Question: PROBLEM STATEMENT Gino is an American multinational technology company founded in 1997 and specializes in consumer electronics. With the COVID-19 pandemic pushing work, school, and

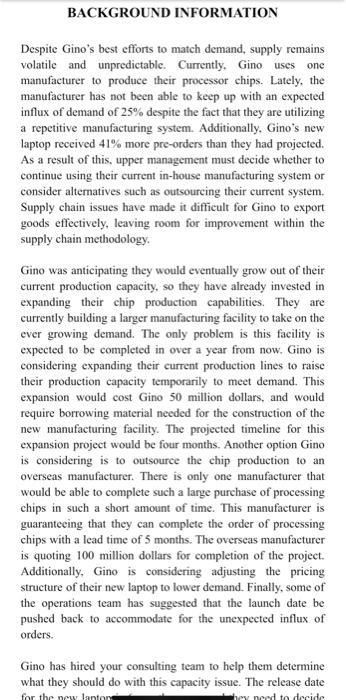

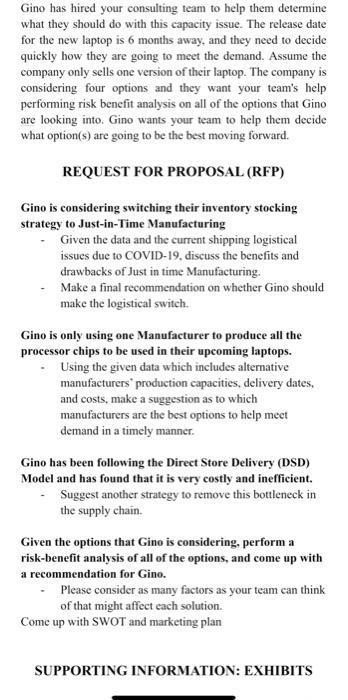

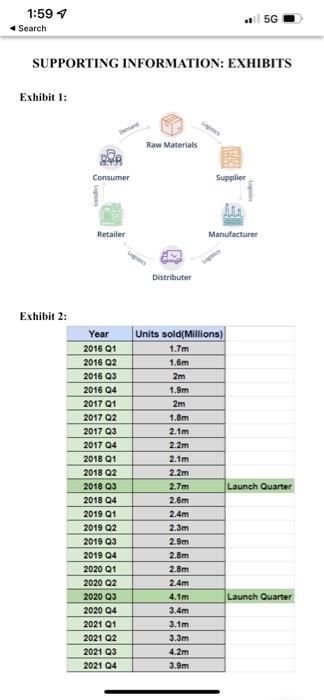

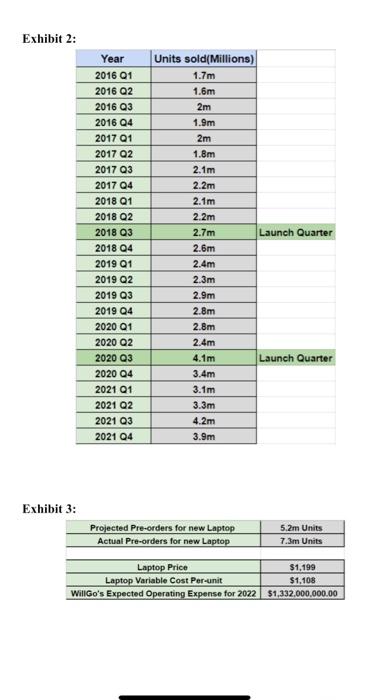

PROBLEM STATEMENT Gino is an American multinational technology company founded in 1997 and specializes in consumer electronics. With the COVID-19 pandemic pushing work, school, and many other events onto a virtual platform, Gino has been seeing a steady increase in sales due to the increased demand for personal laptops to accommodate for these changing times. Although still considered a fairly new technology company, Gino has been changing how people rely on these portable computers for the past 25 years. Gino recently released a teaser for their new laptop that will be releasing later this year. It has received overwhelming hype from its valued customers. They are facing high demands for their product, but cannot match the amount of preorders needed to provide a laptop for every customer. Gino has seen a trend in sales in the past years where they were able to meet customers' demands consistently despite the increase in sales. However, with the introduction of the new processor chips and the competitive pricing against other brands, their demands from consumers have skyrocketed for this new laptop. Gino reached out to your consulting team to help them look for strategies to satisfy customer demands and produce their product efficiently BACKGROUND INFORMATION Despite Gino's best efforts to match demand, supply remains volatile and unpredictable. Currently, Gino uses one manufacturer to produce their processor chips. Lately, the manufacturer has not been able to keep up with an expected influx of demand of 25% despite the fact that they are utilizing a repetitive manufacturing system. Additionally, Gino's new laptop received 41% more pre-orders than they had projected. As a result of this, upper management must decide wb continue using their current in-house manufacturing s. consider alternatives such as outsourcing their current BACKGROUND INFORMATION Despite Gino's best efforts to match demand, supply remains volatile and unpredictable. Currently, Gino uses one manufacturer to produce their processor chips. Lately, the manufacturer has not been able to keep up with an expected influx of demand of 25% despite the fact that they are utilizing a repetitive manufacturing system. Additionally. Gino's new laptop received 41% more pre-orders than they had projected. As a result of this, upper management must decide whether to continue using their current in-house manufacturing system or consider alternatives such as outsourcing their current system. Supply chain issues have made it difficult for Gino to export goods effectively, leaving room for improvement within the supply chain methodology. Gino was anticipating they would eventually grow out of their current production capacity, so they have already invested in expanding their chip production capabilities. They are currently building a larger manufacturing facility to take on the ever growing demand. The only problem is this facility is expected to be completed in over a year from now. Gino is considering expanding their current production lines to raise their production capacity temporarily to meet demand. This expansion would cost Gino 50 million dollars, and would require borrowing material needed for the construction of the new manufacturing facility. The projected timeline for this expansion project would be four months. Another option Gino is considering is to outsource the chip production to an overseas manufacturer. There is only one manufacturer that would be able to complete such a large purchase of processing chips in such a short amount of time. This manufacturer is guaranteeing that they can complete the order of processing chips with a lead time of 5 months. The overseas manufacturer is quoting 100 million dollars for completion of the project. Additionally, Gino is considering adjusting the pricing structure of their new laptop to lower demand. Finally, some of the operations team has suggested that the launch date be pushed back to accommodate for the unexpected influx of orders. Gino has hired your consulting team to help them determine what they should do with this capacity issue. The release date for the new lanton hey need to decide Gino has hired your consulting team to help them determine what they should do with this capacity issue. The release date for the new laptop is 6 months away, and they need to decide quickly how they are going to meet the demand. Assume the company only sells one version of their laptop. The company is considering four options and they want your team's help performing risk benefit analysis on all of the options that Gino are looking into. Gino wants your team to help them decide what option(s) are going to be the best moving forward. REQUEST FOR PROPOSAL (RFP) Gino is considering switching their inventory stocking strategy to Just-in-Time Manufacturing Given the data and the current shipping logistical issues due to COVID-19, discuss the benefits and drawbacks of Just in time Manufacturing. Make a final recommendation on whether Gino should make the logistical switch. Gino is only using one Manufacturer to produce all the processor chips to be used in their upcoming laptops. Using the given data which includes alternative manufacturers' production capacities, delivery dates, and costs, make a suggestion as to which manufacturers are the best options to help meet demand in a timely manner. Gino has been following the Direct Store Delivery (DSD) Model and has found that it is very costly and inefficient. Suggest another strategy to remove this bottleneck in the supply chain. Given the options that Gino is considering, perform a risk-benefit analysis of all of the options, and come up with a recommendation for Gino. Please consider as many factors as your team can think of that might affect each solution. Come up with SWOT and marketing plan SUPPORTING INFORMATION: EXHIBITS 1:59 Search 5G SUPPORTING INFORMATION: EXHIBITS Exhibit 1: Raw Materials Consumer Supplier Retailer Manufacturer Distributer Exhibit 2: Year 2016 Q1 2016 Q2 2016 Q3 2016 Q4 2017 Q1 2017 Q2 2017 Q3 2017 04 2018 Q1 2018 Q2 2018 Q3 2018 Q4 2019 Q1 2019 Q2 2019 Q3 2019 Q4 2020 Q1 2020 Q2 2020 Q3 2020 04 2021 Q1 2021 Q2 2021 Q3 2021 04 Units sold(Millions) 1.7m 1.6m 2m 1.9m 2m 1.8m 2.1m 2.2m 2.1m 2.2m 2.7m Launch Quarter 2.6m 2.4m 2.3m 2.9m 2.8m 2.8m 2.4m 4.1m Launch Quarter 3.4m 3.1m 3.3m 4.2m 3.9m Exhibit 2: Year 2016 Q1 2016 Q2 2016 Q3 2016 04 2017 Q1 2017 Q2 2017 Q3 2017 Q4 2018 Q1 2018 02 2018 Q3 2018 Q4 2019 Q1 2019 Q2 2019 Q3 2019 Q4 2020 01 2020 Q2 2020 Q3 2020 04 2021 Q1 2021 Q2 2021 Q3 2021 04 Units sold(Millions) 1.7m 1.6m 2m 1.9m 2m 1.8m 2.1m 2.2m 2.1m 2.2m 2.7m Launch Quarter 2.6m 2.4m 2.3m 2.9m 2.8m 2.8m 2.4m 4.1m Launch Quarter 3.4m 3.1m 3.3m 4.2m 3.9m Exhibit 3: Projected Pre-orders for new Laptop 5.2m Units Actual Pre-orders for new Laptop 7.3m Units Laptop Price $1,199 Laptop Variable Cost Per-unit $1.108 WillGo's Expected Operating Expense for 2022 51,332.000.000.00