Question: PROBLEM & The following information was obtained in connection with the audit of Matindi Co.'s cash account as of December 31, 2019: a. Cash balance

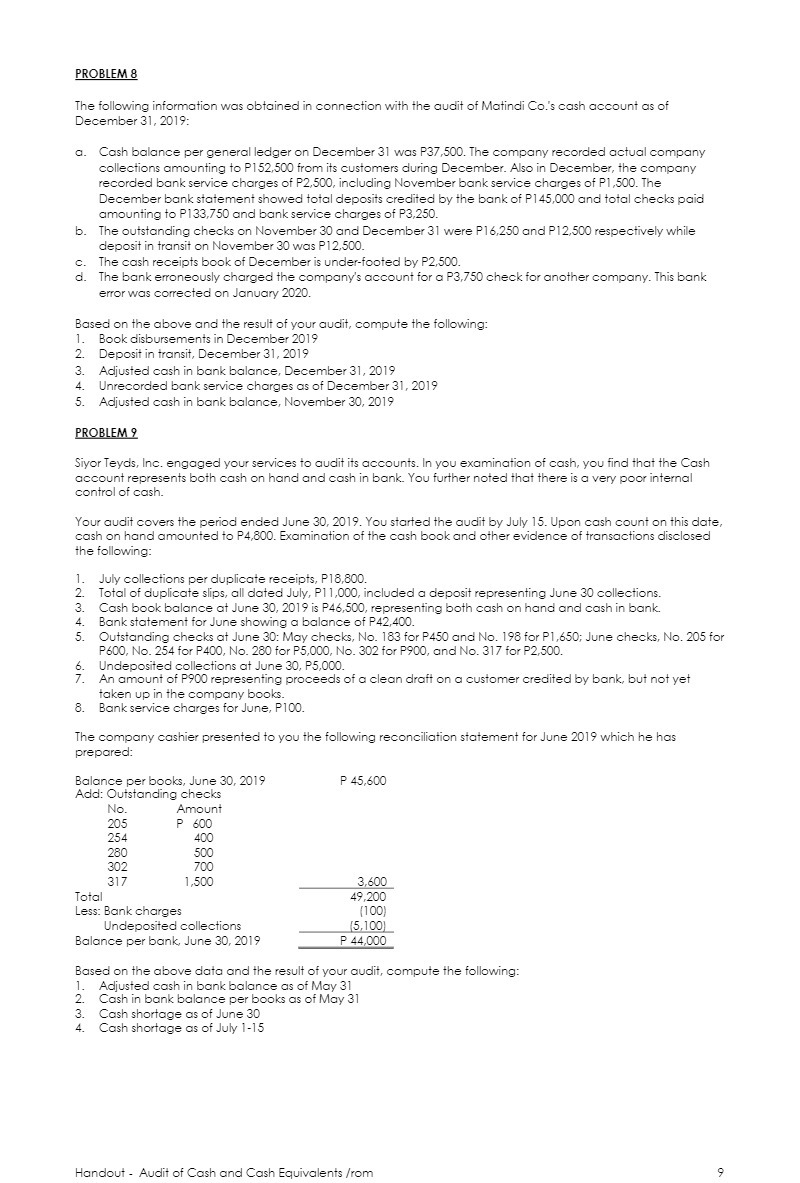

PROBLEM & The following information was obtained in connection with the audit of Matindi Co.'s cash account as of December 31, 2019: a. Cash balance per general ledger on December 31 was P37,500. The company recorded actual company collections amounting to P152,500 from its customers during December. Also in December, the company recorded bank service charges of P2,500, including November bank service charges of P1,500. The December bank statement showed total deposits credited by the bank of P145,000 and total checks paid amounting to P133,750 and bank service charges of P3,250. b. The outstanding checks on November 30 and December 31 were P16,250 and P12,500 respectively while deposit in transit on November 30 was P12,500. C. The cash receipts book of December is under-footed by P2,500. d. The bank erroneously charged the company's account for a P3,750 check for another company. This bank error was corrected on January 2020. Based on the above and the result of your audit, compute the following: 1. Book disbursements in December 2019 2. Deposit in transit, December 31, 2019 3. Adjusted cash in bank balance, December 31, 2019 Unrecorded bank service charges as of December 31, 2019 5. Adjusted cash in bank balance, November 30, 2019 PROBLEM 9 Siyor Teyds, Inc. engaged your services to audit its accounts. In you examination of cash, you find that the Cash account represents both cash on hand and cash in bank. You further noted that there is a very poor internal control of cash. Your audit covers the period ended June 30, 2019. You started the audit by July 15. Upon cash count on this date, cash on hand amounted to P4,800. Examination of the cash book and other evidence of transactions disclosed the following: 1. July collections per duplicate receipts, P18,800. 2. Total of duplicate slips, all dated July, P1 1,000, included a deposit representing June 30 collections. 3. Cash book balance at June 30, 2019 is P46,500, representing both cash on hand and cash in bank. 4 . Bank statement for June showing a balance of P42,400. 5. Outstanding checks at June 30: May checks, No. 183 for P450 and No. 198 for P1,650; June checks, No. 205 for P600, No. 254 for P400, No. 280 for P5,000, No. 302 for P900, and No. 317 for P2,500. Undeposited collections at June 30, P5,000. 7. An amount of P900 representing proceeds of a clean draft on a customer credited by bank, but not yet taken up in the company books. 8. Bank service charges for June, P100. The company cashier presented to you the following reconciliation statement for June 2019 which he has prepared: Balance per books, June 30, 2019 P 45,600 Add: Outstanding checks No. Amount 205 P 600 254 400 280 500 302 700 317 1,500 3,600 Total 49,200 Less: Bank charges (100 Undeposited collections (5.100) Balance per bank, June 30, 2019 P 44,000 Based on the above data and the result of your audit, compute the following: 1. Adjusted cash in bank balance as of May 31 2 . Cash in bank balance per books as of May 31 Cash shortage as of June 30 Cash shortage as of July 1-15 Handout - Audit of Cash and Cash Equivalents /rom