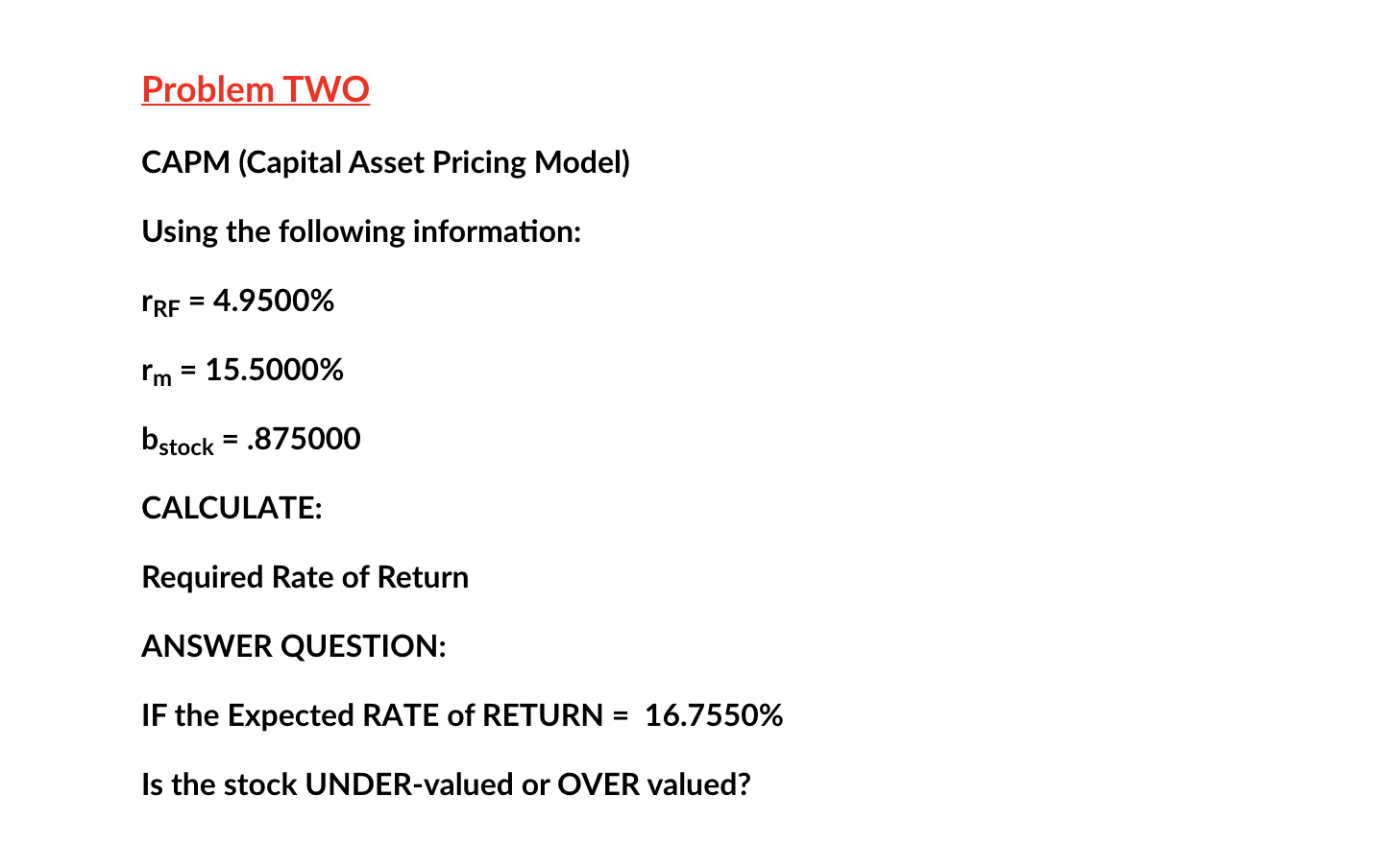

Question: Problem TWO CAPM (Capital Asset Pricing Model) Using the following information: PRE = 4.9500% I'm = 15.5000% = bstock = .875000 = CALCULATE: Required Rate

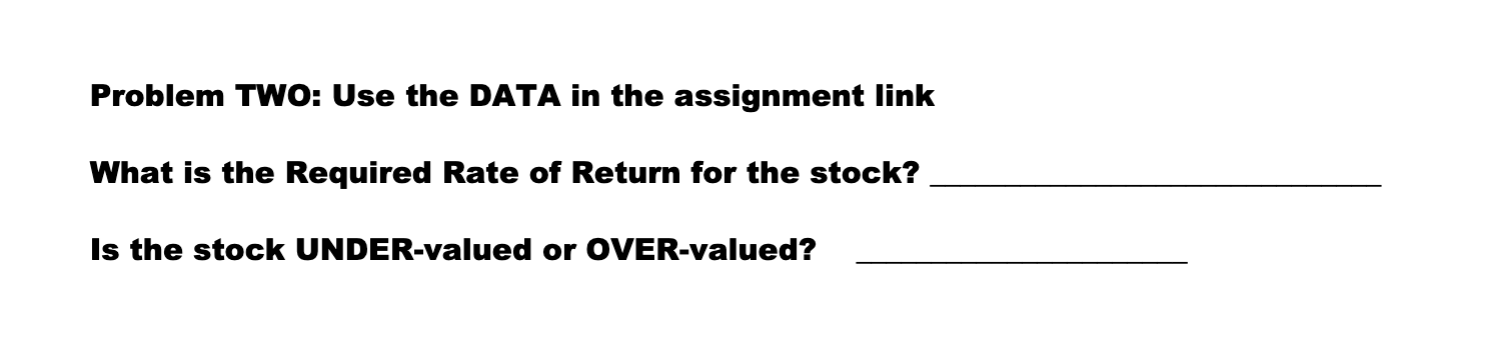

Problem TWO CAPM (Capital Asset Pricing Model) Using the following information: PRE = 4.9500% I'm = 15.5000% = bstock = .875000 = CALCULATE: Required Rate of Return ANSWER QUESTION: IF the Expected RATE of RETURN = 16.7550% Is the stock UNDER-valued or OVER valued? Problem TWO: Use the DATA in the assignment link What is the Required Rate of Return for the stock? Is the stock UNDER-valued or OVER-valued

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts