Question: Problem Three: 1) E9-8 on page 464. Ignore GST. Note that personal property does not mean personal to the owners. Personal property is a legal

Problem Three:

1) E9-8 on page 464. Ignore GST. Note that personal property does not mean personal to the owners. Personal property is a legal term used to distinguish that type of property from real property such as buildings and land. It could include, for example, equipment.

2) Same facts as 1), but assume a yearly accounting period that ends on May 31, 2017. Prepare the adjusting journal entries for depreciation on May 31, 2017.

3) If management were opportunistic, why might they prefer to allocate more of the cost to Building rather than personal property?

4) Ignore 2) above. Prior to the IFRS requirement to depreciate components separately, all of the construction costs may well have been depreciated using the useful life and residual value of the building. Calculate the depreciation expense for 2017 under this scenario and show the difference in profit as compared to 1) above. Ignore income taxes.

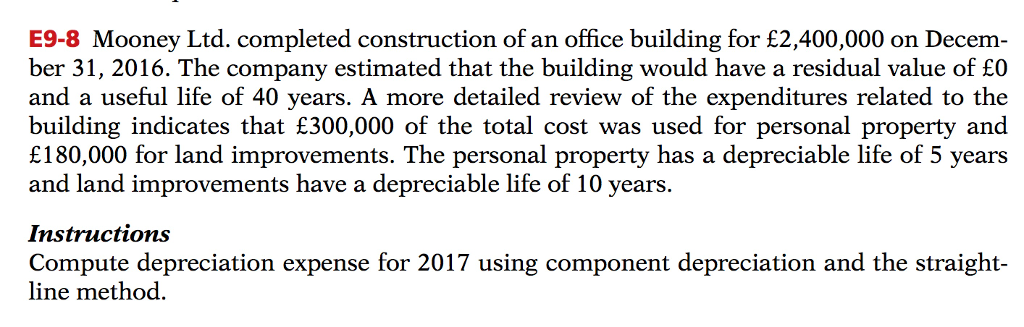

E9-8 Mooney Ltd. completed construction of an office building for 2,400,000 on Decem- ber 31, 2016. The company estimated that the building would have a residual value of 0 and a useful life of 40 years. A more detailed review of the expenditures related to the building indicates that 300,000 of the total cost was used for personal property and 180,000 for land improvements. The personal property has a depreciable life of 5 years and land improvements have a depreciable life of 10 years Instructions Compute depreciation expense for 2017 using component depreciation and the straight- line method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts