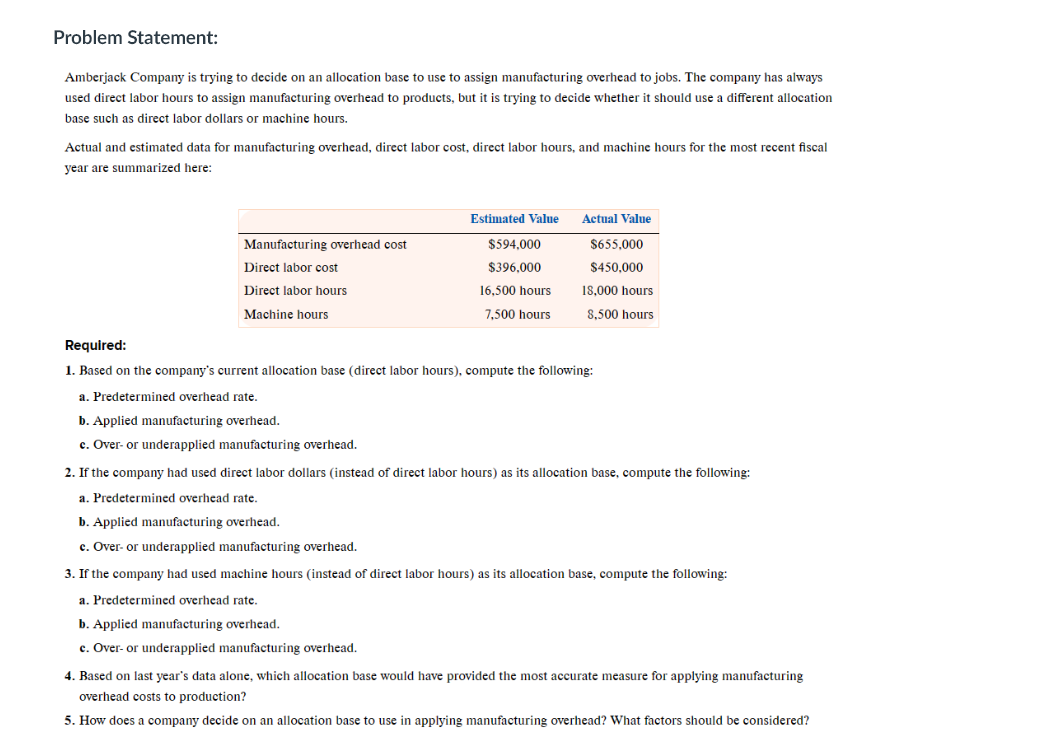

Actual and estimated data for manufacturing overhead, direct labor cost, direct labor hours, and machine hours for the most recent fiscal

year are summarized here:

Required:

Based on the company's current allocation base direct labor hours compute the following:

a Predetermined overhead rate.

b Applied manufacturing overhead.

c Over or underapplied manufacturing overhead.

If the company had used direct labor dollars instead of direct labor hours as its allocation base, compute the following:

a Predetermined overhead rate.

b Applied manufacturing overhead.

c Over or underapplied manufacturing overhead.

If the company had used machine hours instead of direct labor hours as its allocation base, compute the following:

a Predetermined overhead rate.

b Applied manufacturing overhead.

c Over or underapplied manufacturing overhead.

Based on last year's data alone, which allocation base would have provided the most accurate measure for applying manufacturing

overhead costs to production?

How does a company decide on an allocation base to use in applying manufacturing overhead? What factors should be considered?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock