Question: PROBLEM TWO (20 MARKS) In addition to the AAA Ltd. financial statements in Problem One, you are given more information as follows. Sales are forecast

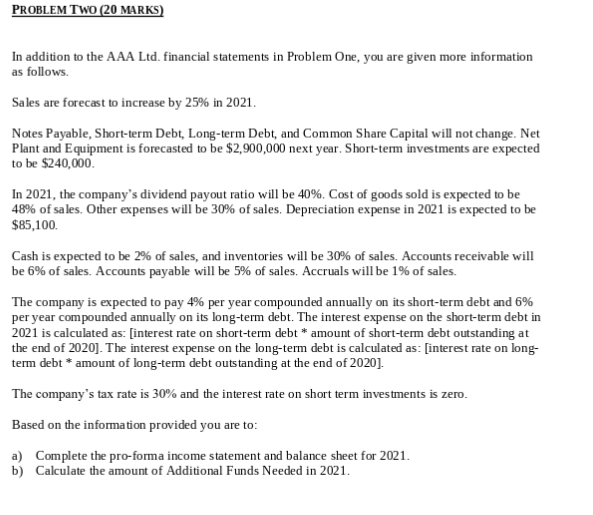

PROBLEM TWO (20 MARKS) In addition to the AAA Ltd. financial statements in Problem One, you are given more information as follows. Sales are forecast to increase by 25% in 2021. Notes Payable, Short-term Debt, Long-term Debt, and Common Share Capital will not change. Net Plant and Equipment is forecasted to be $2,900,000 next year. Short-term investments are expected to be $240,000 In 2021, the company's dividend payout ratio will be 40%. Cost of goods sold is expected to be 48% of sales. Other expenses will be 30% of sales. Depreciation expense in 2021 is expected to be $85,100 Cash is expected to be 2% of sales, and inventories will be 30% of sales. Accounts receivable will be 6% of sales. Accounts payable will be 5% of sales. Accruals will be 1% of sales. The company is expected to pay 4% per year compounded annually on its short-term debt and 6% per year compounded annually on its long-term debt. The interest expense on the short-term debt in 2021 is calculated as: [interest rate on short-term debt * amount of short-term debt outstanding at the end of 2020]. The interest expense on the long-term debt is calculated as: [interest rate on long- term debt* amount of long-term debt outstanding at the end of 2020]. The company's tax rate is 30% and the interest rate on short term investments is zero. Based on the information provided you are to: a) Complete the pro-forma income statement and balance sheet for 2021. b) Calculate the amount of Additional Funds Needed in 2021. PROBLEM TWO (20 MARKS) In addition to the AAA Ltd. financial statements in Problem One, you are given more information as follows. Sales are forecast to increase by 25% in 2021. Notes Payable, Short-term Debt, Long-term Debt, and Common Share Capital will not change. Net Plant and Equipment is forecasted to be $2,900,000 next year. Short-term investments are expected to be $240,000 In 2021, the company's dividend payout ratio will be 40%. Cost of goods sold is expected to be 48% of sales. Other expenses will be 30% of sales. Depreciation expense in 2021 is expected to be $85,100 Cash is expected to be 2% of sales, and inventories will be 30% of sales. Accounts receivable will be 6% of sales. Accounts payable will be 5% of sales. Accruals will be 1% of sales. The company is expected to pay 4% per year compounded annually on its short-term debt and 6% per year compounded annually on its long-term debt. The interest expense on the short-term debt in 2021 is calculated as: [interest rate on short-term debt * amount of short-term debt outstanding at the end of 2020]. The interest expense on the long-term debt is calculated as: [interest rate on long- term debt* amount of long-term debt outstanding at the end of 2020]. The company's tax rate is 30% and the interest rate on short term investments is zero. Based on the information provided you are to: a) Complete the pro-forma income statement and balance sheet for 2021. b) Calculate the amount of Additional Funds Needed in 2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts