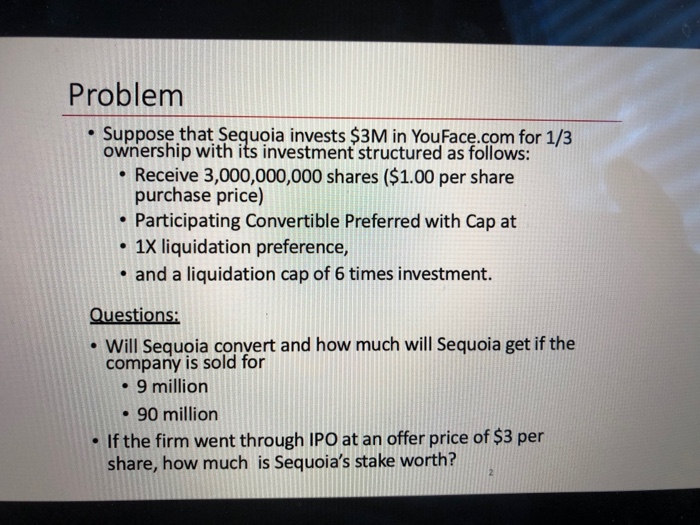

Question: Problem . Suppose that Sequoia invests $3M in YouFace.com for 1/3 ownership with its investment structured as follows: .Receive 3,000,000,000 shares ($1.00 per share purchase

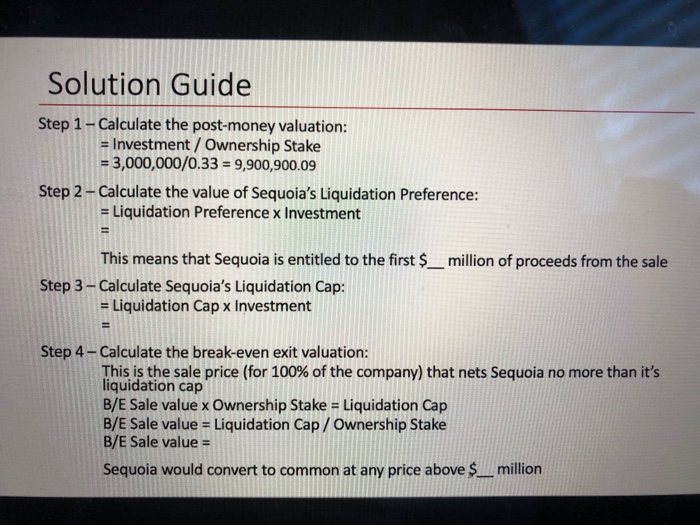

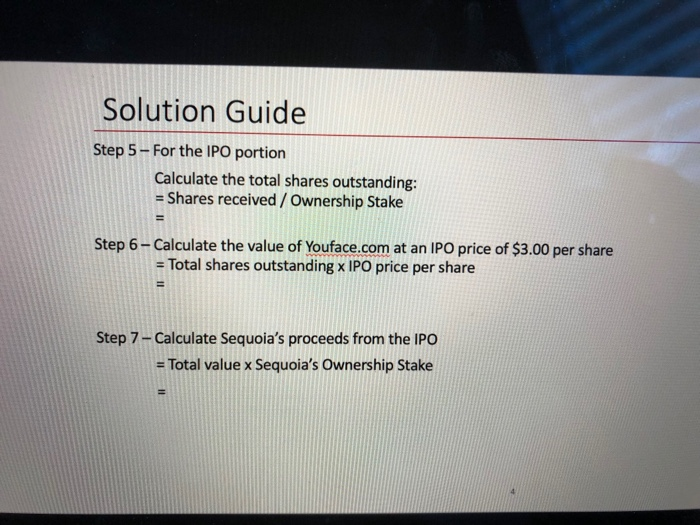

Problem . Suppose that Sequoia invests $3M in YouFace.com for 1/3 ownership with its investment structured as follows: .Receive 3,000,000,000 shares ($1.00 per share purchase price) Participating Convertible Preferred with Cap at 1X liquidation preference, and a liquidation cap of 6 times investment. Questions: Will Sequoia convert and how much will Sequoia get if the company is sold for . 9 million - 90 million If the firm went through IPO at an offer price of $3 per share, how much is Sequoia's stake worth? Solution Guide Step 1-Calculate the post-money valuation: = Investment / Ownership Stake = 3,000,000/0.33 = 9,900,900.09 = Liquidation Preference x Investment This means that Sequoia is entitled to the first $-million of proceeds from the sale = Liquidation Cap x Investment Step 2-Calculate the value of Sequoia's Liquidation Preference: Step 3-Calculate Sequoia's Liquidation Cap Step 4- Calculate the break-even exit valuation: le price (for 100% of the company) that nets Sequoia no more than it's liquidation cap B/E Sale value x Ownership StakeLiquidation Cap B/E Sale value -Liquidation Cap/Ownership Stake B/E Sale value Sequoia would convert to common at any price above S million Solution Guide Step 5- For the IPO portion Calculate the total shares outstanding: -Shares received/Ownership Stake Step 6-Calculate the value of Youface.com at an IPO price of $3.00 per share -Total shares outstanding x IPO price per share Step 7-Calculate Sequoia's proceeds from the IPO -Total value x Sequoia's Ownership Stake

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts