Question: PROBLEM THREE In 2 0 2 3 , William Barker, who is single, earned the following income and incurred the following losses: employment income: $

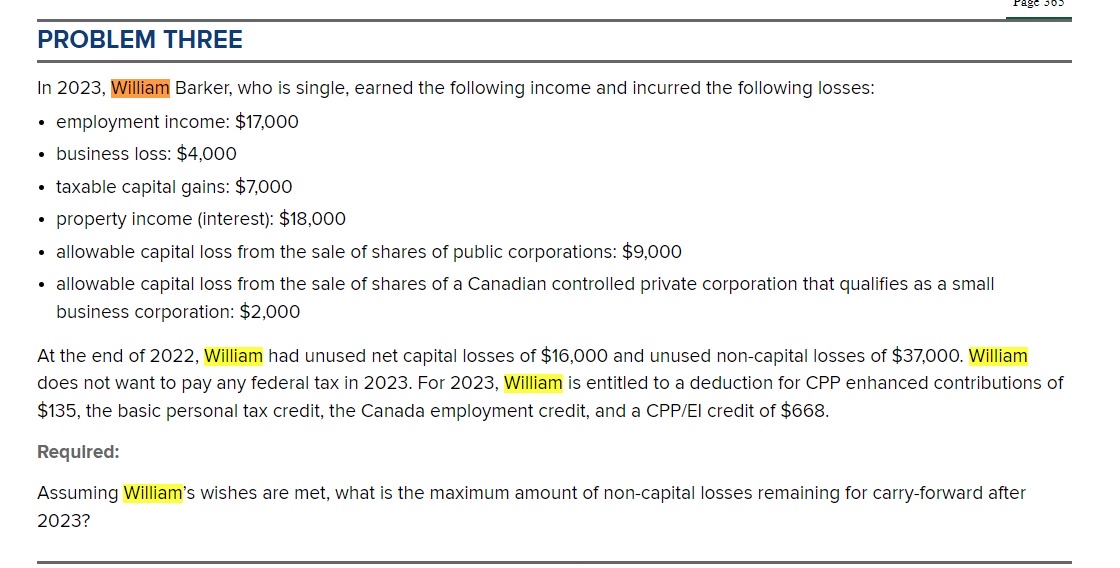

PROBLEM THREE

In William Barker, who is single, earned the following income and incurred the following losses:

employment income: $

business loss: $

taxable capital gains: $

property income interest: $

allowable capital loss from the sale of shares of public corporations: $

allowable capital loss from the sale of shares of a Canadian controlled private corporation that qualifies as a small business corporation: $

At the end of William had unused net capital losses of $ and unused noncapital losses of $ William does not want to pay any federal tax in For William is entitled to a deduction for CPP enhanced contributions of $ the basic personal tax credit, the Canada employment credit, and a CPPEI credit of $

Required:

Assuming William's wishes are met, what is the maximum amount of noncapital losses remaining for carryforward after

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock