Question: Problem Two: Forecasting Financial Statements (5 points) Using the forecasted income statement and balance sheet and additional notes provided in the attached excel file (Final

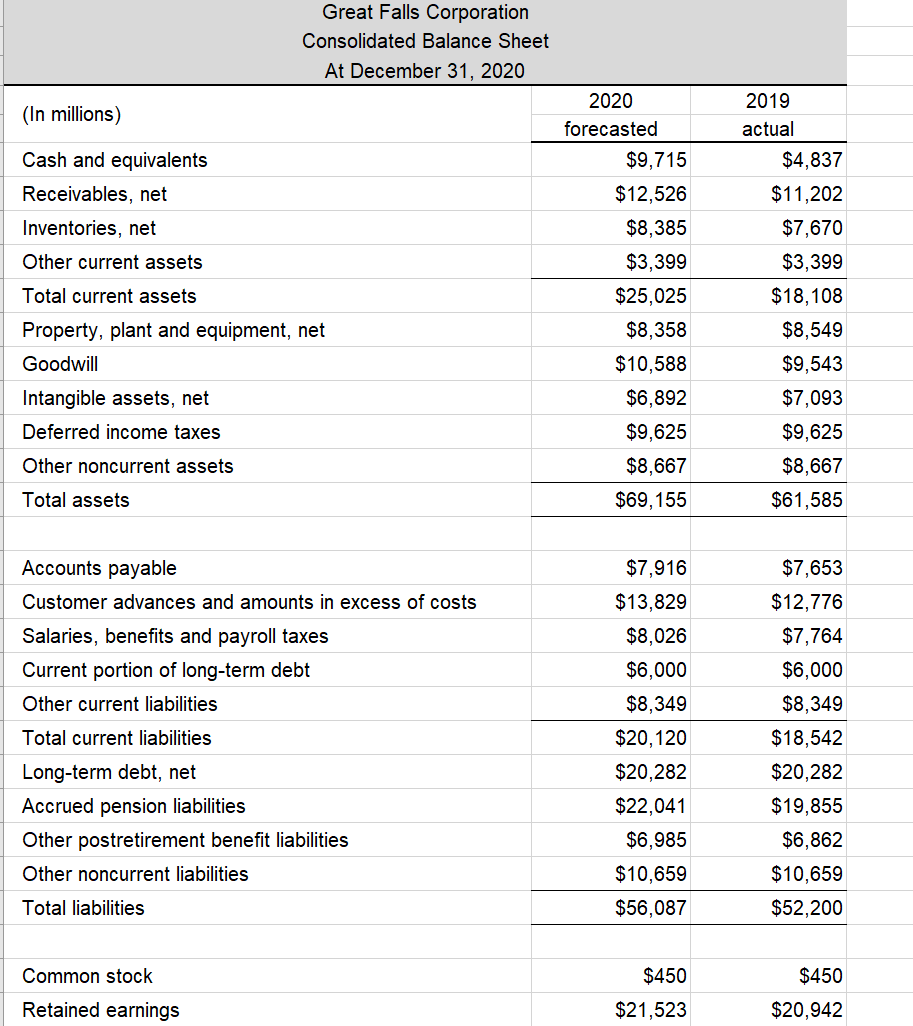

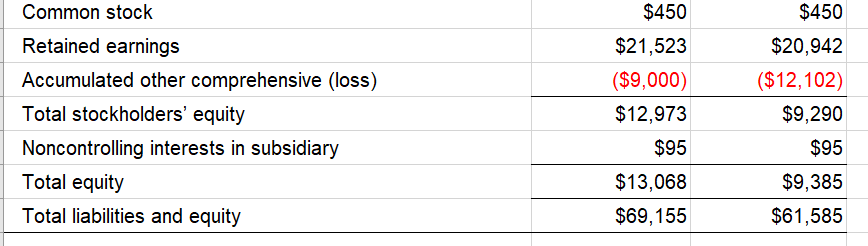

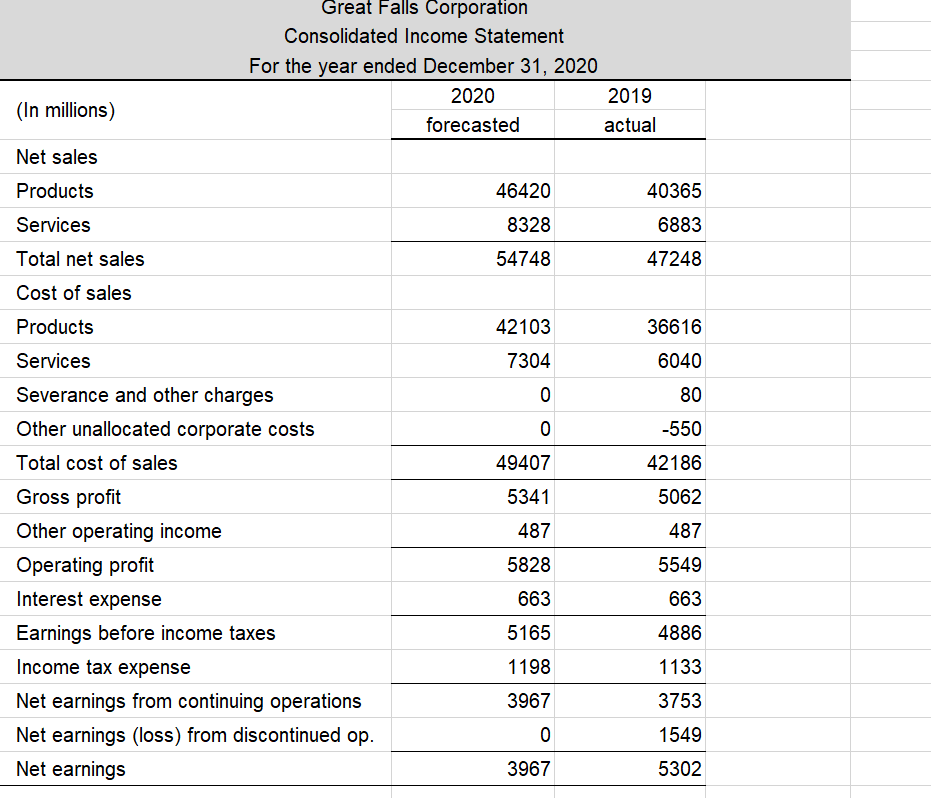

Problem Two: Forecasting Financial Statements (5 points) Using the forecasted income statement and balance sheet and additional notes provided in the attached excel file (Final Exam, tabs Great Falls BS, and Great Falls IS), please answer the following questions:

a. Prepare a forecasted statement of cash flows for the company for 2020 assuming the following assumptions. Depreciation expense to start of year PPE, net 21.2% Amortization expense to start of year intangible assets, net 4.9% CAPEX to total net sales 1.8% Dividends to net earnings 33.5%

b. Assume that net sales will grow by 1.16%, 2.16%, 3.16% and 4.16% for the next five years 2020, 2021, 2022, 2023, and 2024. Use the parsimonious method of forecasting to project net operating profit after tax (NOPAT) and net operating assets (NOA) for 2020 through 2023, inclusive. (2 points)

c. Describe the difference between the full forecast of financial statements and the parsimonious method. When is one preferable to the other? Please support your answer. (3 points)

Great Falls Corporation Consolidated Balance Sheet At December 31, 2020 (In millions) 2020 forecasted $9,715 $12,526 $8,385 2019 actual $4,837 $11,202 $7,670 $3,399 $18, 108 $8,549 Cash and equivalents Receivables, net Inventories, net Other current assets Total current assets Property, plant and equipment, net Goodwill Intangible assets, net Deferred income taxes $3,399 $25,025 $8,358 $10,588 $6,892 $9,625 $9,543 $7,093 $9,625 $8,667 $61,585 Other noncurrent assets $8,667 $69, 155 Total assets Accounts payable Customer advances and amounts in excess of costs Salaries, benefits and payroll taxes Current portion of long-term debt Other current liabilities $7,653 $12,776 $7,764 $6,000 $7,916 $13.829 $8,026 $6,000 $8,349 $20,120 $20,282 $22,041 $6,985 Total current liabilities $8,349 $18,542 $20,282 $19,855 Long-term debt, net Accrued pension liabilities Other postretirement benefit liabilities Other oncurrent liabilities $10,659 $56,087 $6,862 $10,659 $52,200 Total liabilities Common stock Retained earnings $450 $21,523 $450 $20,942 $450 Common stock Retained earnings Accumulated other comprehensive (loss) Total stockholders' equity Noncontrolling interests in subsidiary Total equity Total liabilities and equity $450 $21,523 ($9,000) $12,973 $95 $20,942 ($12,102) $9,290 $95 $13,068 $9,385 $61,585 $69,155 Great Falls Corporation Consolidated Income Statement For the year ended December 31, 2020 2020 2019 forecasted actual (In millions) Net sales 46420 40365 8328 6883 54748 47248 42103 36616 7304 6040 0 80 0 -550 49407 42186 Products Services Total net sales Cost of sales Products Services Severance and other charges Other unallocated corporate costs Total cost of sales Gross profit Other operating income Operating profit Interest expense Earnings before income taxes Income tax expense Net earnings from continuing operations Net earnings (loss) from discontinued op. Net earnings 5341 5062 487 487 5828 5549 663 663 5165 4886 1198 1133 3967 3753 1549 0 3967 5302 Great Falls Corporation Consolidated Balance Sheet At December 31, 2020 (In millions) 2020 forecasted $9,715 $12,526 $8,385 2019 actual $4,837 $11,202 $7,670 $3,399 $18, 108 $8,549 Cash and equivalents Receivables, net Inventories, net Other current assets Total current assets Property, plant and equipment, net Goodwill Intangible assets, net Deferred income taxes $3,399 $25,025 $8,358 $10,588 $6,892 $9,625 $9,543 $7,093 $9,625 $8,667 $61,585 Other noncurrent assets $8,667 $69, 155 Total assets Accounts payable Customer advances and amounts in excess of costs Salaries, benefits and payroll taxes Current portion of long-term debt Other current liabilities $7,653 $12,776 $7,764 $6,000 $7,916 $13.829 $8,026 $6,000 $8,349 $20,120 $20,282 $22,041 $6,985 Total current liabilities $8,349 $18,542 $20,282 $19,855 Long-term debt, net Accrued pension liabilities Other postretirement benefit liabilities Other oncurrent liabilities $10,659 $56,087 $6,862 $10,659 $52,200 Total liabilities Common stock Retained earnings $450 $21,523 $450 $20,942 $450 Common stock Retained earnings Accumulated other comprehensive (loss) Total stockholders' equity Noncontrolling interests in subsidiary Total equity Total liabilities and equity $450 $21,523 ($9,000) $12,973 $95 $20,942 ($12,102) $9,290 $95 $13,068 $9,385 $61,585 $69,155 Great Falls Corporation Consolidated Income Statement For the year ended December 31, 2020 2020 2019 forecasted actual (In millions) Net sales 46420 40365 8328 6883 54748 47248 42103 36616 7304 6040 0 80 0 -550 49407 42186 Products Services Total net sales Cost of sales Products Services Severance and other charges Other unallocated corporate costs Total cost of sales Gross profit Other operating income Operating profit Interest expense Earnings before income taxes Income tax expense Net earnings from continuing operations Net earnings (loss) from discontinued op. Net earnings 5341 5062 487 487 5828 5549 663 663 5165 4886 1198 1133 3967 3753 1549 0 3967 5302

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts