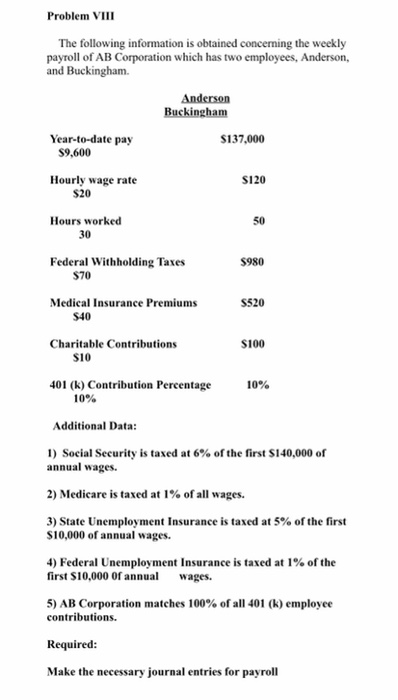

Question: Problem VIII The following information is obtained concerning the weekly payroll of AB Corporation which has two employees, Anderson, and Buckingham. Anderson Buckingham Year-to-date pay

Problem VIII The following information is obtained concerning the weekly payroll of AB Corporation which has two employees, Anderson, and Buckingham. Anderson Buckingham Year-to-date pay $137,000 $9,600 Hourly wage rate SI20 $20 Hours worked 50 30 Federal Withholding Taxes $980 $70 Medical Insurance Premiums S40 S520 Charitable Contributions $100 $10 401(k) Contribution Percentage 10% 10% Additional Data: 1) Social Security is taxed at 6% of the first $140,000 of annual wages. 2) Medicare is taxed at 1% of all wages. 3) State Unemployment Insurance is taxed at 5% of the first $10,000 of annual wages. 4) Federal Unemployment Insurance is taxed at 1% of the first $10,000 of annual wages. 5) AB Corporation matches 100% of all 401(k) employee contributions. Required: Make the necessary journal entries for payroll

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts