Question: Problem Two. It is important to understand four things: (1) evaluating the expected returns on the bonds requires making statements about the expected future interest

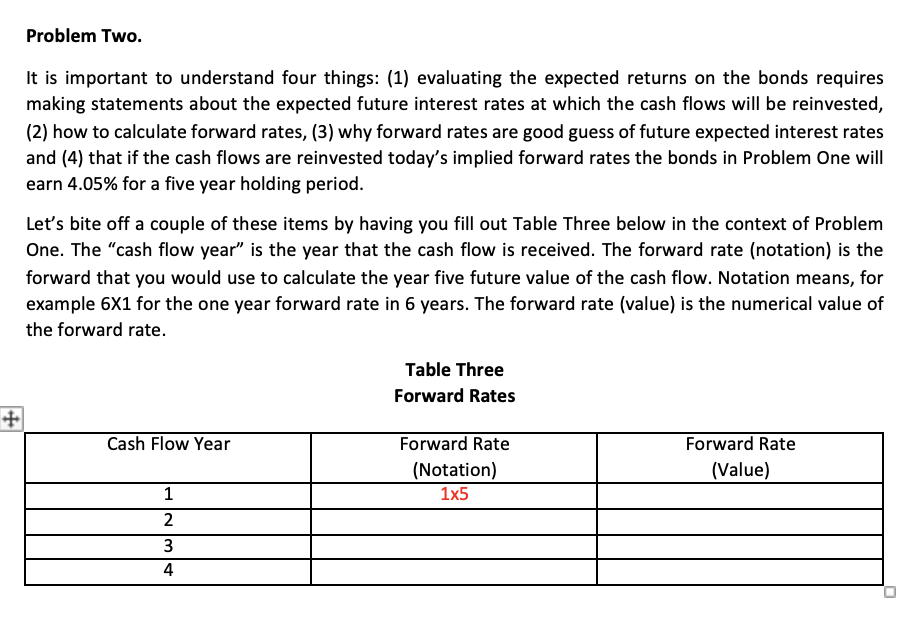

Problem Two. It is important to understand four things: (1) evaluating the expected returns on the bonds requires making statements about the expected future interest rates at which the cash flows will be reinvested, (2) how to calculate forward rates, (3) why forward rates are good guess of future expected interest rates and (4) that if the cash flows are reinvested today's implied forward rates the bonds in Problem One will earn 4.05% for a five year holding period. Let's bite off a couple of these items by having you fill out Table Three below in the context of Problem One. The "cash flow year" is the year that the cash flow is received. The forward rate (notation) is the forward that you would use to calculate the year five future value of the cash flow. Notation means, for example 61 for the one year forward rate in 6 years. The forward rate (value) is the numerical value of the forward rate. Table Three Forward Rates Problem Two. It is important to understand four things: (1) evaluating the expected returns on the bonds requires making statements about the expected future interest rates at which the cash flows will be reinvested, (2) how to calculate forward rates, (3) why forward rates are good guess of future expected interest rates and (4) that if the cash flows are reinvested today's implied forward rates the bonds in Problem One will earn 4.05% for a five year holding period. Let's bite off a couple of these items by having you fill out Table Three below in the context of Problem One. The "cash flow year" is the year that the cash flow is received. The forward rate (notation) is the forward that you would use to calculate the year five future value of the cash flow. Notation means, for example 61 for the one year forward rate in 6 years. The forward rate (value) is the numerical value of the forward rate. Table Three Forward Rates

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts