Question: Problem Three- Deferred Income Taxes (continued): e) Assume that the U.S. statutory tax rate of 35% was used to calculate deferred tax assets related to

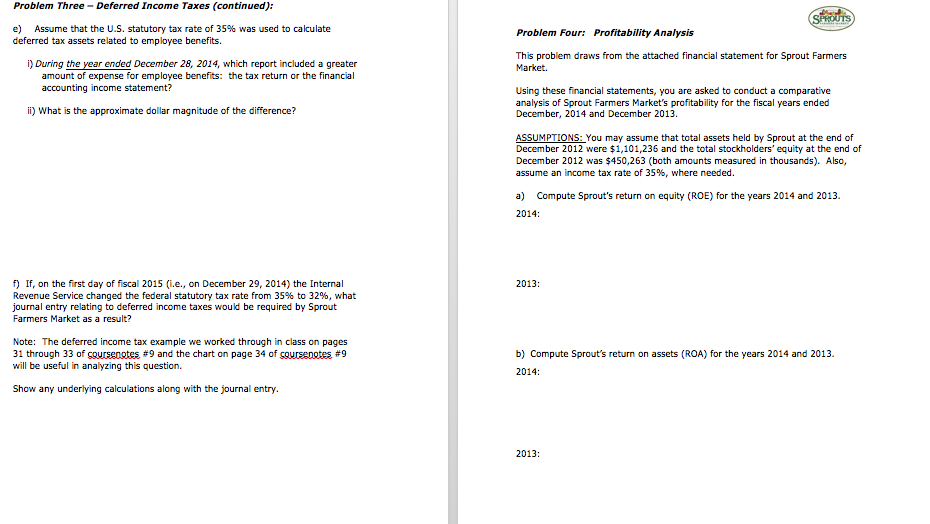

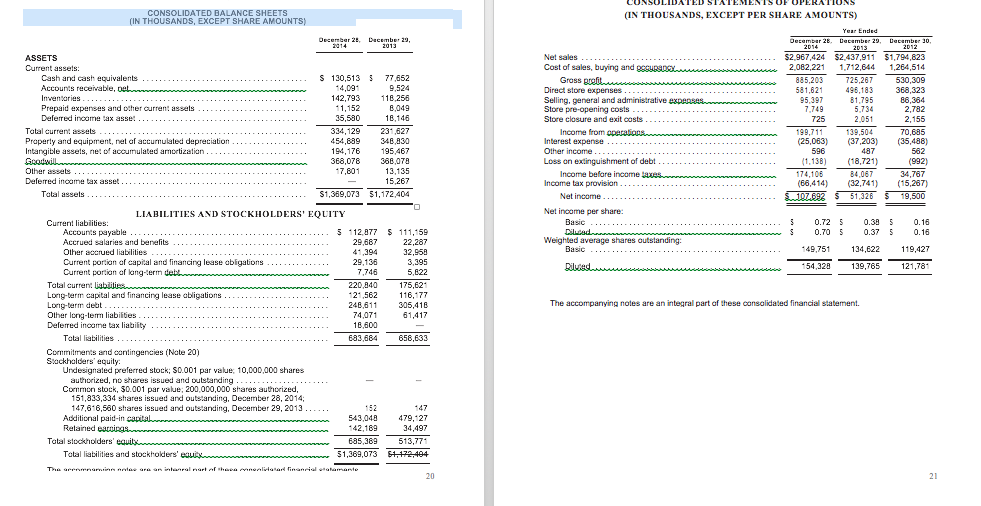

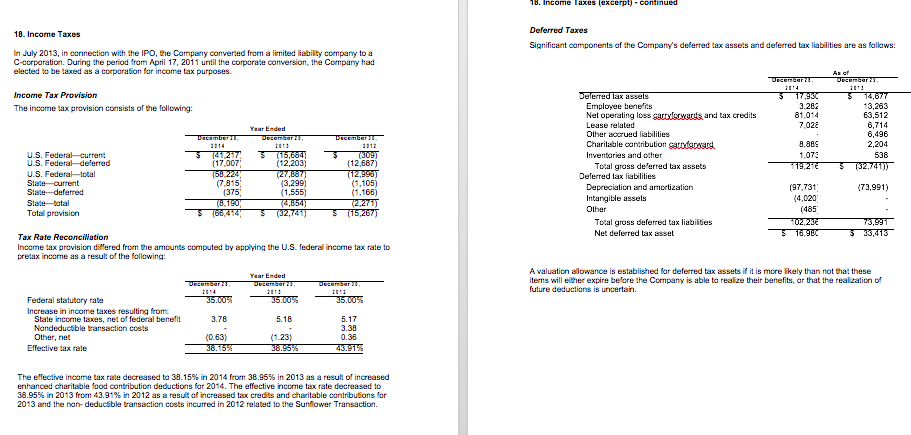

Problem Three- Deferred Income Taxes (continued): e) Assume that the U.S. statutory tax rate of 35% was used to calculate deferred tax assets related to employee benefits. Problem Four: Profitability Analysis )During the year ended December 28, 2014, which report included a greater This problem draws from the attached financial statement for Sprout Farmers Market. amount of expense for employee benefits: the tax return or the financial accounting income statement? Using these financial statements, you are asked to conduct a comparative analysis of Sprout Farmers Market's profitability for the fiscal years ended December, 2014 and December 2013. ii) what is the approximate dollar magnitude of the difference? ASSUMPTIONS:You may assume that total assets held by Sprout at the end of December 2012 were $1,101,236 and the total stockholders' equity at the end of December 2012 was $450,263 (both amounts measured in thousands). Also, assume an income tax rate of 35%, where needed. a) Compute Sprout's return on equity (ROE) for the years 2014 and 2013. 2014: 2013: f) If, on the first day of fiscal 2015 (i.e., on December 29, 2014) the Internal Revenue Service changed the federal statutory tax rate from 35% to 32%, what journal entry relating to deferred income taxes would be required by Sprout Farmers Market as a result? Note: The deferred income tax example we worked through in class on pages 31 through 33 of ggursenote #9 and the chart on page 34 ofggurseno #9 will be useful in analyzing this question. b) Compute Sprout's return on assets (ROA) for the years 2014 and 2013. 2014: Show any underlying calculations along with the journal entry 2013: Problem Three- Deferred Income Taxes (continued): e) Assume that the U.S. statutory tax rate of 35% was used to calculate deferred tax assets related to employee benefits. Problem Four: Profitability Analysis )During the year ended December 28, 2014, which report included a greater This problem draws from the attached financial statement for Sprout Farmers Market. amount of expense for employee benefits: the tax return or the financial accounting income statement? Using these financial statements, you are asked to conduct a comparative analysis of Sprout Farmers Market's profitability for the fiscal years ended December, 2014 and December 2013. ii) what is the approximate dollar magnitude of the difference? ASSUMPTIONS:You may assume that total assets held by Sprout at the end of December 2012 were $1,101,236 and the total stockholders' equity at the end of December 2012 was $450,263 (both amounts measured in thousands). Also, assume an income tax rate of 35%, where needed. a) Compute Sprout's return on equity (ROE) for the years 2014 and 2013. 2014: 2013: f) If, on the first day of fiscal 2015 (i.e., on December 29, 2014) the Internal Revenue Service changed the federal statutory tax rate from 35% to 32%, what journal entry relating to deferred income taxes would be required by Sprout Farmers Market as a result? Note: The deferred income tax example we worked through in class on pages 31 through 33 of ggursenote #9 and the chart on page 34 ofggurseno #9 will be useful in analyzing this question. b) Compute Sprout's return on assets (ROA) for the years 2014 and 2013. 2014: Show any underlying calculations along with the journal entry 2013

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts