Question: Problem Three: Ignore GST. The following potential errors were discovered during the financial year ending December 31, 2017 for Oscar Ltd: A machine with a

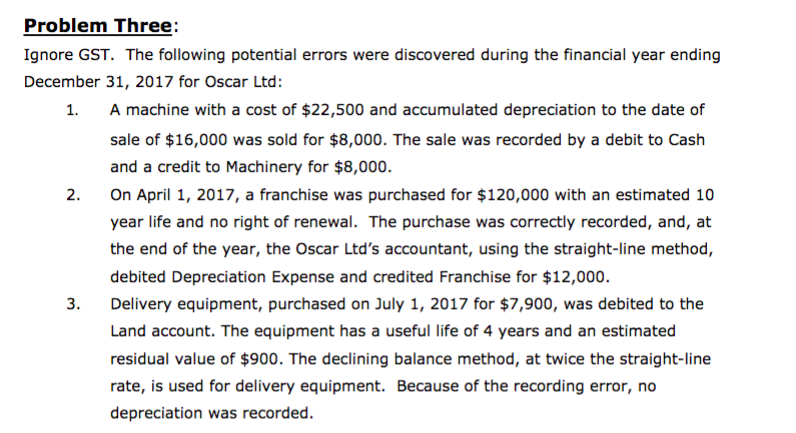

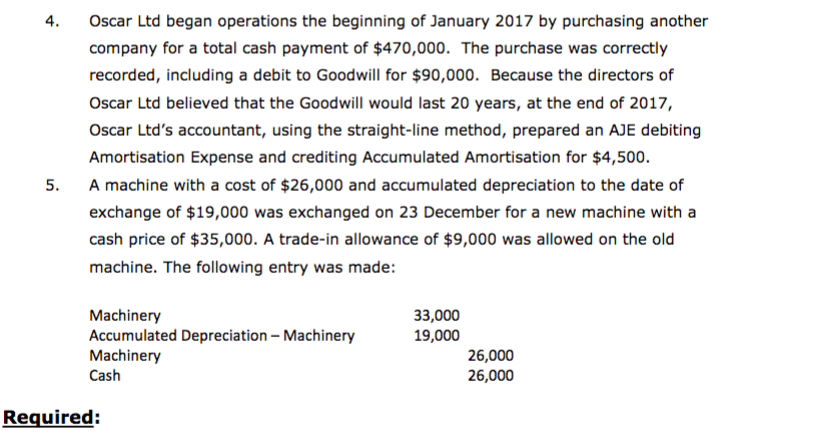

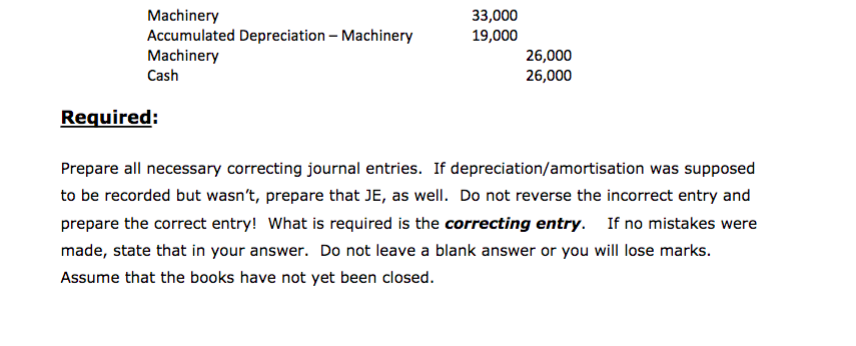

Problem Three: Ignore GST. The following potential errors were discovered during the financial year ending December 31, 2017 for Oscar Ltd: A machine with a cost of $22,500 and accumulated depreciation to the date of sale of $16,000 was sold for $8,000. The sale was recorded by a debit to Cash and a credit to Machinery for $8,000. On April 1, 2017, a franchise was purchased for $120,000 with an estimated 10 year life and no right of renewal. The purchase was correctly recorded, and, at the end of the year, the Oscar Ltd's accountant, using the straight-line method, debited Depreciation Expense and credited Franchise for $12,000 Delivery equipment, purchased on July 1, 2017 for $7,900, was debited to the Land account. The equipment has a useful life of 4 years and an estimated residual value of $900. The declining balance method, at twice the straight-line rate, is used for delivery equipment. Because of the recording error, no depreciation was recorded. 1. 2. 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts