Question: Problem: We are about to do a project with a local nonprofit in finance. I bought this book to help me with learning the finances.

Problem: We are about to do a project with a local nonprofit in finance. I bought this book to help me with learning the finances. When I looked at this case study I couldn't do it correctly. I need help with 2-16. This is not for school or no project. This is for my own notes and practice. Can someone help me?????????????????????? Can I get help with any.4 just to begin with

I need help with this case study. Question 2 -16!

I need help with this case study. Question 2 -16!

This is part 3 can someone help me with the following anything or any advice at all

| Hays County IDS | ||

| Statement of Operations | ||

| Through December 31, 2017 | ||

| 2017 | ||

| REVENUES | ||

| Gross Patient Services Revenue | $ 326,910,000 | |

| Provisions for contractual adjustments | $ (43,936,704) | |

| Provisions for charity care | $ (58,843,800) | |

| Net Patient Services Revenue | $ 224,129,496 | |

| Provisions for bad debt allowance | $ (58,843,800) | |

| Net Patient Services Revenue less provisions for bad debt | $ 165,285,696 | |

| Premium revenue (Capitation reimbursements) | $ 900,000 | |

| Other operating revenue | $ 100,000 | |

| Total Operating Revenue | $ 166,285,696 | |

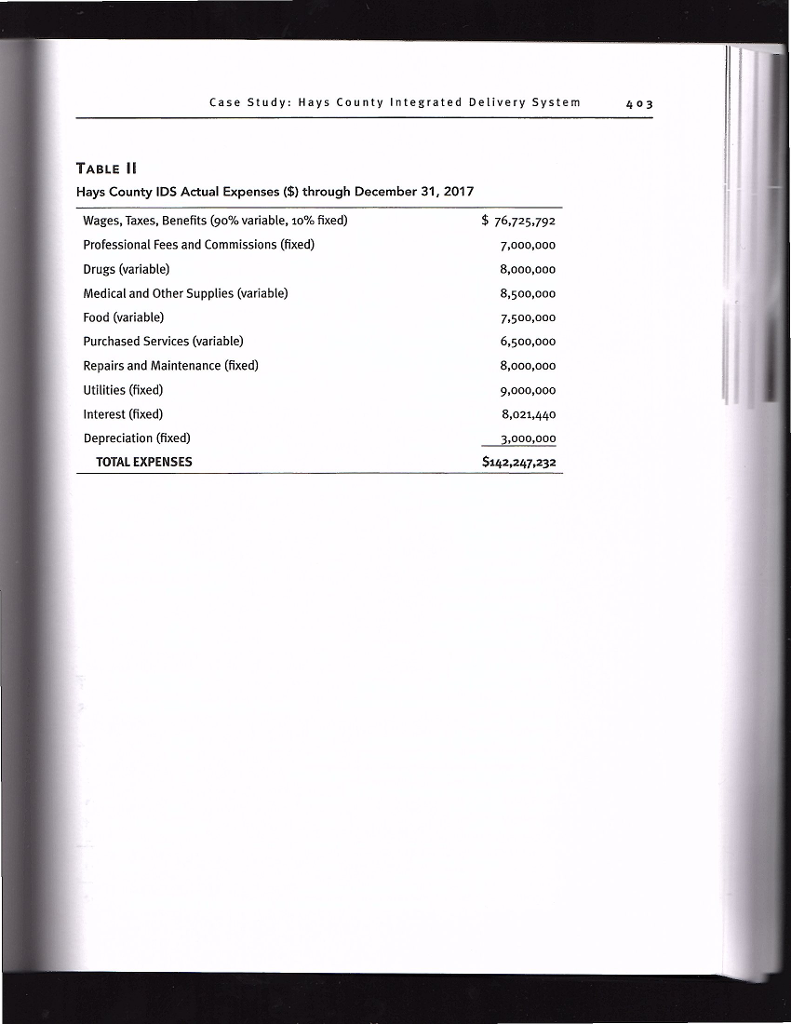

| EXPENSES | ||

| Wages, Taxes, Benefits (90% variable, 10% fixed) | $ 76,725,792 | |

| Professional Fees and Commissions (fixed) | $ 7,000,000 | |

| Drugs (variable) | $ 8,000,000 | |

| Medical and other supplies (variable) | $ 8,500,000 | |

| Food (variable) | $ 7,500,000 | |

| Purchased Services (variable) | $ 6,500,000 | |

| Repairs and Maintenance (fixed) | $ 8,000,000 | |

| Utilities (fixed) | $ 9,000,000 | |

| Interest (fixed) | $ 8,021,440 | |

| Depreciation (fixed) | $ 3,000,000 | |

| Total Operating Expenses | $ 142,247,232 | |

| OPERATING INCOME | $ 24,038,464 | |

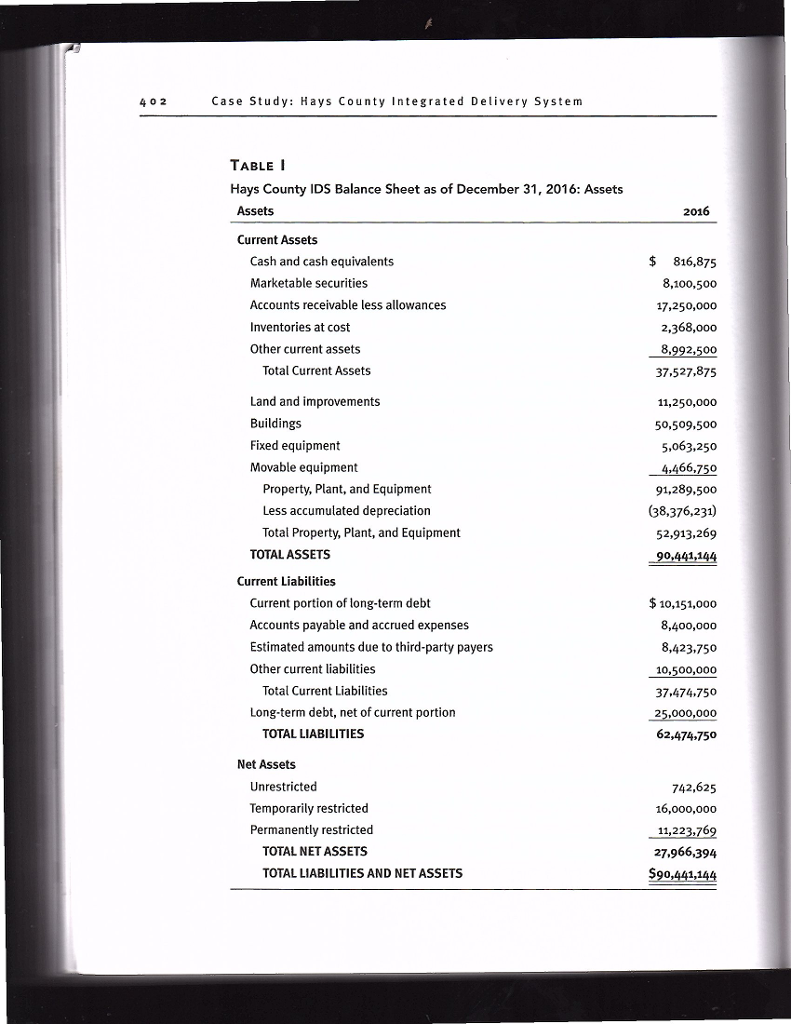

| Hays County IDS | ||

| Balance Sheet | ||

| December 31, 2017 | ||

| 2017 | ||

| ASSETS | ||

| Current Assets | ||

| Cash and cash equivalents | $ 816,875 | |

| Marketable securities | $ 8,100,500 | |

| Accounts Receivable less allowances | $ 17,250,000 | |

| Inventories at cost | $ 2,368,000 | |

| Other current assets | $ 8,992,500 | |

| Total Current Assets | $ 37,527,875 | |

| Land and improvements | $ 11,250,000 | |

| Buildings | $ 50,509,500 | |

| Fixed equipment | $ 5,063,250 | |

| Movable equipment | $ 4,466,750 | |

| Property, Plant and Equipment | $ 91,289,500 | |

| Less accumulated depreciation | $ (38,376,231) | |

| Total Property, Plant and Equipment | $ 52,913,269 | |

| TOTAL ASSETS | $ 90,441,144 | |

| Current Liabilities | ||

| Current portion of long-term debt | $ 10,151,000 | |

| Accounts payable and accrued expenses | $ 8,400,000 | |

| Estimated amounts due to third-party payors | $ 8,423,750 | |

| Other current liabilities | $ 10,500,000 | |

| Total Current Liabilities | $ 37,474,750 | |

| Long-tern debt, net of current portion | $ 25,000,000 | |

| TOTAL LIABILITIES | $ 62,474,750 | |

| Net Assets | ||

| Unrestricted | $ 742,625 | |

| Temporarily restricted | $ 16,000,000 | |

| Permanently restricted | $ 11,223,769 | |

| TOTAL NET ASSETS | $ 27,966,394 | |

| TOTAL LIABILITIES AND NET ASSETS | $ 90,441,144 |

|

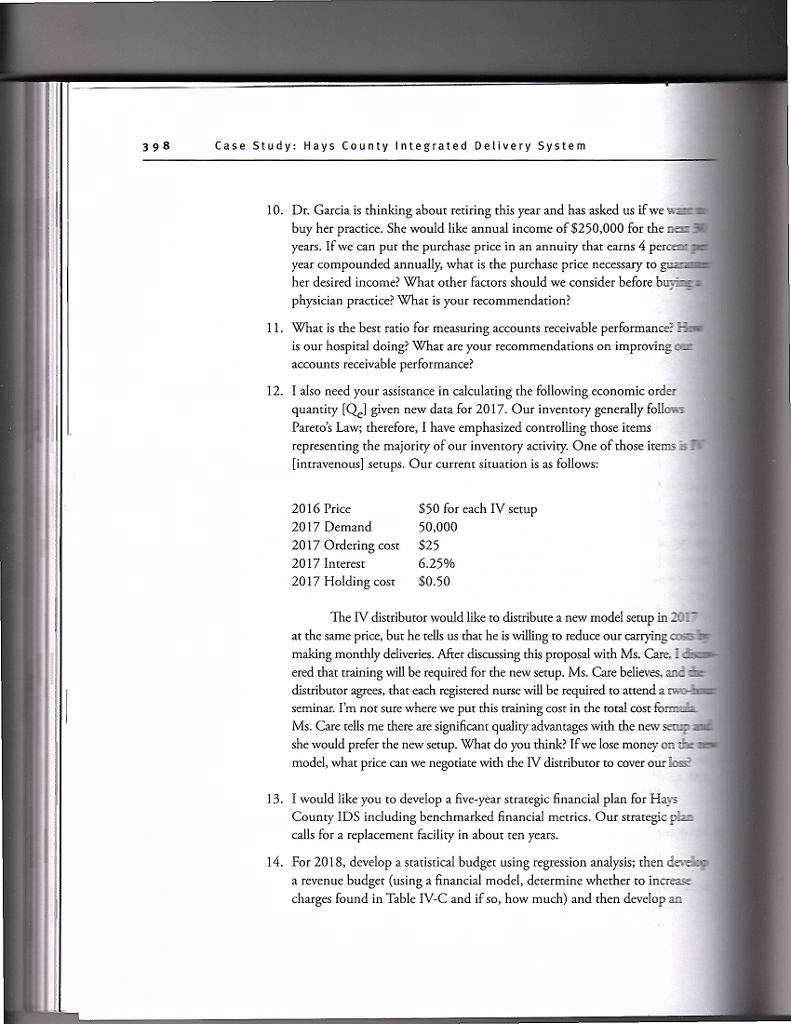

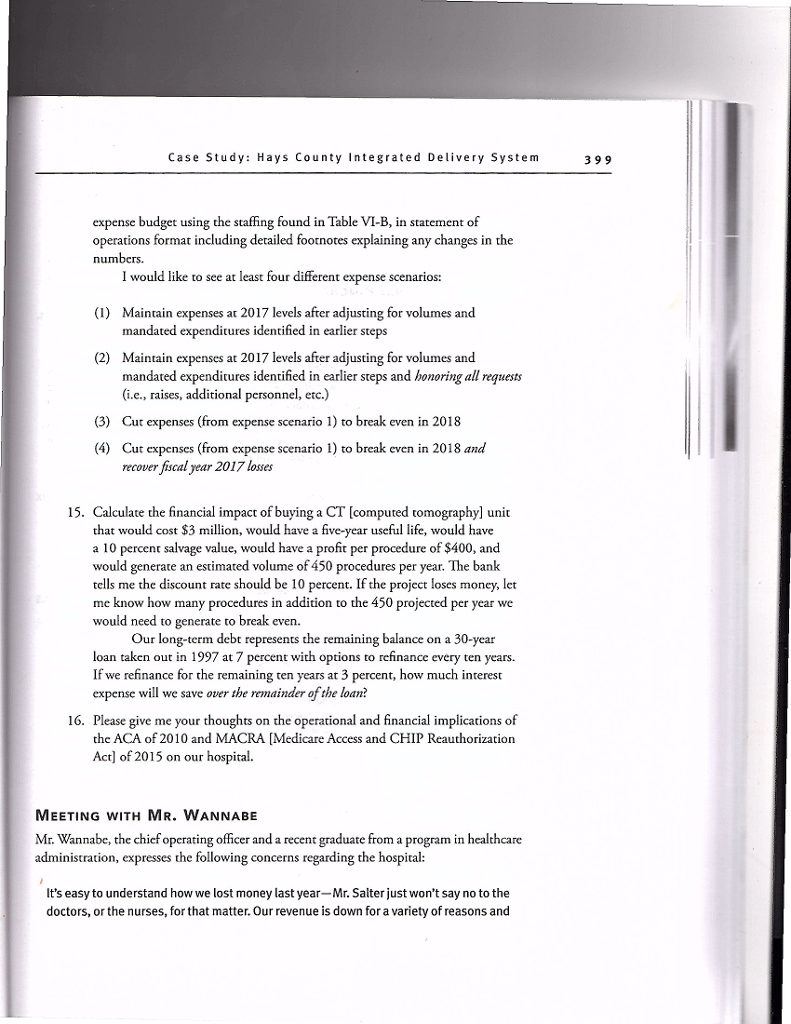

396 Case Study: Hays County Integrated Delivery System MEETING WITH DR. SPOK Dr. Spok, hospital medical director, tells you: Most doctors have been on the medical staff for at least ten years. There is little loyalty to the hospital, and most doctors also have admitting privileges at St. Teresa's, a newer hospital with better facilities. While it is a hassle for the doctors to drive the 25 miles from San Marcos to St. Teresa's to see patients, there are a few good reasons for the doctors to admit their patients to St. Teresa's. St. Teresa's has a hospitalist and pays physicians for menial service assignments like committee work (a practice that County has refused to implement) MEETING WITH MR. SALTER Mr. Salter, chief executive officer, states: I just don't understand why we are losing money. Ispent a considerable amount of time recruiting new doctors while keeping the existing doctors happy. The new, younger doctors just don't seem to have a sense of loyalty to County. Furthermore, l've tried to establish a "family atmosphere" for our employees that stresses getting along well with others in return for job security. Everyone seems happy-everyone except Mr. Finance Myway, whom you'll be replacing. He and I both started in January 2015 and he seemed increasingly frustrated with the way 1 do things here-he just didn't fit in. I tried to accommodate him by implementing some of his recommendations, even though they were against my better judgment-like charging visitors for parking, which generated S10o,ooo in other operating revenue in 2017, but I have discontinued the practice for 2018 because no other organization in San Marcos, other than the university, charges for parking. And when I announced that I was bringing in more business to the hos- pital by entering into a two-year capitated managed care agreement with the city (it expires this month)-we get $250 per month per family for taking care of the 300 city employees and their families, whether they're sick or not-Mr. Myway threw a fit at an executive team meeting. He claimed that my decisions were driving County deeper into the red, and as a result, I had to show Mr. Myway the highway for insubordination. That happened last month. Mr. Salter has asked you to do the following [Note: Steps in the case correspond to chapters in the textbook]: Iwould like you to make a fifteen-minute, 25-slide PowerPoint presentation during our board strategic planning retreat regarding the effects of the economy [see appendix 1.2 in chapter 1] on the healthcare industry. 1. 396 Case Study: Hays County Integrated Delivery System MEETING WITH DR. SPOK Dr. Spok, hospital medical director, tells you: Most doctors have been on the medical staff for at least ten years. There is little loyalty to the hospital, and most doctors also have admitting privileges at St. Teresa's, a newer hospital with better facilities. While it is a hassle for the doctors to drive the 25 miles from San Marcos to St. Teresa's to see patients, there are a few good reasons for the doctors to admit their patients to St. Teresa's. St. Teresa's has a hospitalist and pays physicians for menial service assignments like committee work (a practice that County has refused to implement) MEETING WITH MR. SALTER Mr. Salter, chief executive officer, states: I just don't understand why we are losing money. Ispent a considerable amount of time recruiting new doctors while keeping the existing doctors happy. The new, younger doctors just don't seem to have a sense of loyalty to County. Furthermore, l've tried to establish a "family atmosphere" for our employees that stresses getting along well with others in return for job security. Everyone seems happy-everyone except Mr. Finance Myway, whom you'll be replacing. He and I both started in January 2015 and he seemed increasingly frustrated with the way 1 do things here-he just didn't fit in. I tried to accommodate him by implementing some of his recommendations, even though they were against my better judgment-like charging visitors for parking, which generated S10o,ooo in other operating revenue in 2017, but I have discontinued the practice for 2018 because no other organization in San Marcos, other than the university, charges for parking. And when I announced that I was bringing in more business to the hos- pital by entering into a two-year capitated managed care agreement with the city (it expires this month)-we get $250 per month per family for taking care of the 300 city employees and their families, whether they're sick or not-Mr. Myway threw a fit at an executive team meeting. He claimed that my decisions were driving County deeper into the red, and as a result, I had to show Mr. Myway the highway for insubordination. That happened last month. Mr. Salter has asked you to do the following [Note: Steps in the case correspond to chapters in the textbook]: Iwould like you to make a fifteen-minute, 25-slide PowerPoint presentation during our board strategic planning retreat regarding the effects of the economy [see appendix 1.2 in chapter 1] on the healthcare industry. 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts