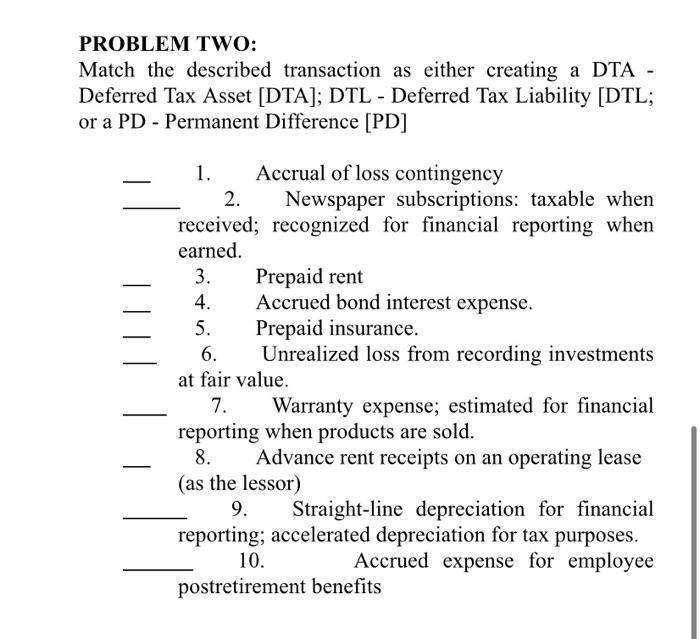

Question: PROBLEM TWO: Match the described transaction as either creating a DTA - Deferred Tax Asset [DTA]; DTL - Deferred Tax Liability [DTL; or a PD

PROBLEM TWO: Match the described transaction as either creating a DTA - Deferred Tax Asset [DTA]; DTL - Deferred Tax Liability [DTL; or a PD - Permanent Difference [PD] 1. Accrual of loss contingency 2. Newspaper subscriptions: taxable when received; recognized for financial reporting when earned. 3. Prepaid rent 4. Accrued bond interest expense. 5. Prepaid insurance. 6. Unrealized loss from recording investments at fair value. 7. Warranty expense; estimated for financial reporting when products are sold. 8. Advance rent receipts on an operating lease (as the lessor) 9. Straight-line depreciation for financial reporting; accelerated depreciation for tax purposes. 10. Accrued expense for employee postretirement benefits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts