Question: Problem Two Use the following data to answer Questions 4 through 6. Janet Adams, CFA, is reviewing Rival Company's financial statements. Rival's long-term debt totals

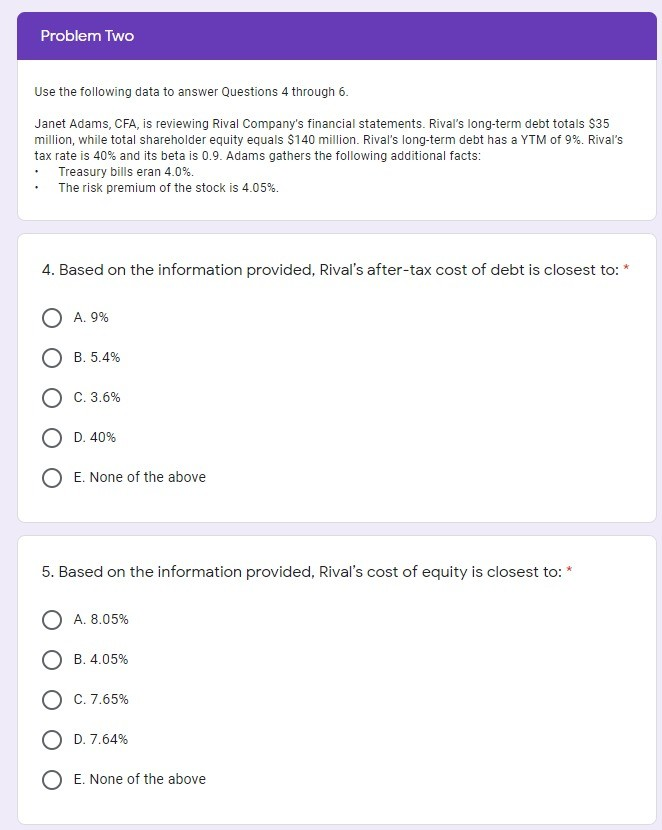

Problem Two Use the following data to answer Questions 4 through 6. Janet Adams, CFA, is reviewing Rival Company's financial statements. Rival's long-term debt totals $35 million, while total shareholder equity equals $140 million. Rival's long-term debt has a YTM of 9%. Rival's tax rate is 40% and its beta is 0.9. Adams gathers the following additional facts: Treasury bills eran 4.0%. The risk premium of the stock is 4.05%. 4. Based on the information provided, Rival's after-tax cost of debt is closest to: A. 9% B. 5.4% C. 3.6% 10% E. None of the above 5. Based on the information provided, Rival's cost of equity is closest to: * A. 8.05% O B. 4.05% O C. 7.65% O D. 7.64% O E. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts